Amundi has overhauled its ESG range, shifting over €13bn of assets to track Paris Aligned Benchmarks (PAB) and Climate Transition Benchmark (CTB) indices.

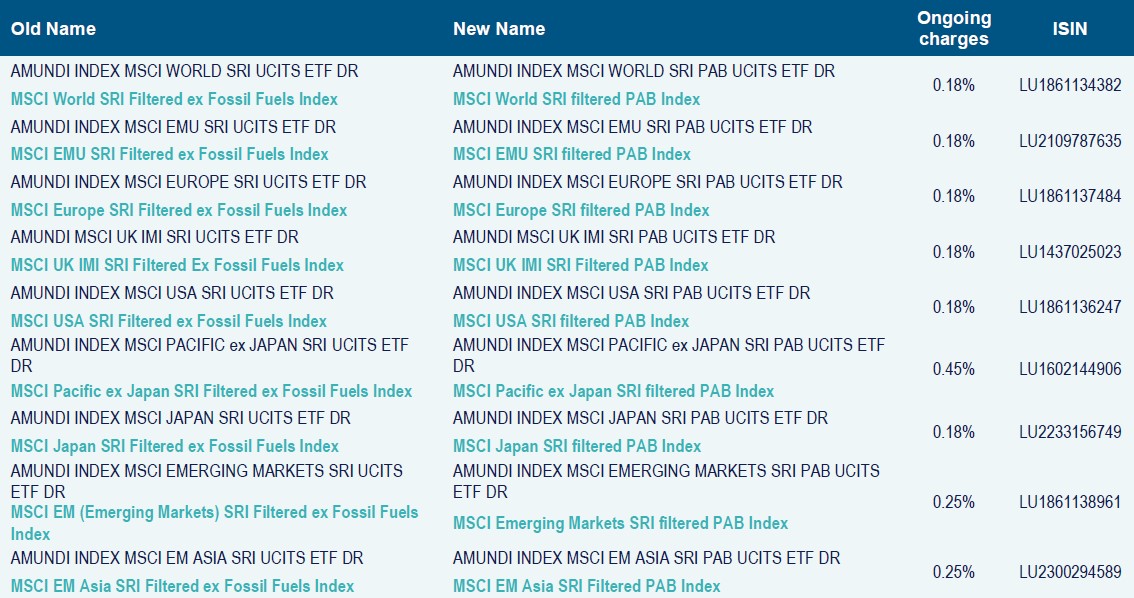

Effective 1 March, nine ETFs tracking SRI ex-fossil fuel indices – with assets under management (AUM) of €12bn – started tracking the MSCI SRI Filtered PAB indices. This includes the €3bn Amundi Index MSCI World SRI PAB UCITS ETF (WSRI) and the €3.2bn Amundi Index MSCI Europe SRI PAB UCITS ETF (ESRU).

It means the range will now fall in line with the EU’s PAB, designed to support a net-zero world by 2050 and limit the global average increase in temperature to 1.5°C.

The ETFs will follow a trajectory of a 7% reduction in carbon emissions on an annual basis and integrate an immediate reduction of 50% of the carbon intensity compared to the investable universe.

Source: Amundi

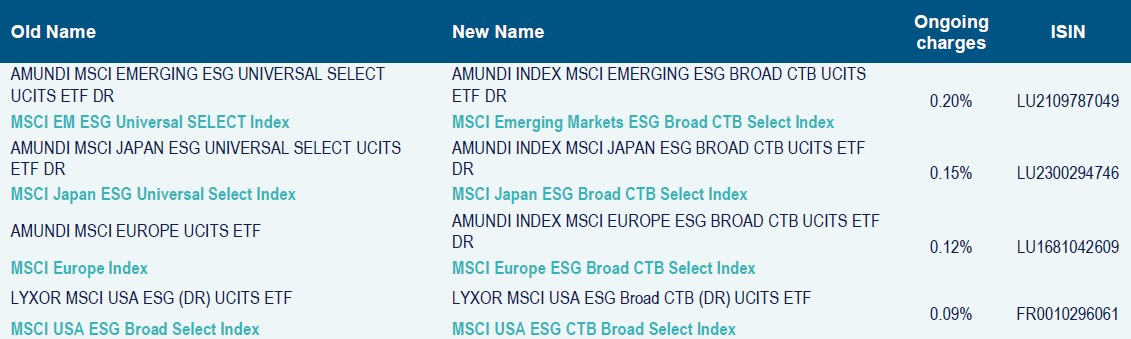

A further four ESG ETFs, with roughly €1.4bn AUM, have integrated climate criteria into their indices and will now track the MSCI ESG Broad CTB Select indices.

Source: Amundi

The names of all 13 ETFs will change to reflect the new benchmarks but will remain under the same ticker. The total expense ratios (TERs) will also remain unchanged.

Arnaud Llinas (pictured), head of ETF, indexing and smart beta at Amundi, said: “ETFs are reliable tools enabling all types of investors to access sustainable investing in a transparent, simple and cost-effective way.

“With this latest evolution within the range, Amundi reaffirms its strategic commitment to facilitating investors’ ESG and climate transition”.

It comes as issuers continue to green up their portfolios via index switches and new launches, driven by increased regulation and client demand.

Last December, BNP Paribas Asset Management underwent a major overhaul of its ETF range, shifting €9bn assets to ESG indices or the PAB with further plans to switch the whole range this year.

BlackRock also shifted its $9bn six-strong ETF range to track MSCI climate indices that are aligned to the PAB last October.

Related articles