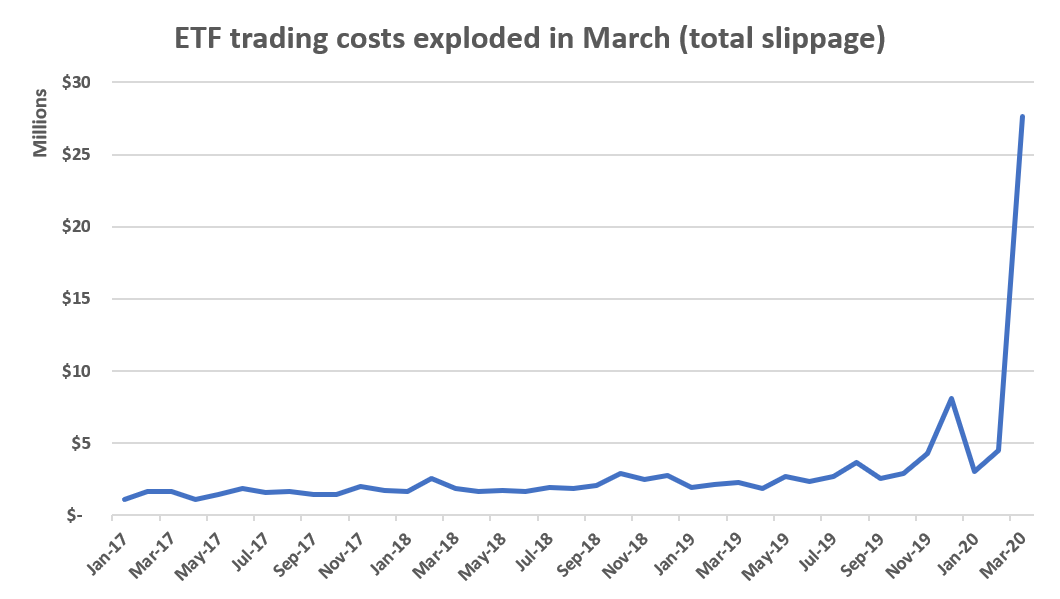

The costs of trading ETFs exploded in March, with Australians paying more than $27 million to trade, new ASX data reveals.

