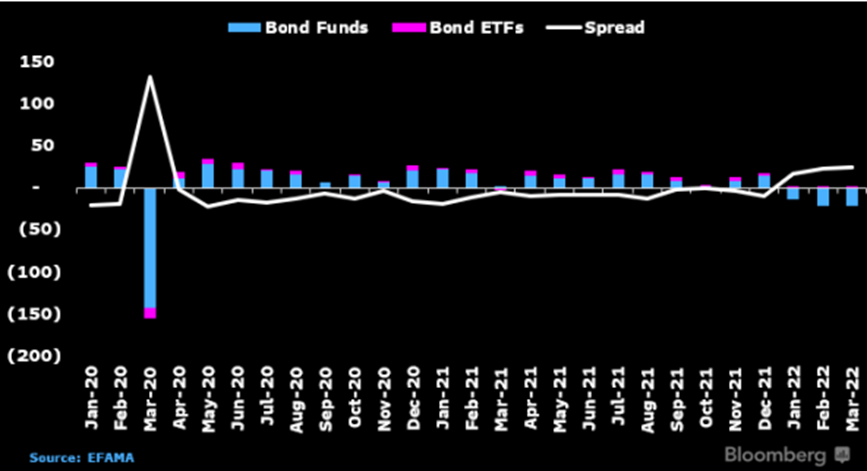

Bond ETFs in Europe could be set for a boon as they continue to pick up inflows despite a substantial asset exodus from bond mutual funds over the first half of 2022.

Fixed income ETFs on the continent, which account for less than 10% of European fund assets, have taken in €6bn year-to-date, while the region’s bond mutual funds saw €57bn outflows in Q1 alone, according to data from Bloomberg Intelligence.

The outflows are the most severe from the asset class since March 2020 as rising interest rates prompt investors to flee fixed income.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, believes bond ETFs are ripe to capitalise on mutual fund woes.

“Outflows from bond mutual funds are opening up an opportunity for bond ETFs, which have taken in €6bn year-to-date. Bond ETF inflows tend to be steadier, shrinking the asset gap with mutual funds during heavy redemption periods,” he said.

Source: Bloomberg Intelligence

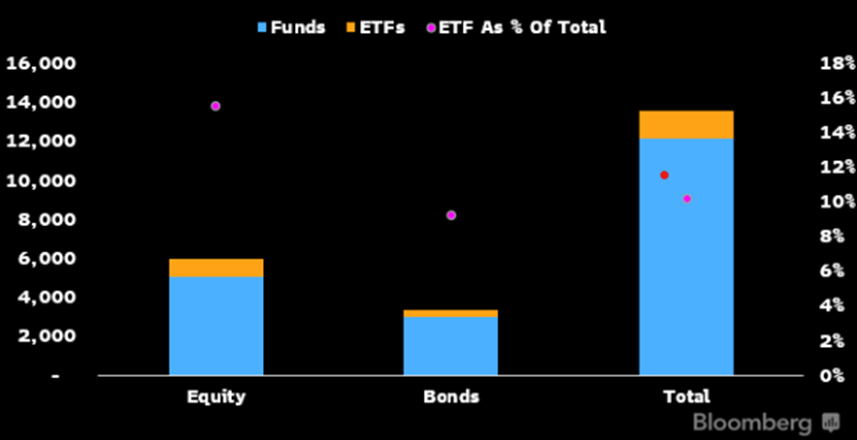

Despite this, bond ETFs in Europe account for roughly €300bn out of a total of €3.3trn, while equity ETFs make up around 16% of total European assets under management.

Last month, BlackRock also predicted that bond ETFs were set for take-off, anticipating global fixed income ETFs assets to hit $5trn by 2030, driven by current market conditions and a growing universe of bond ETFs which has more than doubled since 2015.

Psarofagis added: “Bond ETFs' market-share gains could accelerate if redemptions persist in bond mutual funds. Despite the lack of a meaningful tax advantage over mutual funds, we believe the ability to trade ETFs tactically in a volatile environment will continue to fuel the vehicles' steady growth.”

Source: Bloomberg Intelligence

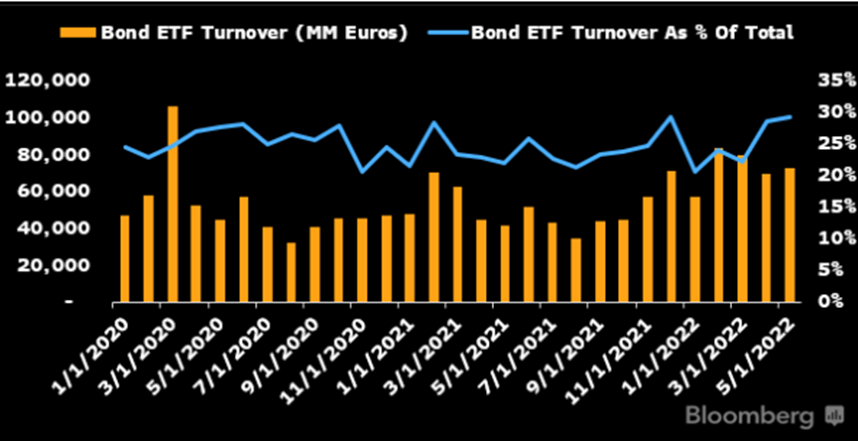

Furthermore, the tactical use of bond ETFs during market volatility has fuelled bond trading in Q2, which peaked at 30% of total ETF trading in May.

“We expect the maturing of the trading ecosystem around bond ETFs to continue to fuel inflows, even as investors pull cash from mutual funds,” Psarofagis said.

Source: Bloomberg Intelligence

The trend in Europe has been felt globally as central banks indicate they are set to raise rates at a quicker pace than first anticipated.

Flows into sovereign bond ETFs set a monthly record in May with $26bn flowing into the asset class, eclipsing the previous record of $18.5bn set in December 2018, according to data from BlackRock.

While interest has picked up across the curve, short-duration ETFs dominated inflows, accounting for $9.2bn globally in May.

Last month, the Fed hiked rates by 50 basis points to a range of 0.75% to 1%, its fastest increase since 2000, in a bid to quell inflation which has jumped to 8.5% in the US.

Related articles