The ETF market will continue to grow according to 92 per cent of respondents in the EY 2018 ETF Research, released today. In addition to the expected growth, 65 per cent believe that active managers and/or asset management arms to large banks will enter the ETF market.

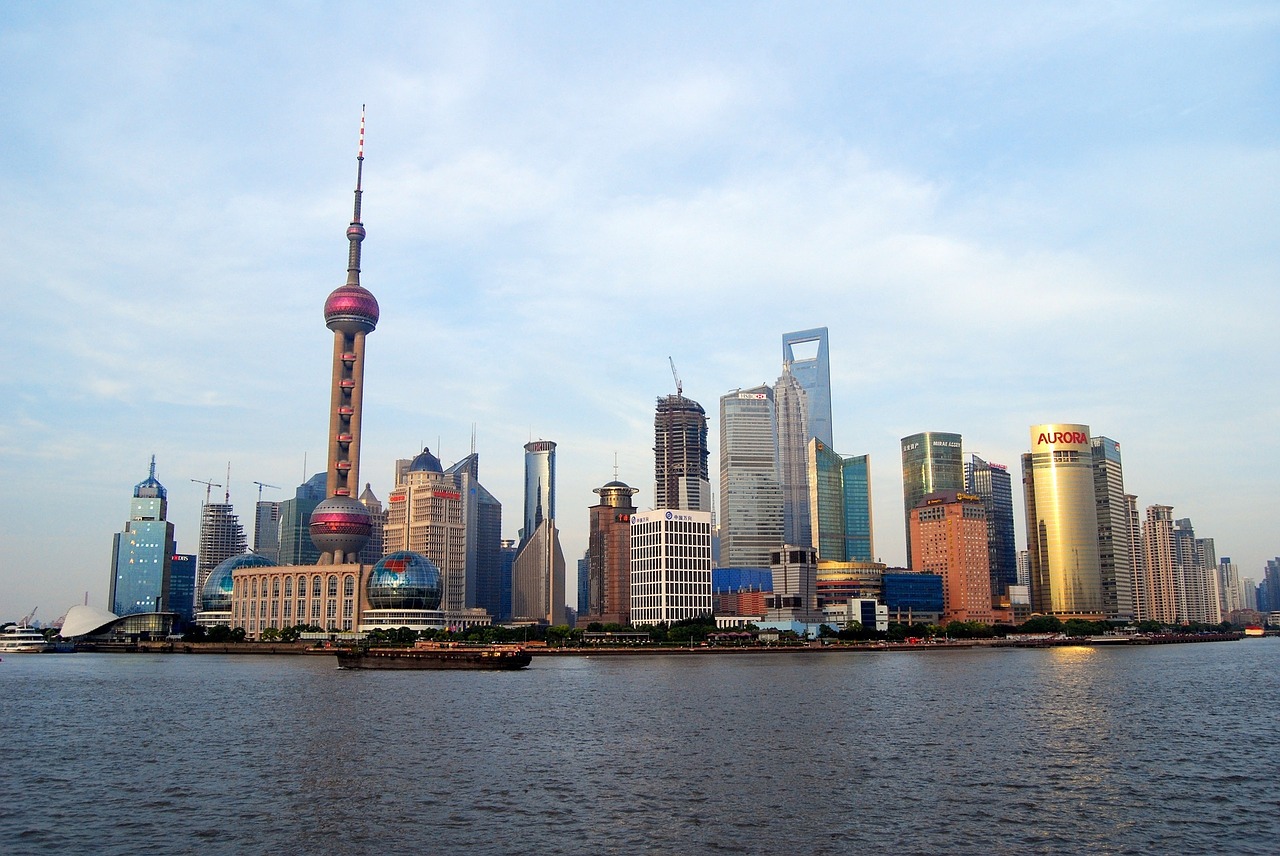

China is being labelled the 'gamechanger' to the ETF market as the vast majority (97 per cent) of the study believe the Chinese market will reach $100bn in AUM in the next five years. A key driver for this decision is the launching of ETF Connect, the cross-border project which enables Chinese investors to invest in overseas assets via ETFs listed in Hong Kong. A more promising two-thirds believe the market will reach $100bn within three years.

For the market to further develop its distribution strategies, 67 per cent surveyed said ETF issuers need to enhance its product data on their websites. Additionally 62 per cent said they would prefer if the products were made available through online platforms as technology becomes a key factor within the industry. It is expected the inclusion of emerging technologies will reduce costs, according to asset manager.

Lisa Kealy, EY EMEIA Wealth & Asset Management ETF Leader: "Cost is now seen as a performance metric, so technology and operating model changes are planned to help create a competitive advantage. More than two-thirds (83 per cent) of asset managers have told us they are looking to use new technologies to reduce costs. So there will be significant shift in the operating model."