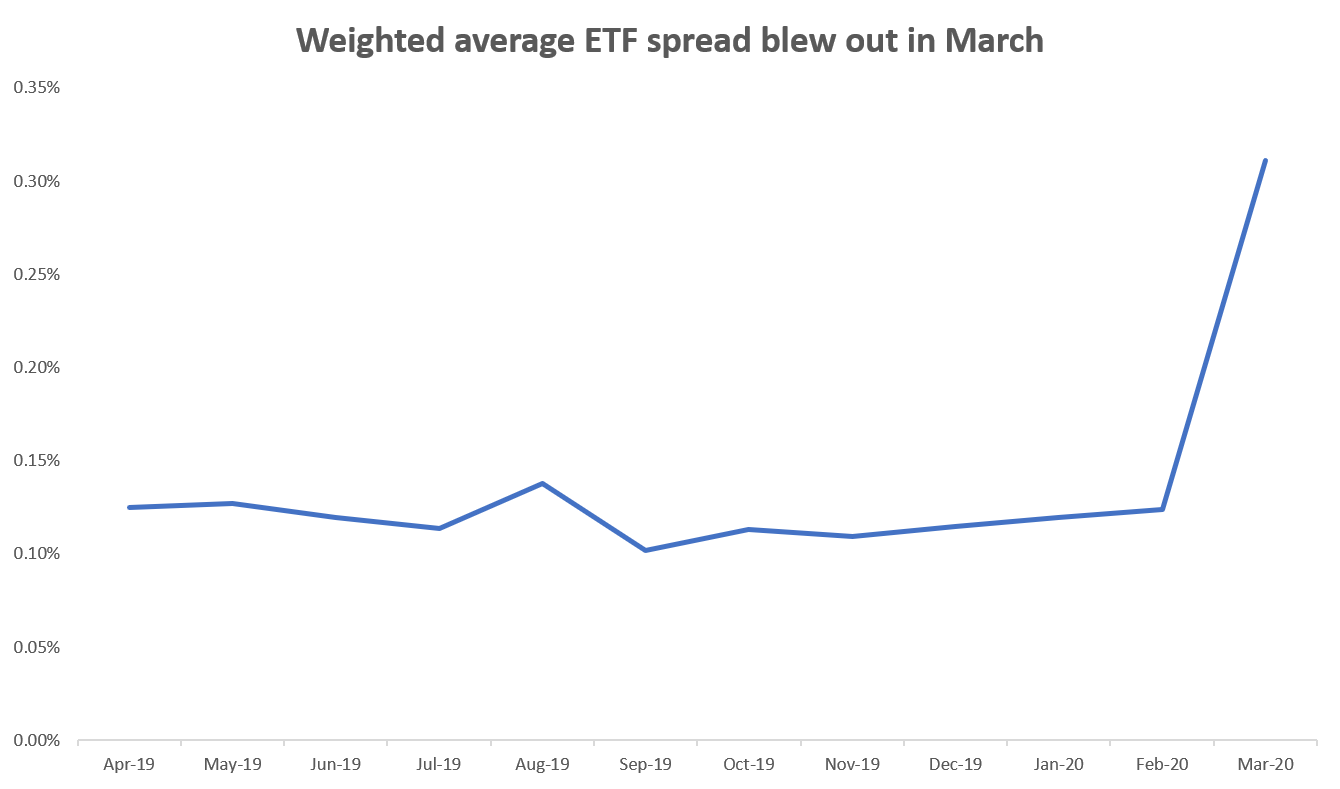

As coronavirus volatility rocked markets, the price of buying and selling ETFs – called “spreads” – increased dramatically. In March, the average spread on an Aussie ETF was 31 basis points, meaning that for every $10,000 of ETFs that traded, investors paid $31 round trip. This was nearly triple February’s average of $12.

Source: ETF Stream, ASX

Despite the higher costs, investors charged in like the Light Brigade with more ETFs changing hands in March than any month before.

The result of this – more trading, higher trading costs – was that Australians paid over $27 million to buy and sell ETFs over the month. This is up from the $5m paid in February, and the $3.5m paid in January.

Much – but not all – of this $27m will have been gone to professional trading companies called market makers. Most ETF trading on the ASX is controlled by market makers, although some is also controlled by private investors.

Exactly how much of the $27m will have been trousered as raw profit by market makers is hard to calculate. While market makers are known to profit when volatility rises, their own costs of trading and hedging also increase. Meaning a full picture of market maker profitability is very hard to build. However, if the United States is any guide, market making profits will be sharply increased.

According to Andrew Campion, the head of investment products at the ASX, ETFs proved highly resilient given the challenging market conditions.

"March was a month of unprecedented volatility across... equities, interest rate and equity derivatives, and ETFs. Reduced liquidity...is a natural consequence of heightened volatility as market participants seek to manage risk, and ETFs are not immune to that," he said.

"The fact that we had several days of greater than $1bn of traded value in ETFs during the month demonstrates the growing importance of ETFs as an investment tool."

