January saw a wide spread of market recovery from a less than convincing Q4 2018. In particular, fixed income ETF's net flows for the month reached a record high of €6.2bn, according to Lyxor's latest Money Monitor report.

The ETF market as a whole saw net flows triple from €2.5bn in December to €7.6bn in January. Fixed income ETFs were a significant contributor for this figure with equity ETFs contributing only €1.6bn, which is a modest rebound following the major sell off the asset class faced at the end of last year.

Source: Lyxor

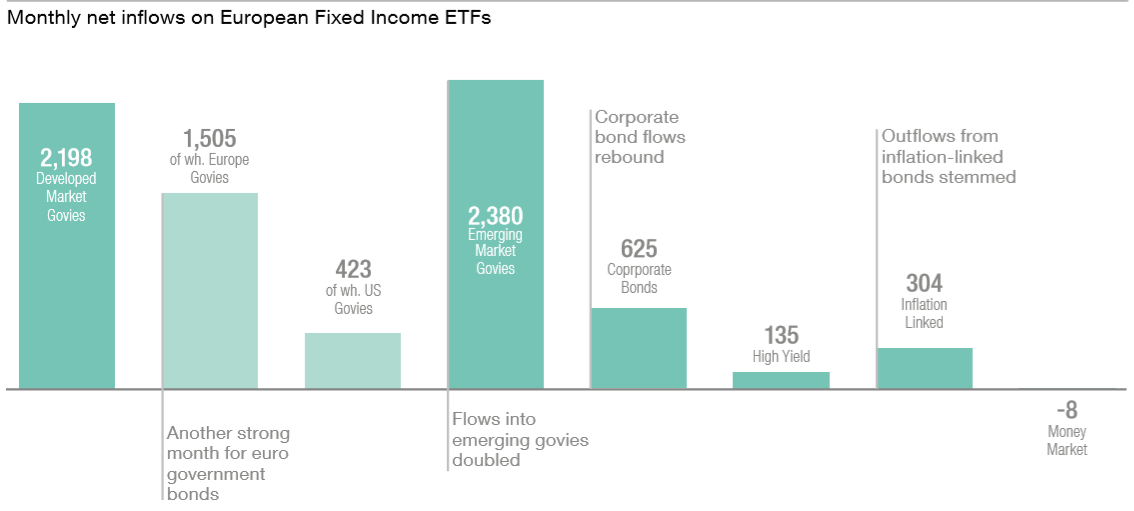

Developed and emerging market government bonds were the leading products of choice within the fixed income asset class with inflows of €2.2bn and €2.4bn, respectively. Asset flows within emerging market government bonds doubled for January in comparison to the previous month.

Emerging markets were the product of choice within the equity market as well, with inflows of over €2.4bn. In comparison, developed markets were still facing a selloff as the DM equity ETFs saw outflows in excess of €1.2bn for January alone.

Investors were moving assets out of their volatile products and investing in to more Smart Beta strategies. €1.4bn was moved in to SB strategies, €1bn of which went in to developed markets.