Lyxor’s emerging markets ETF that excludes China saw over $100m inflows in one day this week, in a sign investors are becoming increasingly concerned about the level of state intervention in the world’s second-largest economy.

According to data from Bloomberg Intelligence, the Lyxor MSCI Emerging Markets Ex China UCITS ETF (EMXC) saw $116m inflows this week, taking its overall assets under management (AUM) to $204m.

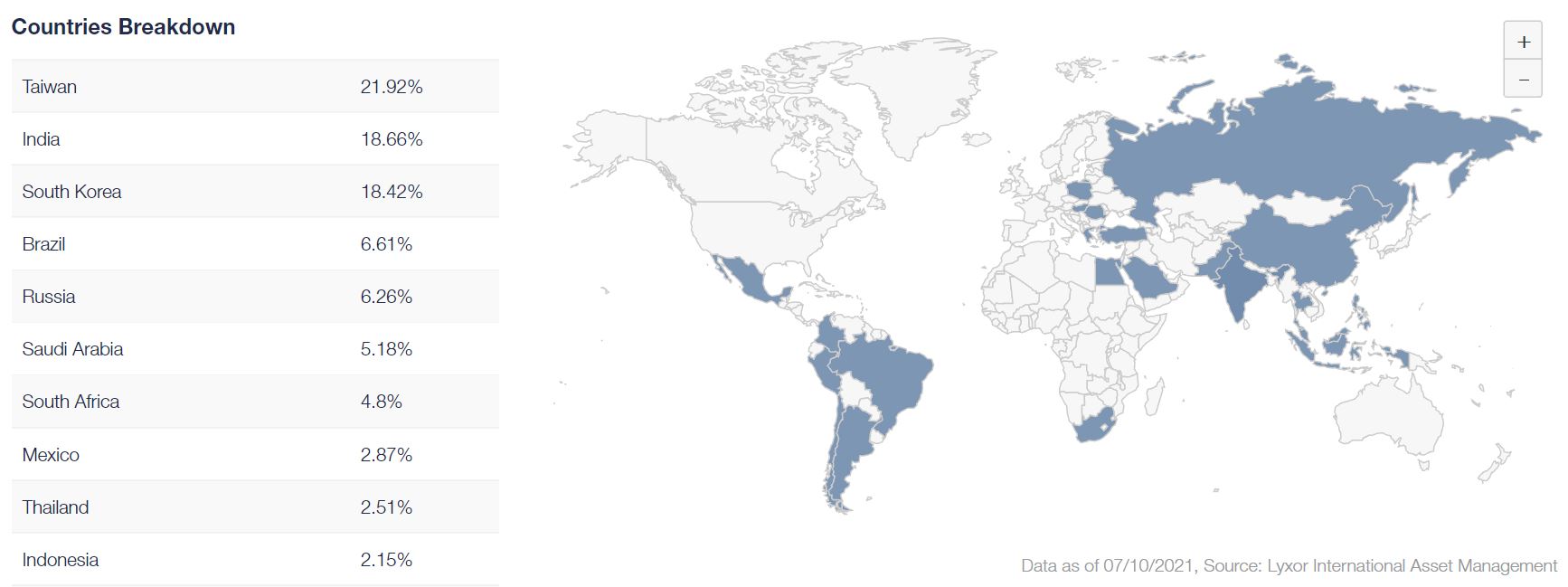

Chart 1: EMXC country breakdown

The inflows come in the wake of a regulatory crackdown in China which has seen private companies targeted by the government.

In particular, President Xi Jinping’s government has introduced a string of measures that have been aimed at the country’s tech sector in areas such as private tutoring.

As a result, avoiding exposure to mainland Chinese securities, A-Shares, which have become a bigger part of emerging market indices over the past few years, could be a key driver behind the recent inflows.

Demand for A-Shares has weakened recently with the iShares MSCI China A UCITS ETF (CNYA) seeing $130m outflows over the past three months, as at 14 October, according to data from ETFLogic.

This trend has been occurring across the pond as well. The iShares MSCI Emerging Markets ex China ETF (EMXC) has seen $792m inflows over the past three months as investor concerns around the freedom of Chinese companies grow.

Recognising the potential demand, BlackRock followed Lyxor in launching its own ETF in Europe, the iShares MSCI EM ex-China UCITS ETF (EXCH), which has gathered $33m AUM since coming to market in April.

Some investors, however, have viewed the recent collapse in valuations as an attractive entry point. Highlighting this, the KraneShares CSI China Internet UCITS ETF (KWEB) has seen $392m inflows over the past three months, as at 14 October, while its US-listed counterpart, the KraneShares CSI China Internet ETF (KWEB) has seen a huge $4.6bn inflows.

Further reading