Issuers felt March volatility differently

Source: ETF Stream, ASX

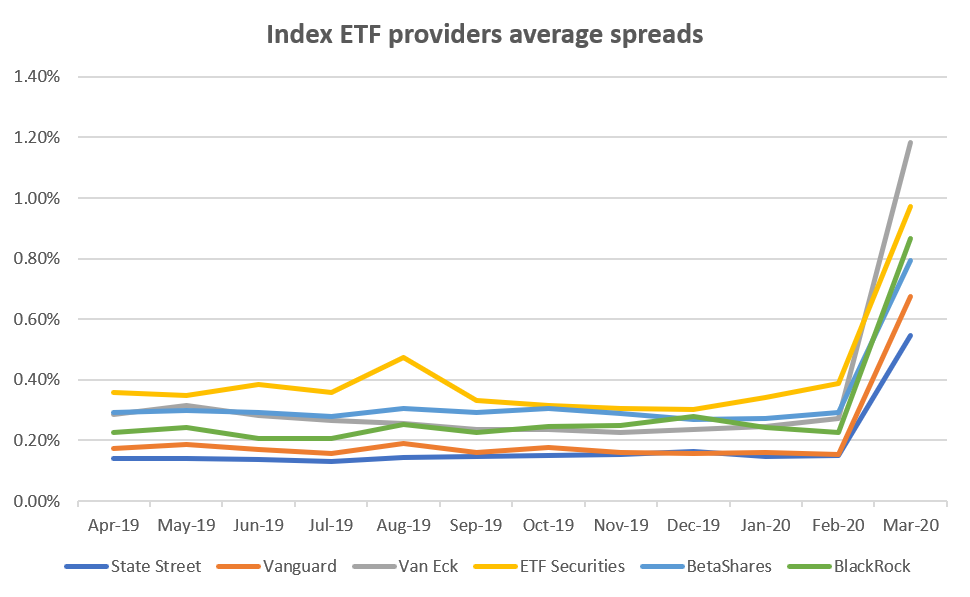

While volatility and wider spreads struck every ETF and provider, there were vast differences between ETFs and companies.

State Street cruised through March – relatively speaking – with its funds trading on some of the tightest spreads. Other ETF providers faced choppier waters, particularly those with more ETFs that hold illiquid securities or are actively managed.

Van Eck’s average spread was the highest of any index ETF provider. However, its spreads were smaller than some actively managed ETFs. Global funds giant Fidelity, for example, saw the spreads on its emerging markets ETF nearly triple to 1.2%.

Source: ASX, ETF Stream

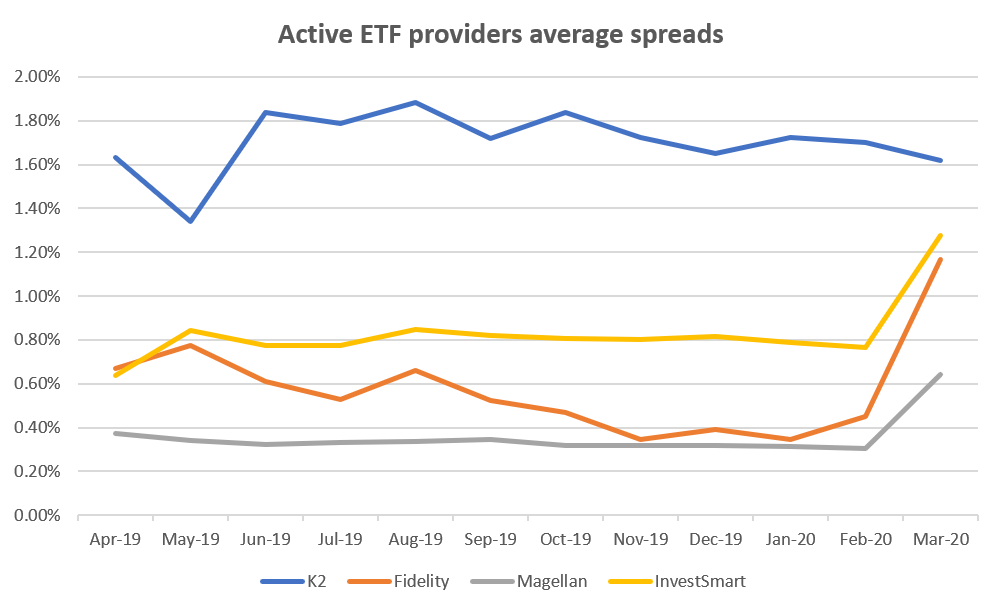

Peculiarly, one fund saw its spreads decline: the K2 Australian Small Cap Fund (KSM), which is provided by the Melbourne-based hedge fund K2 Asset Management.

