The BetaShares Australian Strong Bear (Hedge Fund) ETF – known by its ASX ticker “BBOZ” – is not exactly a household name among Australian investors.

Yet the fund, which allows investors to profit when the Australian economy tanks, has become the most traded ETF in the country, new data from the ASX indicates.

In March, BBOZ saw a staggering $2 billion worth of trades over 23 trading days – meaning an average of almost $86 million of BBOZ changed hands every day. This meant the fund traded more than many well-known companies' shares, such as Telstra.

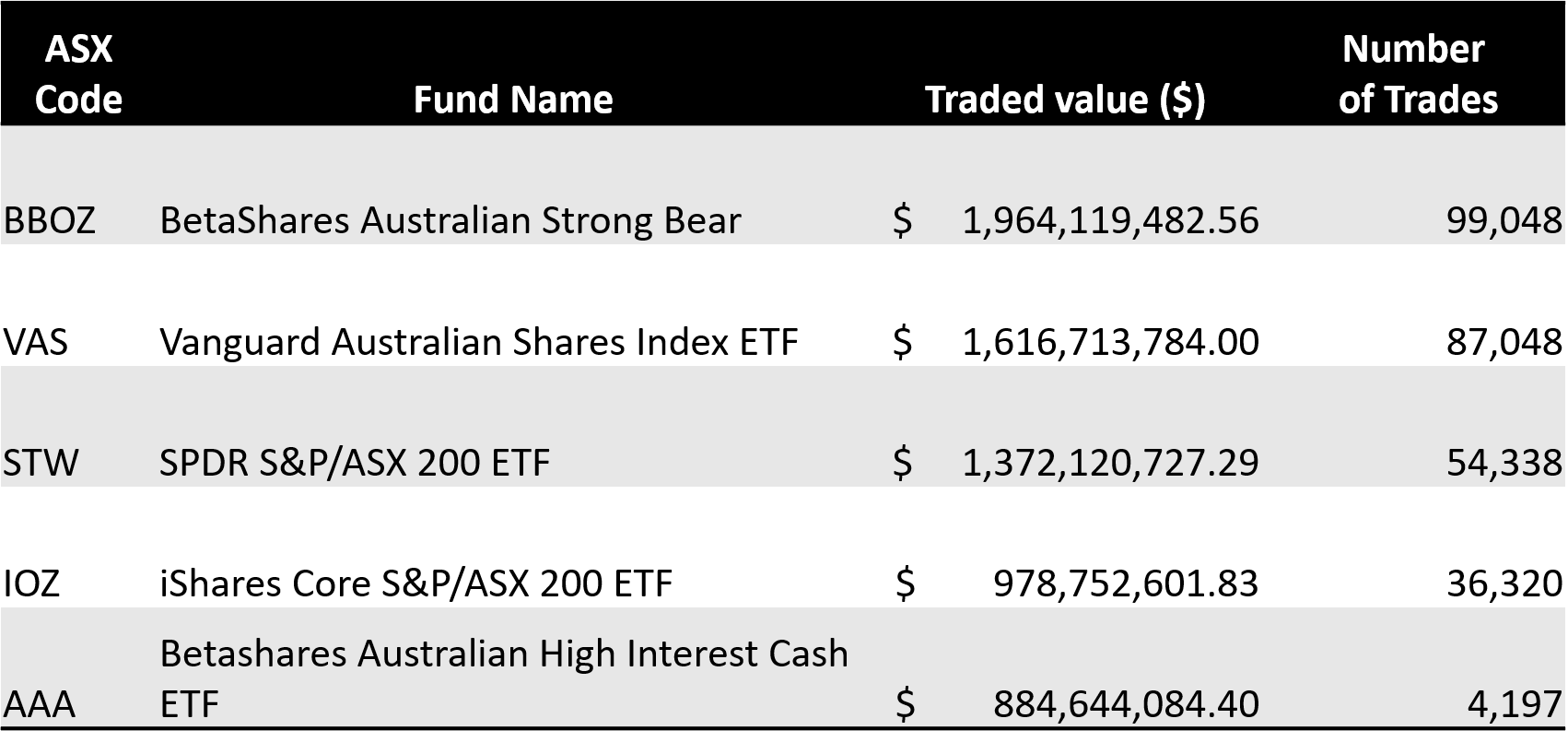

Australia's most traded ETFs in March. Source: ASX.

The figure represents a 500% increase in trading activity from the month before, ASX data indicated.

According to Alex Vynokur, chief executive of BetaShares, most of the trading coming from fund managers and advisors who use BBOZ to get around mandates restricting the use of derivatives.

“A lot of it comes down to mandate,” he says.

“Many mandates for separately managed accounts ban the use of derivatives. An advantage of BBOZ is that it is not a derivative—it is a security that trades on the ASX and does not have the risks of derivatives.”

He adds that some retail punters are using BBOZ to make downbeat wagers on the Australian economy—but they’re a minority.

“Some people want to profit from when the market falls. [But] the vast majority of turnover is institutional investors. Retail [use] would be small…maybe 20%.”

Spanish flu offers no tips for coronavirus dip buyers

The heavy trading coincided with the fund having its best performing month of all time. In March, BBOZ rose 36% in value, while the Australian share market fell approximately -22%.

BBOZ profits from a falling market by short selling Australian share index futures.

The fund was not invented as a standalone investment or for long-term buy and hold investors. Rather it was created as an alternative to derivatives like contracts for difference, where investors risk losing more money than they have.

Sign up to ETF Stream’s weekly email here