60% of institutions have increased their use of bond ETFs, a new report from Greenwich Associates has found

The turn to ETFs for bond liquidity has been particularly acute since 2008 as banks have stepped back from providing bond liquidity

BlackRock's bond ETFs are the overwhelming favourite among investors, with over 70% of institutions saying they prefer iShares for bonds

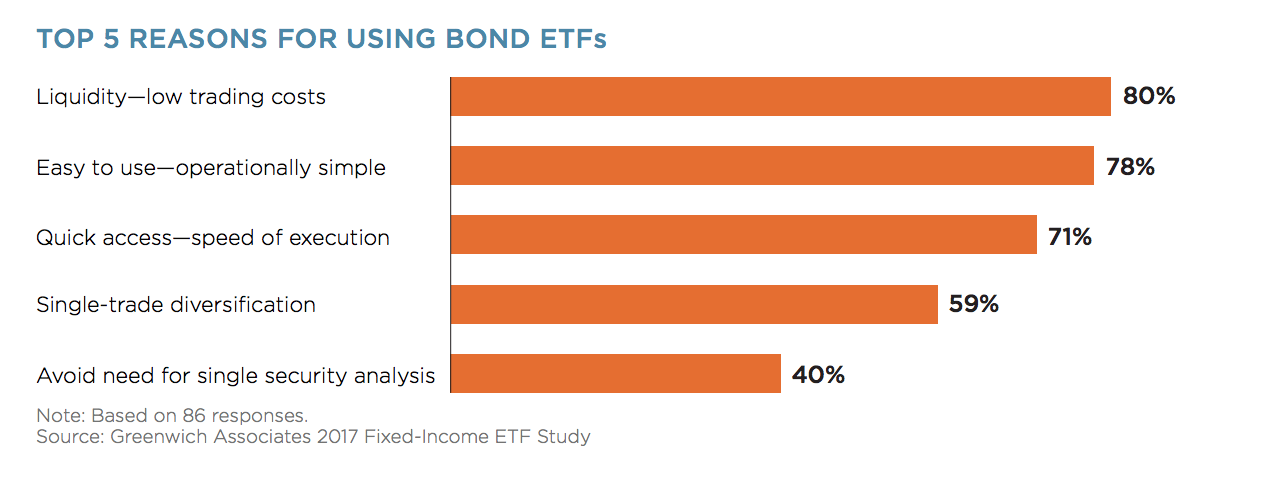

Investors are increasingly using ETFs for bond market exposure, as trading ETFs is significantly easier than trading actual bonds, new research by consultancy Greenwich Associates

.

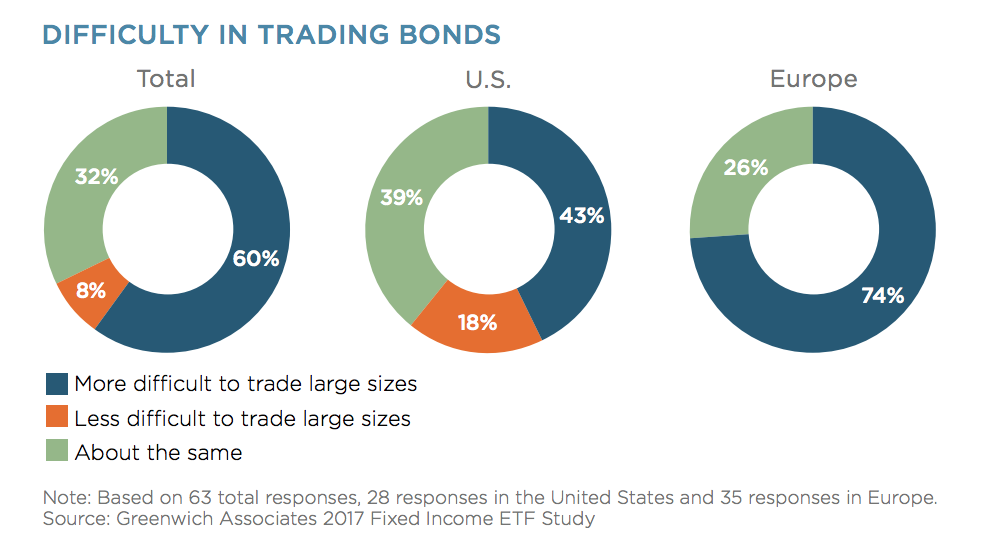

Buying bonds is different from buying shares. Bonds do not trade on exchange and bond markets are often fragmented and opaque. Making matters trickier, many bonds haven't recovered to the liquidity levels they held in 2007 before the financial crisis.

The result is investors are turning to bond ETFs, which are transparent, simple, and because they're on exchange, often easier to buy and sell than the actual bonds, the report said.

"Current [bond] liquidity issues are due in large part to increased bank capital requirements put in place post-financial crisis," the report found.

"Heightened capital reserves make it more expensive for banks to hold the large inventories of bonds needed to act as market makers. These increased expenses and other new rules have forced banks to slash their inventories and pull back from their prior role of broad fixed-income market liquidity providers."

As banks have stepped back from their traditional role as providers of bond market liquidity, a majority of institutions around the world have come to see ETFs as an alternative vehicle to access the bond market.

In the US, where the bond ETF market is older, bond ETF trading has become widespread, the report found. Thirty percent of US institutions have made a $50 million bond trade, and 14% of institutions have made a bond trade greater than $100 million.

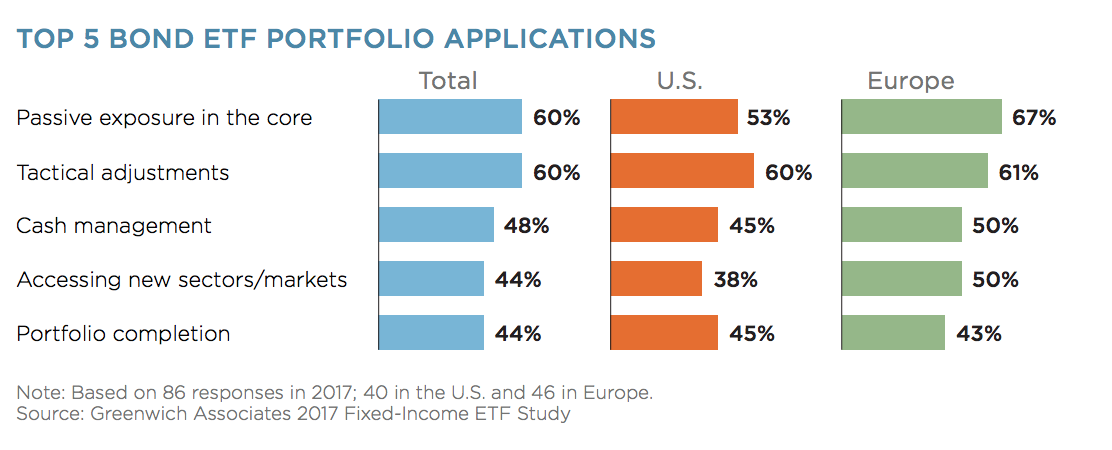

Passive investors are often thought to be the core constituency for ETFs. Yet when it comes to bond ETFs, Greenwich found, tactical allocations were as popular a reason for using ETFs. These include more risky areas like high yield and emerging market bonds which have gathered tens of billions in assets.

Among providers, BlackRock's bond funds were the overwhelming favourite. Greenwich found that among institutions in both Europe and the US, 79% tapped iShares as their fixed-income ETF provider of choice. At 7%, Vanguard came a very distant second.