The fund invests in Australian small companies. Yet despite the spreads on its underlying holdings widening, KSM’s spreads declined. KSM has had by far the widest spreads of any Aussie ETF historically.

K2 declined ETF Stream’s request for comment.

Hyper liquid ETFs not immune

Even the mighty were not spared. The iShares S&P 500 ETF (IVV) – one of the most popular ETFs in the world, with $175bn under management globally – saw its spreads widen from 4 to 15 bps on the ASX.

Keeping ETFs that track the S&P 500 trading on tight spreads is usually quite easy as there are tools traders can use – called “hedges” – to iron out wrinkles. These hedges include S&P 500 futures as well as other S&P 500 ETFs.

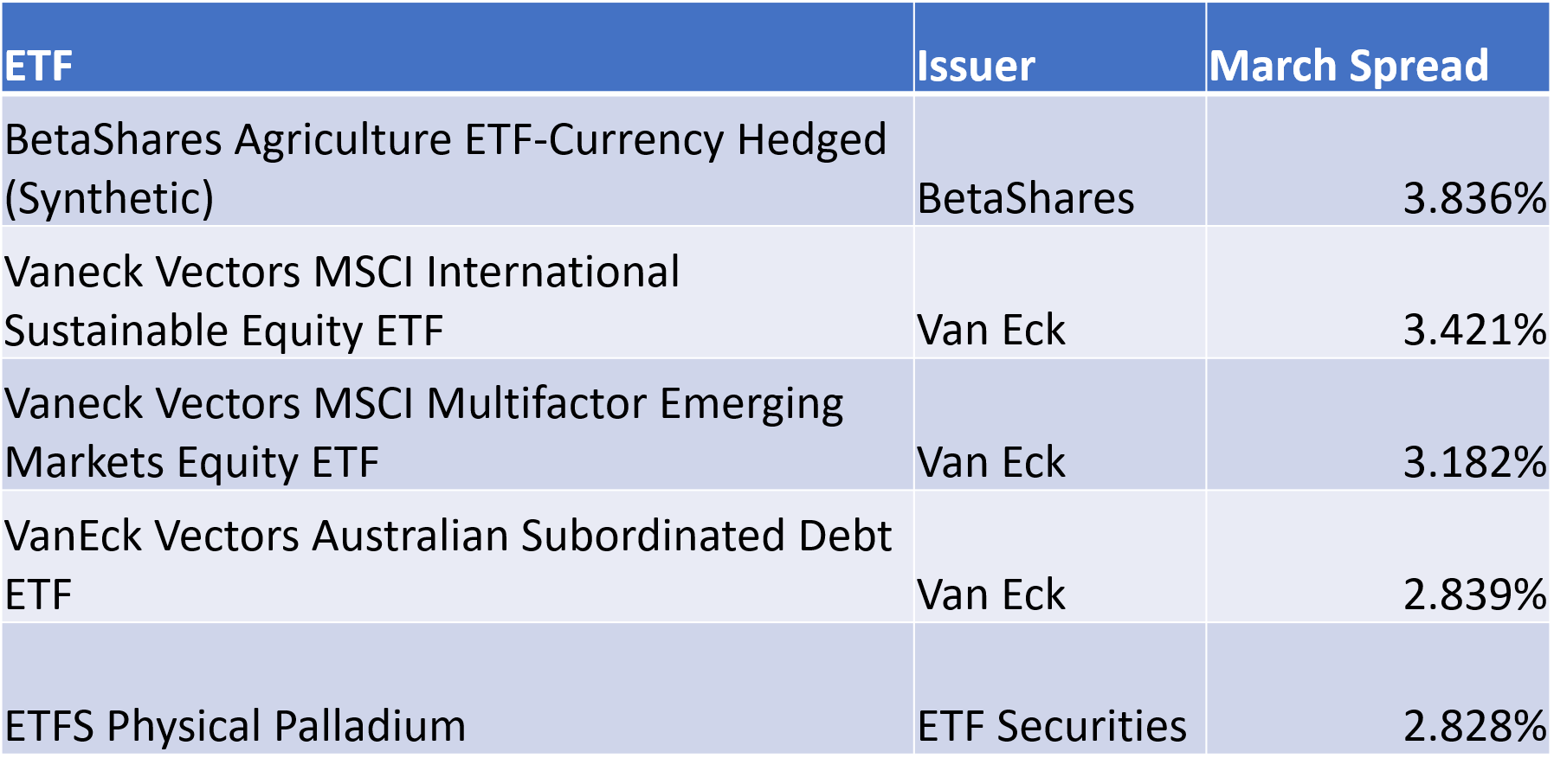

ETFs with the widest spreads in March

Source: ASX, ETF Stream

The sheer abundance of hedges means that in the United States, IVV typically trades on a tiny 1 basis point spread – making it one of the easiest and cheapest securities to trade globally.

