While markets have spent the year so far staring down the barrel of seemingly inevitable recession, a recent shift in asset flows and returns suggests there is no consensus on whether a slowdown will have dire consequences for investors or whether the worst has already been baked into valuations.

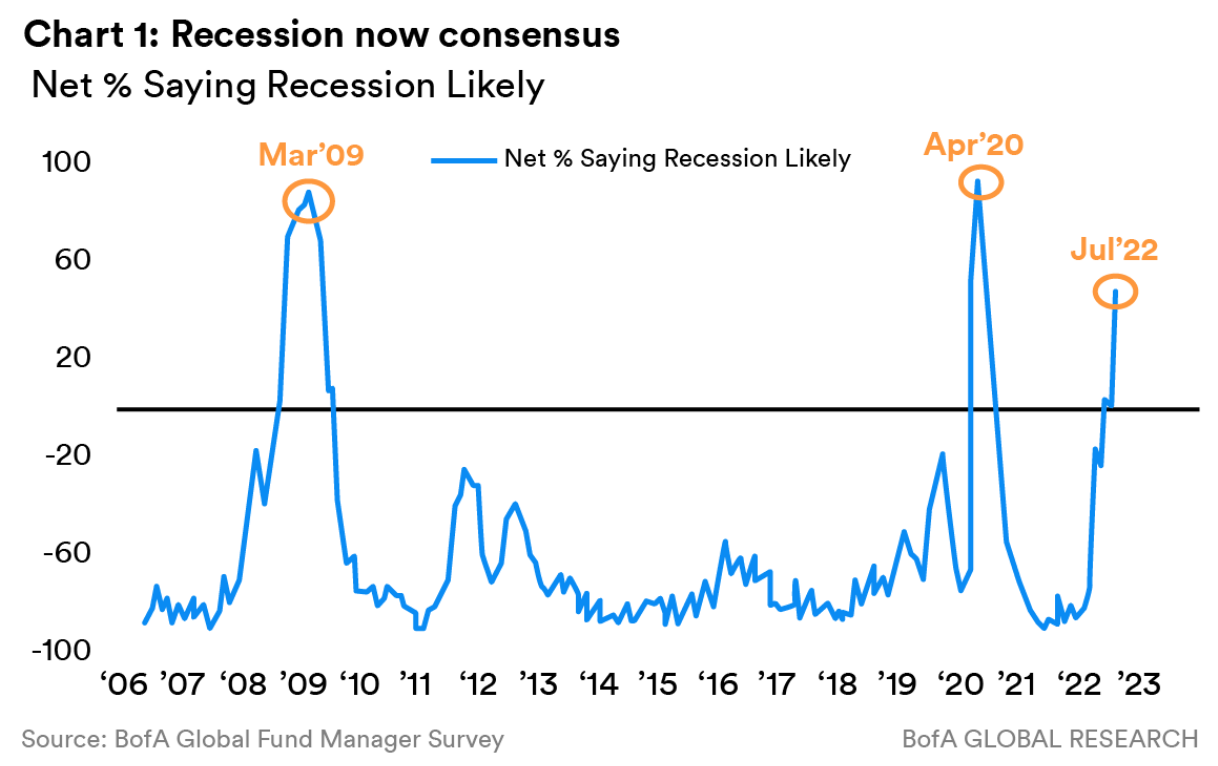

Of course, a recession is not a foregone conclusion but one expected by a growing share of market participants. According to Bank of America’s (BofA) latest fund manager survey, the number of respondents forecasting a recession is at its third-highest level in 15 years.

Even more uninspiring is the percentage of respondents expecting global profits to improve going forward is at its lowest monthly reading since the turn of the millennia.

This bearish view is reflected in asset allocation with an exodus from commodity exposures both sides of the Atlantic. In fact, investors pulled $5.1bn outflows from US-listed commodity ETFs in the first three weeks of July marking the asset class’s worst three-week flow in a decade.

At the same time, investors are simultaneously going risk-off and preparing ‘dry powder’ by allocating to cash at the highest rate since 2001.

