The iShares MSCI Argentina and Global Exposure ETF (AGT) took a huge blow on 12 August following the Argentina's primary elections which the results were announced last weekend.

Fears of former president Cristina Fernandez de Kirchner returning to power resulted in the MERVAL index, Argentina’s largest stock index, falling 37.9% on Monday as the market opened after the weekend. The index has since recovered 13.3% since this point but remains nearly 30% below its close on Friday of 44,350.

ETFs with exposure to Argentina have subsequentially suffered significant losses. AGT saw its Net Asset Value (NAV) fall 24.1% on Monday and a further 1% over the remainder of the week. MercadoLibre, AGT’s largest holding with 27% of the fund, saw its share price fall 11.1%. With that being said, according to the fund’s product page, Argentina only accounts for 47% of AGT’s geography exposure.

The Global X MSCI Argentina ETF (ARGT), which is comprised solely of Argentinian stocks, as well as a handful of currencies, saw its NAV fall 24.4% on Monday, only slightly more than AGT.

Argentina plays a significant role for frontier ETFs, with the country accounting for 15% of the Xtrackers S&P Select Frontier Swap UCITS ETF (XSFD). As a result of this large exposure, XSFD also saw its NAV drop 6.8% on Monday and a further 1.6% for the rest of the week.

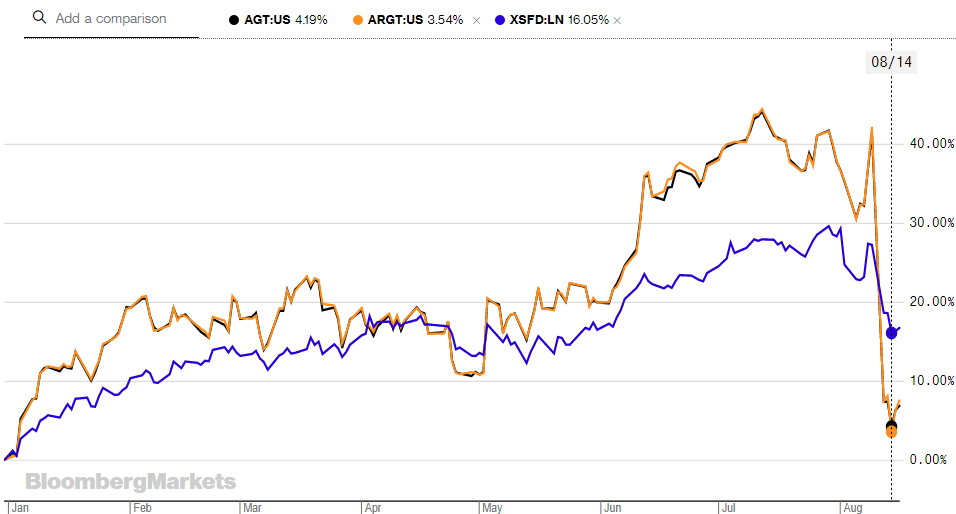

AGT, ARGT and XSFD's YTD performance - Source: Bloomberg

From the graph above it is obvious the event on Monday has caused AGT (Black), ARGT (Yellow) and XSFD (Blue) to see a large portion of their year-to-date gains to be lost. AGT and ARGT, in particular, saw their NAV climb over 40% between New Years and 8 August. Following the election, both are still positive for the year but significantly lower with AGT up 6.8% and ARGT up 7.5%.

In May, MSCI upgraded Argentina to emerging market status, resulting in stocks domiciled in the country being included in the corresponding indices. The performance of a number of emerging market ETFs has not been great as a result of the ongoing trade war between China and the US.