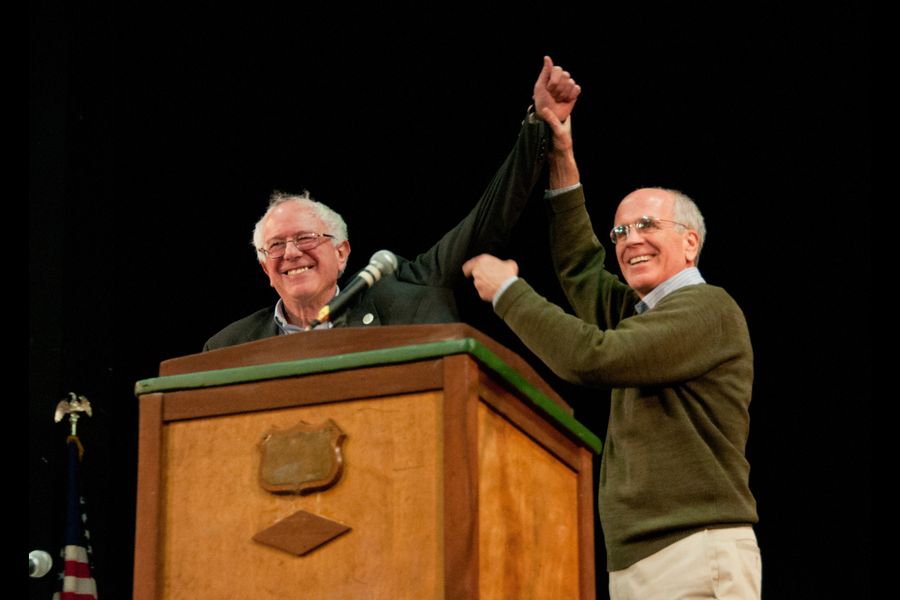

US senator Bernie Sanders has called out the ‘Big Three’ of BlackRock, Vanguard and State Street Global Advisors (SSGA) over their growing influence on financial markets.

In a tweet, Sanders noted how the trio has amassed over $22trn assets and are major shareholders in more than 96% of S&P 500 companies.

Concerns over the rise of the ‘Big Three’ issuers have been growing over the past year, with many speculating passive funds influence more broadly are becoming too influential.

Sanders is the latest to blast the common ownership issues of index funds. In February, Charlie Munger said the rise of the 'Big Three' is creating a new centre of power for corporate governance while Elon Musk also recently took to Twitter to declare that "passives have gone too far".

Passive funds’ – including ETFs – own on average 21.2% of every company in the S&P 500, according to data from Bloomberg Intelligence, a figure that has doubled over the past seven years.

However, the ETF fandom was quick to defend the 'Big Three', highlighting the benefits they have brought to the industry such as lowering costs associated with investing.

As Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, said: “If Bernie Sanders understood the low-cost revolution led by the ‘Big Three’, he would likely find it is right up his populist ally.”

In a blog post titled Even Socialists Misunderstand Indexing, wealth manager Barry Ritholtz said Sander’s comments show a “fundamental misunderstanding” of what has been going on in the world of investments.

“What seems to be misunderstood by Senator Sanders is how these three giant asset managers took away a lot of this business from the old guard of expensive Wall Street,” he wrote.

“They did it moving to a very different business model of low-cost passive indexing. They refused to play the wild alpha-chasing game, and started offering simple, inexpensive ETFs and mutual funds.”

Universal managers, not monolithic owners

Research published by MSCI said while principal shareholder power was becoming increasingly concentrated, it was important to remember the ‘Big Three’ are not the “ultimate beneficial owners”.

The research found that BlackRock owns 5% or more of 638 index constituents, 458 of which are US listed, with an average holding size of 7.5%. Meanwhile, Vanguard held more than 5% of more than 424 index constituents, 395 of which are US listed, with an average holding size of 9.4%.

However, MSCI said it was important to see the ‘Big Three’ as “universal managers not as monolithic owners”.

“It also suggests the apparent ownership concentration we observed may really just reflect a new way of achieving — and managing — more widely dispersed ownership,” it said.

“If we think of universal managers not as monolithic owners but rather as complex mechanisms whereby their many clients may ultimately exercise their shareholder rights and responsibilities more efficiently and effectively, then what we may see is not greater ownership concentration but its opposite.”

Despite this, a growing body of research continues to highlight the risks around the concentration of assets of just a small number of issuers.

This includes reducing stock market efficiency by over a third to using their vast voting powers as a marketing tool in a bid to attract younger investors more conscious of ESG.

So far, BlackRock is the only issuer that has looked to address the concerns. Last month, it announced it would increase the range of funds eligible for its Voting Choice programme in the UK and expand the scheme to Canadian and Irish pooled funds, giving investors a choice on how their votes are being cast.

It takes the assets eligible under Voting Choice to 47% – $2.3trn – of its $4.9trn index equity assets, covering certain index strategies invested in by institutional clients, pension funds, insurance companies and corporations in the US and UK.

Related articles