Results for Q2 of 2018 for Australian ETFs.

Popularity

Only 56% of Australian ETFs received any inflows at all in Q2, meaning that if your ETF received some inflows - even if only a couple of cents - it has probably done above average.

On salesmanship in Q2, Vanguard and BetaShares had strong quarters. Both issuers have invested heavily in distribution firepower and Vanguard's additions to its Melbourne-based sales team appear to be paying off. Australians prefer investing in the Australian market, flows suggest.

Asset growth paints a different picture, suggesting size begets size. The biggest growers were all among the biggest equity ETFs. They were all equity ETFs because global stockmarkets did relatively well the past quarter, meaning bond, gold, and cash ETFs did not grow as much.

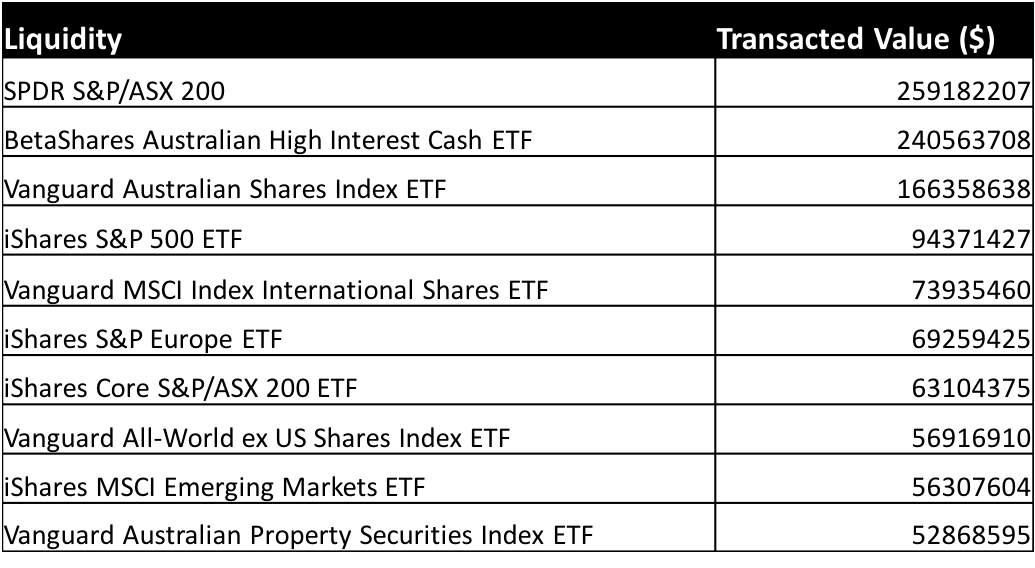

Liquidity

Liquidity is a must have for any ETF provider targeting institutional investors. And some ETFs are very liquid indeed. State Street's ASX 200 tracker and BetaShares Cash ETF were in a league of their own, however.

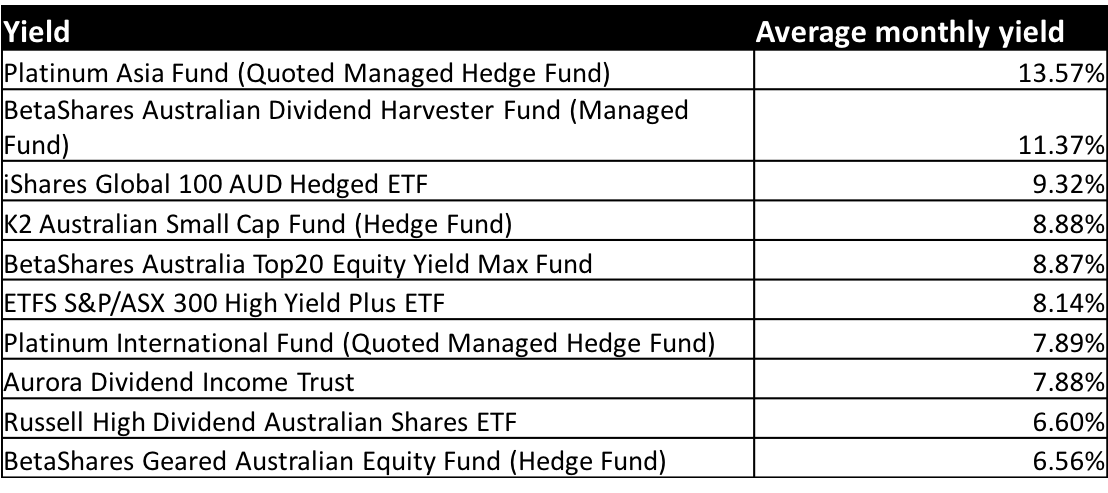

Yield

For older people - or for those simply yield minded - ETFs that style themselves as yield motivated have delivered. Interestingly, a majority of the products are actively managed, suggesting that active mandates here may be effective.

Performance

Exposure to the resources and energy sectors paid off handsomely this quarter -- all of which had double-digit returns thanks to surging commodities prices. It's also interesting to note the prevalence of BetaShares lineup in the top 10. This owes, at least in part, to BetaShares willingness to roll out niche products - like it's geared line - that take on more risk. Geared ETFs and synthetic ETFs are probably not the best ideas for long-term "buy and forget" investors. But for those with a gambling instinct, they can sometimes come in strong.

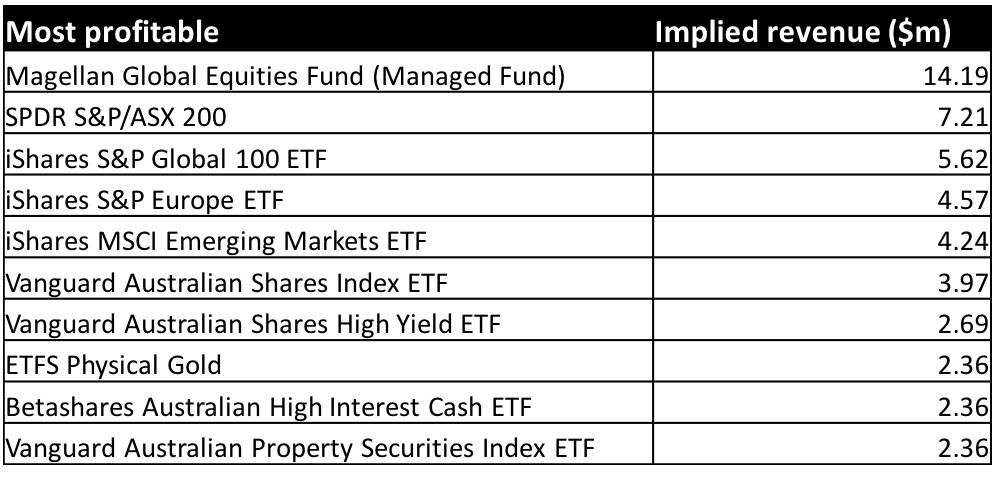

Revenue. Who's making money?

Last but not least, who's making money? The table below shows annual run rate revenue, based on fees as assets. Magellan's MGE is the most profitable ETF in Australia by far, followed by State Street's STW. There are two important caveats to this data. First, it assumes that issuers have given no rebates/discounts. Second, it includes Magellan's MGE. (Under ASIC's definition, actively managed ETMFs like Magellan's MGE qualify as ETFs. The naming convention remains controversial).

Sources and acknowledgments

All data comes from the ASX Investment Products reports for May, April and June. Spreadsheets are available on the ASX website.