Passive ETF providers grow increasingly impatient with "active ETFs".

Actively managed ETFs are one of the fastest growing corners of the Australian ETF landscape, bringing in new investors and new money into ETPs. But as they do, active ETFs are drawing fire from traditional ETF providers, who regard them as an inferior product.

Why the beef? Fees.

To any outsider, active versus traditional ETFs may sound like the narcissism of the small difference. But as the Aussie ETF market is now worth $37bn, a growing split between active and traditional ETFs has emerged, with many traditional ETF providers spoiling for a fight.

The main bone of contention concerns fees, and how the "ETF" brand is seen as synonymous with keeping them low.

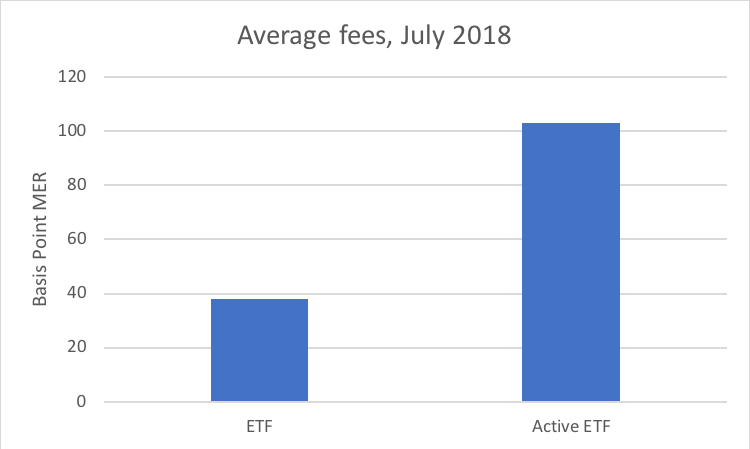

The average fee on traditional ETFs is 38 basis points - making them the lowest cost fund type available to Aussie retail investors. Traditional ETF providers forego millions of dollars in revenue in order to keep fees low, partly in hope that ETFs will come to be identified with low fees.

But when it comes to fees, active ETF providers read from a different rulebook. The average fee charged by an active ETF is 108bps -- almost 300% more than a traditional ETF. On top of higher management fees, active ETF providers then often charge an additional layer of performance fees, making them more expensive still. (Traditional ETFs, by contrast, do not charge performance fees).

For many traditional ETF providers, the game played by active ETFs amounts to a bait and switch. Investors are told a fund is an "ETF" - which many understand to mean low fee - only to find that their ETF is an "active ETF" that charges high fees more typical of managed funds.

"The "exchange traded fund" label… [has] been present in the global funds industry for 25 years and [is] now intrinsically linked with financial products with specific features which investors rely on and trust," Christian Obrist, boss of iShares Australia, told ETF Stream in an email.

"These active ETFs may have higher and more complex fee structures, lower transparency in terms of asset allocation and market-making structures, reduced liquidity profiles and other associated risks. We believe that these differences should be clearly highlighted to clients to distinguish active ETFs from traditional ETFs."

Transparency (or lack thereof)

Another major difference is transparency. Traditional ETFs tend to track public indexes like the ASX 200 and the S&P 500. Having a public index means anyone with an internet connection can find out what's inside the ETFs that track them. (By Google searching the ASX 200, I can know what's inside State Street's STW, for example).

But here again, active ETFs read from a different rule book. Active ETF managers keep their funds' holdings secret, believing their stock picks constitute intellectual property. This means active ETFs are non-transparent and investors never really know what's going on inside.

"Active ETFs are not ETFs," said Arian Neiron, boss of VanEck Australia.

"[They] do not seek to track an index… are not required to publish their full holdings, so investors never know… exactly what stocks or how much cash is being held in the fund.

"This leads to potential concentration risks, inadequate strategic asset allocation and being charged fees on uninvested cash."

Internal market making

The final difference concerns market making and pricing.

Traditional ETFs have an arbitrage channel called "creation-redemption", which ensures they are always fairly priced. If they get too expensive, traders can short sell them and go "create" more units with the ETF provider by buying the securities they track. If they get too cheap, traders can buy the cheap ETFs and "redeem" them for the securities they track, making the difference in profit.

Active ETFs, by contrast, have no arbitrage channel. This means investors have a much weaker assurance that the fund will be fairly priced.

"We have no problem with active ETFs [and] believe [they] can be a very effective mechanism for distributing active products," Damien Sherman, head of ETF capital markets at Vanguard, told ETF Stream.

"But we believe they should be transparent and give investors the full disclosure of their underlying holdings... There should be independent market making... [to ensure] that units are created and redeemed at NAV."

ASIC declines to comment

Contacted for comment, ASIC declined to answer questions and instead directed ETF Stream to a 60-page ETP report published early August.

In the report, ASIC noted that there were "inherent conflicts" of interest within active ETFs. These included incentives to give "unfavourably low" prices to investors trying to sell out of the fund. And incentives to create illusory profits from market making and then charge performance fees on them.

Active ETF providers have also been publishing false iNAVs, the report found, and continued publishing them despite knowing they were false. "There have also been instances… where… the iNAV was not reasonably accurate, yet [active ETF issuers] continued to publish the iNAV," it said.

Curiously - and in what is perhaps in error - ASIC said only "one issuer" believed that the creation-redemption mechanism was the best method for ensuring accurate ETF pricing for investors. Every issuer contacted by ETF Stream believed this, not just one.

++++

Photo: Christian Obrist, head of iShares Australia. Source: supplied.