But rather unusually, and in a sign of how serious last month’s volatility was, S&P 500 hedges – including both futures and other ETFs – saw their spreads thrown out too. This meant the spreads on IVV fell out.

Indexes matter

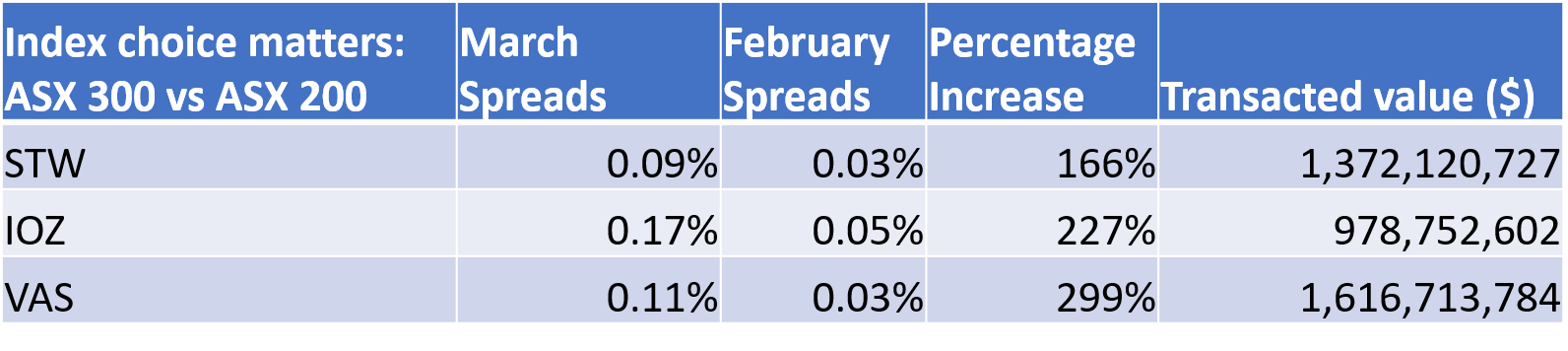

March volatility also showed that the spreads on ETFs can be influenced by which index they track – even for ETFs that are nominally the same.

The Vanguard Australian Shares Index ETF (VAS) is usually the most popular and heavily traded Australian ETF. Yet VAS saw its spreads blow out further than its lesser-traded competitors, State Street’s SPDR S&P/ASX 200 ETF (STW), and iShares S&P/ASX 200 ETF (IOZ).

Source: ETF Stream, ASX

This was thanks to VAS following the ASX 300 index rather than the more famous ASX 200 index. The lesser-known ASX 300 index contains smaller companies that trade far less. This can mean it is more expensive to buy and sell all the shares VAS holds and can make Australian share index futures, called SPI, less accurate hedges.

Sign up to ETF Stream’s weekly email here