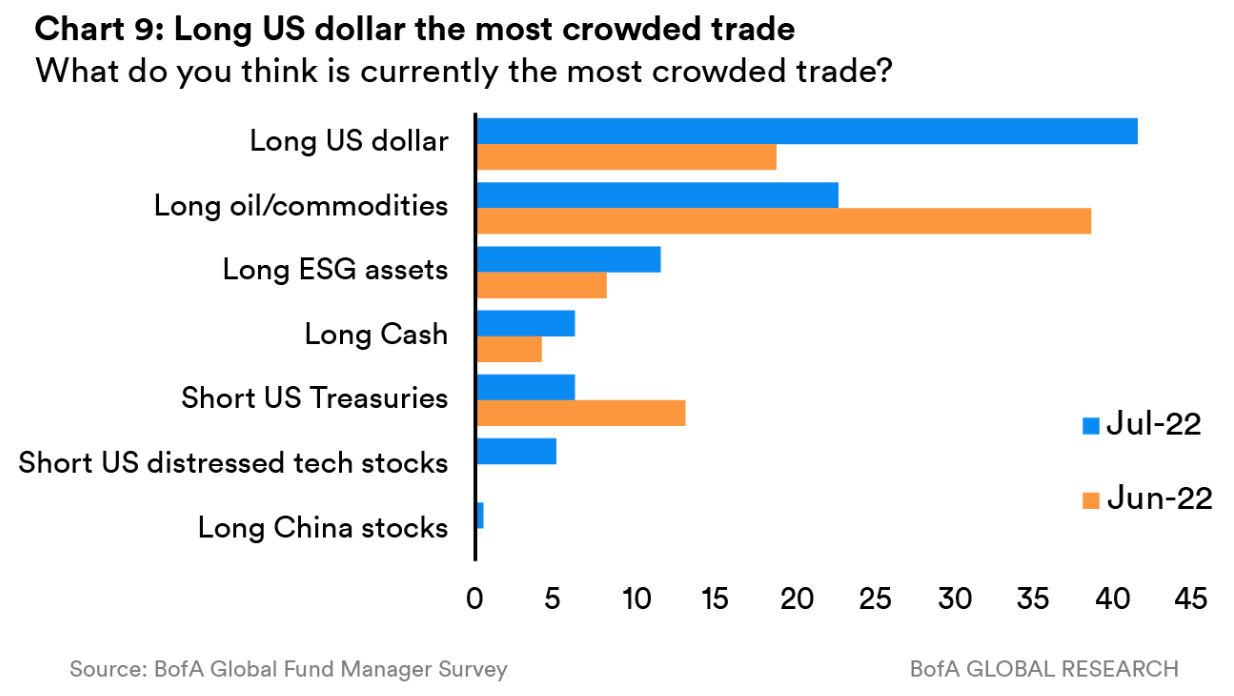

Meanwhile, they are rushing to safe havens such as the US dollar – with the WisdomTree Short JPY Long USD (SJPY) returning an impressive 23% over the 12 months to 25 July, according to data from ETFLogic. BofA’s survey respondents also named ‘long US dollar’ as the most overcrowded trade in July.

However, there are varying shades of doom and gloom among investors – and some anticipate a recession to act as more of an inflationary firebreak than a catastrophic event.

For instance, JP Morgan’s July global markets strategy argued a mild recession has already been factored into prices – and we have already seen the most severe Federal Reserve pricing.

“While recession odds are increasing, a mild recession appears already priced in based on the year-to-date underperformance of cyclical versus defensive equity sectors, the depth of negative earnings revisions that already matches past recession moves, and the shift in rates markets to price in an earlier and lower Fed funds rate peak.

“With the peak in Fed pricing likely behind us, the worst for risk markets and market volatility should also be behind us.”

Supporting the view that recession fears are overplayed, popular volatility hedge – gold – currently dominates outflows in Europe, with investors pulling $1.3bn from the $14.2bn iShares Physical Gold ETC (IGLN) over the past month, as at 26 July, according to data from ETFLogic.

However, it is worth noting the US dollar’s recent strength has created an inverse relationship between the greenback and gold – with potential further downside risk for the precious metal.

Also, the large outflow from IGLN could owe to a risk-on rotation from a single or handful of investors into ETFs such as the $910m SPDR S&P U.S. Technology Select Sector UCITS ETF (ZPDT), which topped European inflows last week with $376m in new assets, according to Ultumus.

This shift into tech and growth more broadly is a positive signal, with these higher beta positions tending to be taken by investors who may still expect a recession while anticipating the worst of the impact to have already been priced-in.

Making this case, Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said a sea change has been occurring in value’s outperformance versus growth.

