The equity market's most recent bull run turned 10 years old at the beginning of March however, some analysts believe this run concluded back in December while others believe it could

.

A third opinion is that the investment cycle is coming to an end, which is the perception taken by BlackRock in its latest survey on the future of the equity market.

In response, BlackRock, the world's largest asset manager, predicts institutional investors will adjust their allocations from index equity strategies to lean more towards active management.

Acknowledging there has been growing interest in passive investing such as ETFs, an anonymous senior investment officer for a state investment board, says in the report: "We use active management in all asset categories, and passive is used to complement that. It is not an either/or choice."

This would suggest that neither strategy is going to completely dominate a portfolio, but the weighting and exposure will be regularly adjusted depending on the state of the market.

Meanwhile, the head of manager selection at a $65 billion UK corporate pension fund, says in the report: "We made large allocations to alternative indices about five years ago, but in the next five years, we expect to shift more from passive to active with the end of a bull-market cycle, greater volatility and higher valuations."

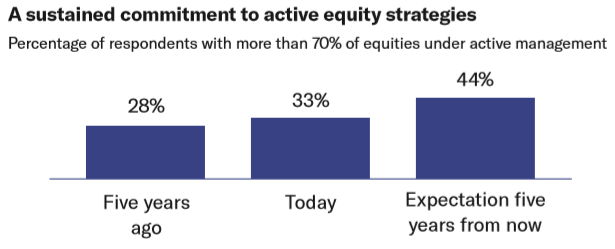

While only 28% of the 200 institutional investors surveyed had more than 70% of equities under active management five years ago, this figure is likely to increase over the next five years to 44%.

Source: BlackRock

The SPDR S&P 500 ETF (SPY) and the iShares FTSE 250 ETF (MIDD) have produced returns of 108.45% and 34.63%, respectively, over the last five years. However, both funds' momentum shifted at the end of 2018 due to volatility, losing all returns gained throughout 2017 and 2018. As a result, institutional investors are now considering an active strategy is more appropriate.

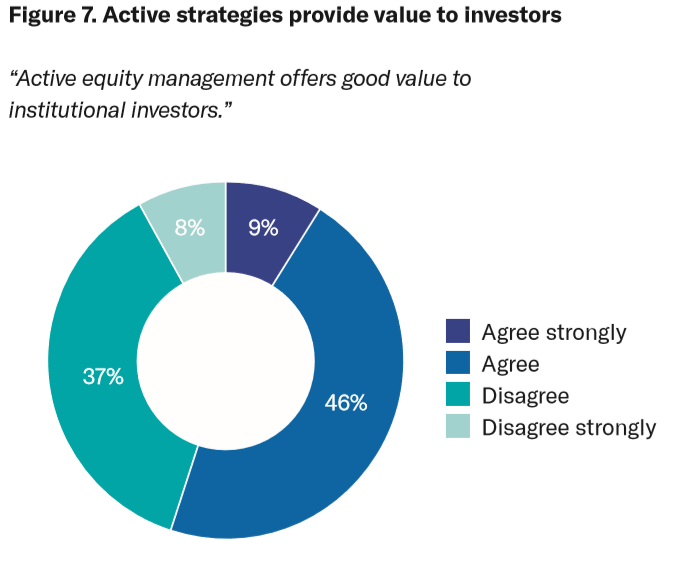

Source: BlackRock

When asked whether active management offers value, only 55% of respondents agreed/strongly agreed that it does. This is a good representative as to why passive investments are growing in popularity but are used to compliment active strategies as there is still a divide on the value of active management.