The big question earlier in the year, as the high-flying performance of ARK Investment Management’s ETFs began descending to earth only to land in choppy seas, was whether investors would hold on in these rough waters.

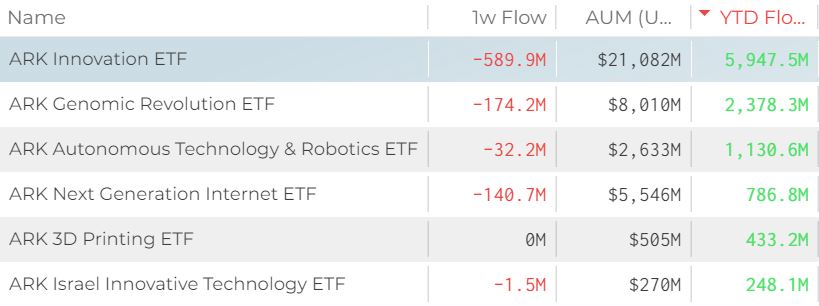

While year-to-date performance of the ETF range has been disappointing, at least relative to the S&P 500, ARK Invest has had no trouble continuing to gain and maintain assets as it navigates turbulent seas.

Despite this, however, several of the ARK ETFs have picked up well over $1bn so far this year. The Ark Innovation ETF (ARKK), for example, has seen nearly $5.9bn inflows, as at 19 August.

Source: ETFLogic

The two ETFs that have gained the most assets so far this year, ARKK and the ARK Genomic Revolution ETF (ARKG), are the two worst-performing strategies of the suite with year-to-date returns in negative territory.

Flagship ETF falters

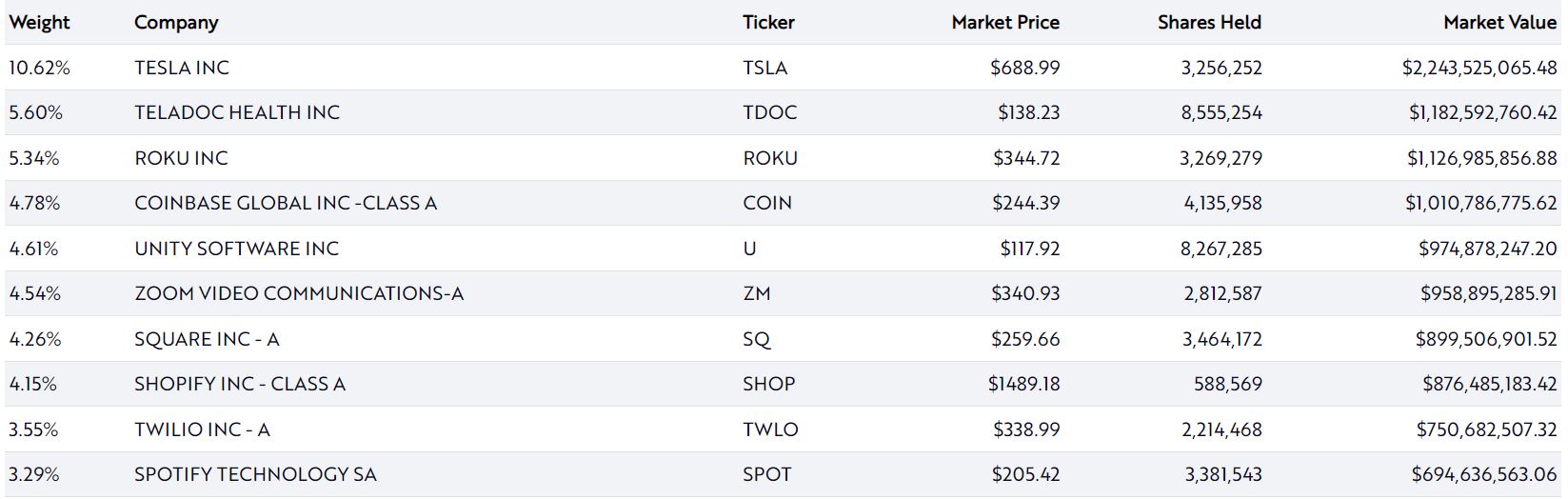

ARKK, the issuer’s flagship ETF, which has $22.6bn assets under management (AUM), had been up more than 25% in February before beginning its downward trend. The fund holds a portfolio of global stocks that are involved with or benefit from disruptive innovation.

ARKK is concentrated in software, biotech and IT services, with these industries making up about 50% of the portfolio. ARKK is relatively concentrated, with over half of the holdings in the top 10 and only holding 50 stocks in total.

Source: ARK Invest

With concentrated portfolios, there is a higher risk of volatility, as there is less diversification to smooth out returns should some of the holdings underperform.

Of the top 10 holdings, several have been significant detractors from the fund’s return for the year-to-date. Teladoc Health, Unity Software and Spotify are down anywhere from 16% to 33% so far this year.

The one thing all of these stocks have in common is that their stock prices ran up significantly in 2020, benefitting from the stay-at-home trade.

With revenue growth slowing in 2021, and investors focusing on stocks that would benefit from reopening, the shine has come off these names.

Biotech names bumble

ARKG has fared even worse this year, falling by 11.9% year-to-date after having gained more than 20% in mid-February. The $8.5 billion ETF has a more focused mandate versus ARKK’s, targeting companies involved in the genomics industry.

Similar to ARKK, the ETF is highly concentrated, with 43% of the portfolio in the top 10, and 59 holdings in total.