Looking at US ETFs, he said: “That outperformance appears to be stalling, driving more than $3bn in outflows from value ETFs in the past three weeks versus inflows for growth-oriented peers.

“A broader market recovery could drive more outflows from value ETFs as investors rotate into higher-beta growth funds.”

JP Morgan’s view is economic activity might be “challenged” in H2, however, “bad data is starting to be seen as good” and an activity reset is actually “what many want to see to start looking through”.

The firm also predicted such a slowdown could lead to a more balanced Fed and a “rollover” in bond yields, alongside a potentially peaking US dollar and levelling off in inflation.

This creates a positive set of conditions for tech and growth more broadly, whose constituents have responded well to earnings releases, according to Longview Economics Research.

“We expect bond yields to continue to moderate from current levels.” Longview added. “If so, that should support further tech outperformance over coming weeks and months.”

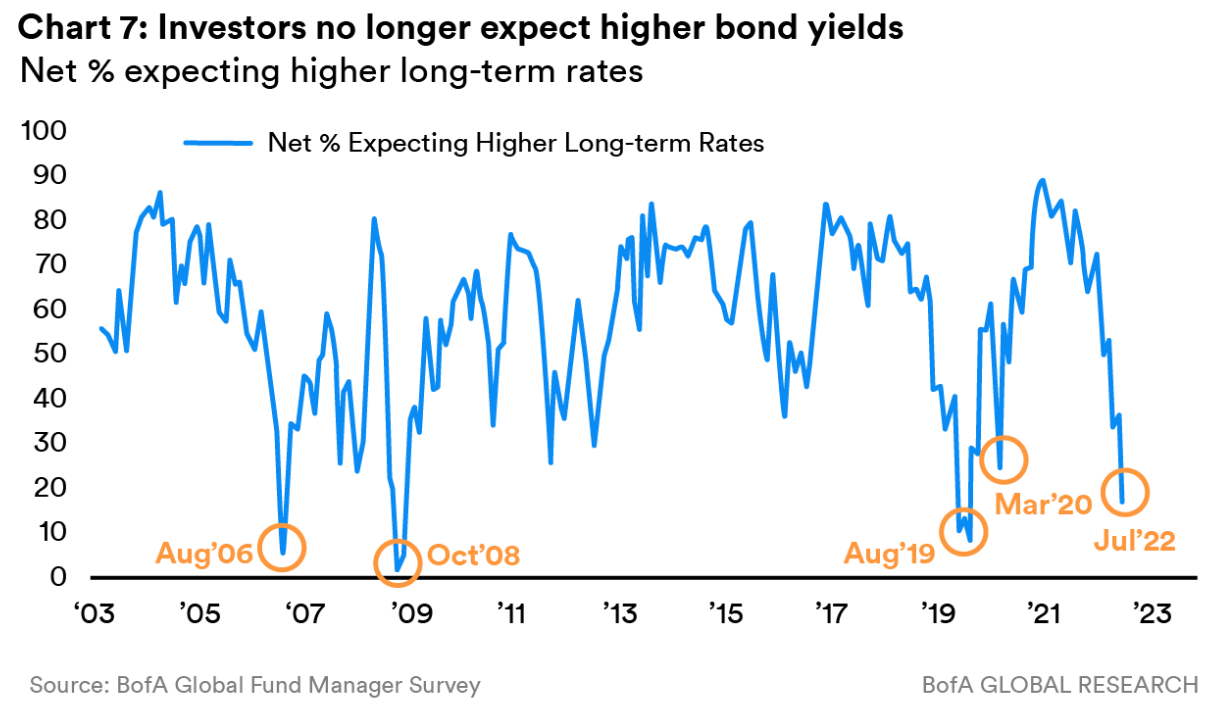

The view that bond yields could continue softening was shared by BofA respondents, with the percentage expecting rates to increase at their lowest level since the pre-pandemic era.

Arguably, what has played out in flows in recent weeks is positioning at either end of the recession cycle.

Commodity outflows suggest investors see a likelihood of continued economic slowdown in Q2 data and beyond. As this slowdown plays out, investors might then expect inflation to cool, Fed policy to become less severe, bond yields to moderate and in turn, conditions could be prime for growth outperformance.

Flows over the past week would suggest this more risk-on positioning is the route some investors are beginning to resume after bear market returns capped off a risk-averse H1.

Related articles