BlackRock has expanded its environmental, social and governance (ESG) ETF range with the launch of a UK strategy, ETF Stream can reveal.

The iShares MSCI UK IMI ESG Leaders UCITS ETF (UKEL) is listed on the London Stock Exchange with a total expense ratio (TER) of 0.15%.

UKEL tracks the MSCI UK IMI Country ESG Leaders 5% Issuer Capped index which offers exposure to small, medium, and large-cap UK equities, with constituents scoring highly on ESG considerations versus their sector counterparts.

The benchmark is similar to the MSCI UK IMI Country ESG Leaders index with the addition of a maximum weighting per company of 5% to limit concentration risk.

Excluding thermal coal, oil sands, nuclear weapons, controversial weapons, tobacco, UN Compact violators and civilian firearms, the index has a 24.1% focus on financials and then has a 15.8% weighting in consumer staples, 15.4% in industrials, and 11.6% in consumer discretionary.

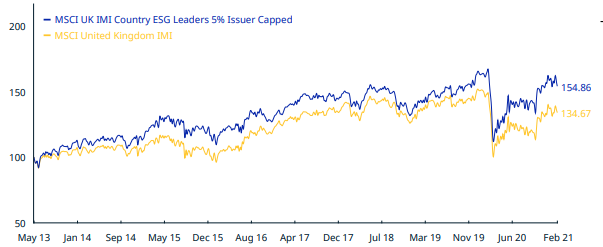

The MSCI ESG issuer capped index has outperformed the non-ESG MSCI IMI UK index on a cumulative basis since at least May 2013, and by 7.2% in 2020.

Demand for UK equities with an ESG tilt is developing rapidly. In response, issuers have been bringing ETFs to market at a rapid rate.

In December 2020, DWS switched its UK equity ETF to an ESG index and changed the strategy's name to the Xtrackers MSCI UK ESG UCITS ETF (XASX).

Furthermore, HSBC Global Asset Management expanded its low carbon suite in October 2020 with the addition of the HSBC UK Sustainable Equity UCITS ETF (HSUK) while Amundi swapped the index on its FTSE 100 ETF to track the MSCI UK IMI SRI Filtered Ex Fossil Fuels index.