Source: ARK Invest

Nearly half of the fund is in biotechnology names. In a similar story to ARKK’s, many of the top holdings have had double-digit losses this year.

Teladoc is a top holding in this ETF as well. Other names such as Exact Sciences, Ionis Pharmaceuticals and Twist Bioscience are all down nearly 30% for the year.

Biotech names are generally a riskier and more volatile area of the market, with stocks in this space often depending on binary outcomes. For example, Ionis Pharmaceuticals’ stock fell nearly 22% in one day in mid-March after its partner, Roche Holding, announced plans to stop treating patients with Ionis’ drug, Tominersen.

Yields weigh on growth names

Aside from stock-specific risk, these ETFs have also been subject to downward pressure from the sharp increase in the US 10-year Treasury yield, particularly in the early spring months.

Source: MacroTrends

Yields nearly doubled from the beginning of the year through the end of the first quarter. Growth stocks, like the ones favoured by ARK Invest, are negatively affected by rising rates.

Growth stocks tend to command premium valuations due to the promise of higher growth in the future. However, rising rates – meaning more expensive borrowing and higher levels of inflation – eat into these future cash flows, putting downward pressure on prices.

Time horizon important

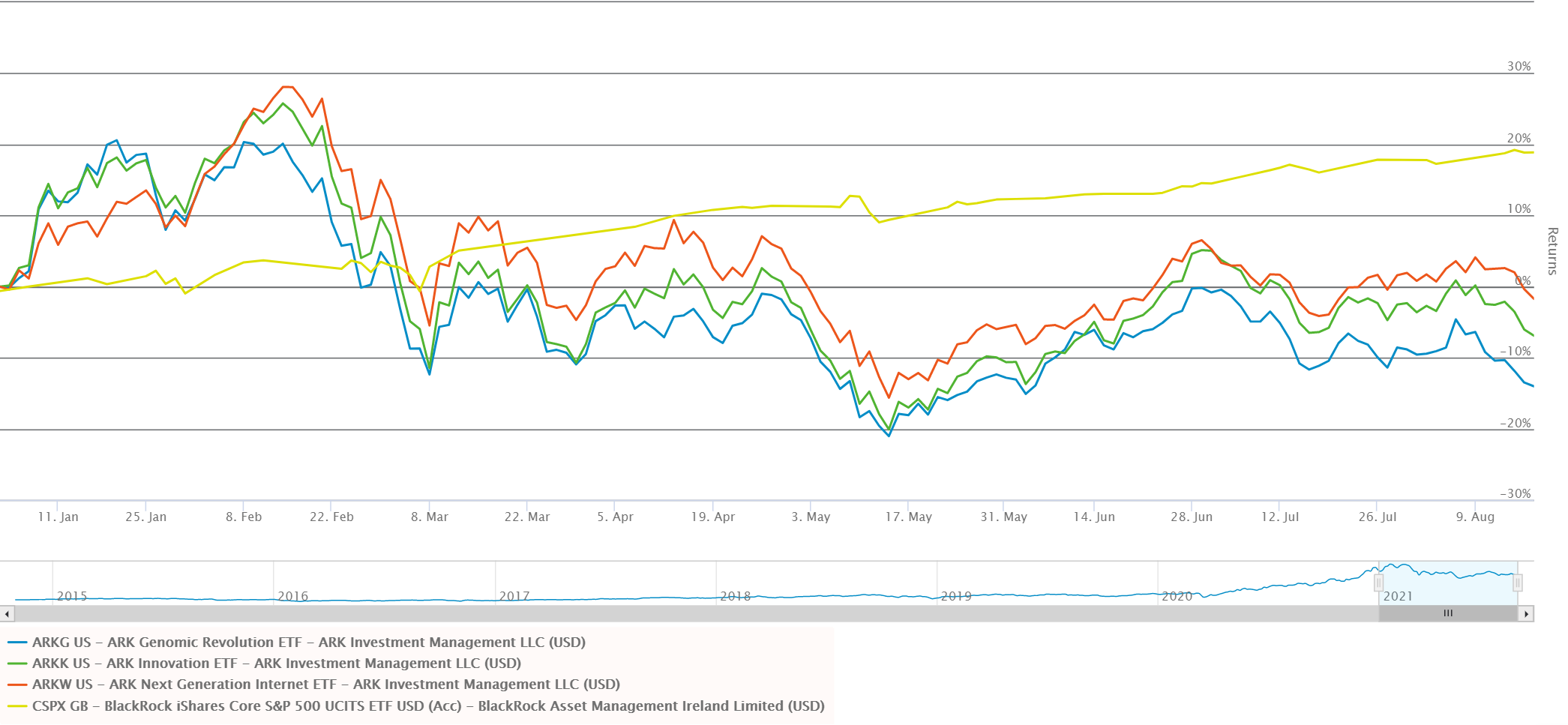

As mentioned above, concentrated portfolios such as those run by Cathie Wood and her team are particularly prone to volatility. However, widening the lens and looking at the long term can help remind investors of the importance of staying patient.

Over the trailing three years, the three largest ARK ETFs have more than doubled the performance of the iShares Core S&P 500 UCITS ETF (CSPX), even after accounting for their lacklustre performance this year.

Source: ETFLogic

Though past performance is no indication of future results, it seems most investors in these ETFs are all hands-on deck and holding course, betting that history will repeat itself.

This story was originally published on ETF.com