Factor investors looking to increase their allocation to ESG ETFs are being met with a dearth of products with nearly half citing it as a key barrier to entry, according to a survey conducted by Invesco.

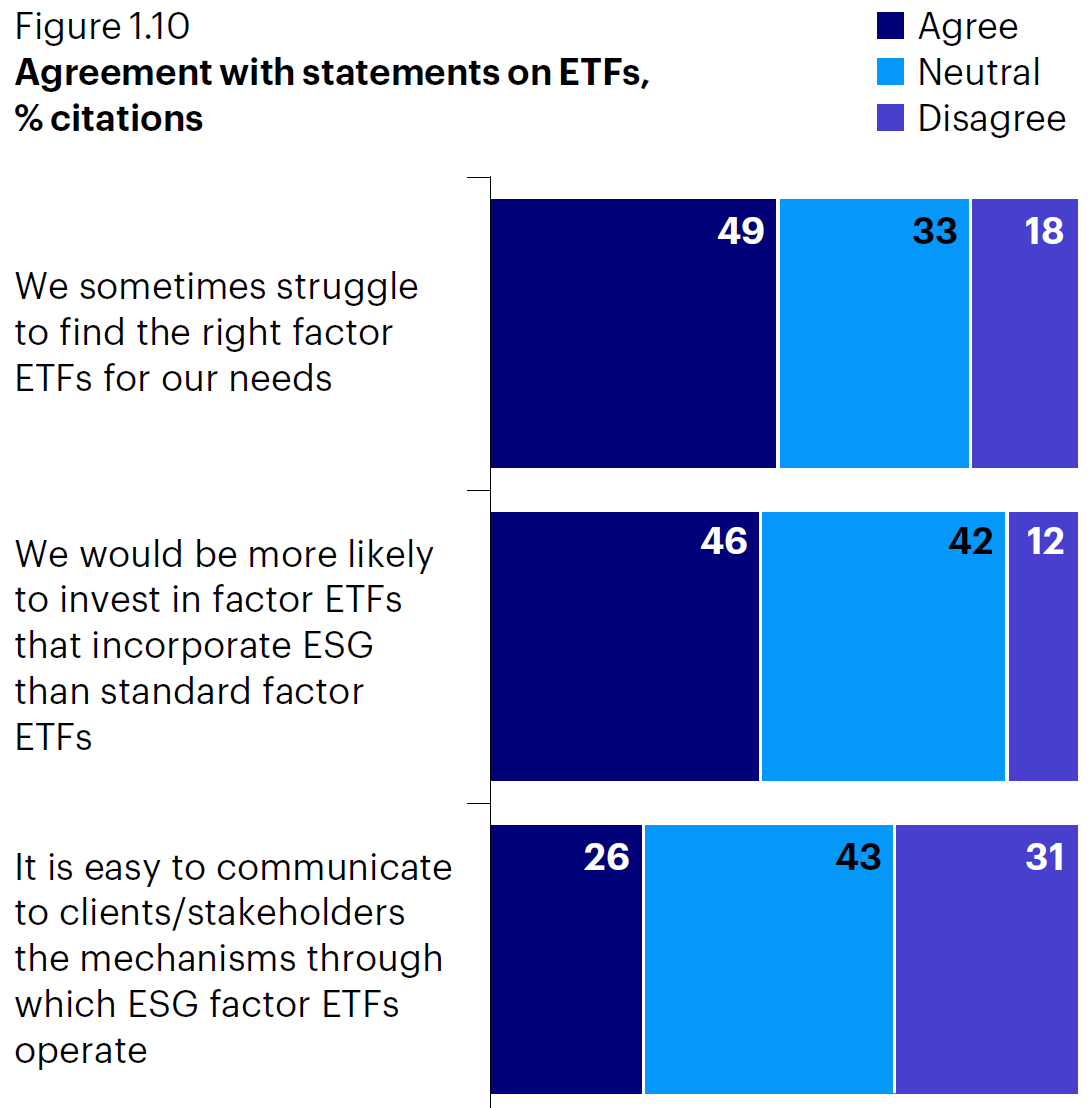

The survey, which interviewed 130 institutional investors and 111 wholesale investors, found 49% of respondents said factor ESG ETFs are difficult to source, despite 46% adding they would be more likely to use factor investing if it was combined with ESG.

While a few products have hit the market in recent times, launches are seemingly few and far between leaving investors with little to choose from.

Last April, BlackRock launched three ETFs that combine ESG with a minimum volatility factor tilt while Northern Trust Asset Management added a further two smart beta climate ETFs to its range in Europe earlier this week.

Georg Elsaesser, senior portfolio manager for quantitative strategies at Invesco, told ETF Stream the reason for the lack of ESG products in the space is down to broad definitions, the lack of engagement from index providers and the moving feast that is the Paris Agreement targets.

“The reason why people still do not see enough products out there is that ESG really means different things to different people,” he continued.

“When the index providers do not engage that can be an issue with ETFs. This typically pushes investors away from ETFs and towards asset managers.”

Demand for factor ESG ETFs was highlighted in July when investors switched from two smart beta ETFs into ESG counterparts. The iShares Edge MSCI USA Value Factor UCITS ETF (IUVF) and iShares Edge MSCI USA Momentum Factor UCITS ETF (IUMF) recorded $1.5bn and $1.4bn outflows, respectively in the week ending 9 July, with the same amount flowing into their ESG counterparts, the iShares MSCI USA Momentum Factor ESG UCITS ETF (IUME) and iShares MSCI USA Value Factor ESG UCITS ETF (IUVE).

Source: Invesco Global Factor Investing Study 2021

Despite this, the survey found investors believe factor investing is more compatible with ESG than a market cap-weighted approach – while still lagging fundamental active management – with 78% citing performance as the main reason for incorporating ESG.

Elsaesser added that ongoing discussions around the Paris Agreement makes it difficult for investors to implement an index without having to make update it regularly.

“Temperature targets are probably slightly more difficult to implement in an index due to moving targets. These things are changing over the course of time and you might have to change the index which is a hassle,” he said.

Despite this, respondents said that ESG was more likely to push them towards factor investing (36%) than fundamental active management (26%).

When it came to whether investors thought ESG itself was an investment factor, just 30% of respondents agreed while 41% said ESG is completely independent of investment factors.

Elsewhere, 45% of investors said the low yield environment had made the use of factors within fixed income portfolios more attractive. Here too, the limited availability of fixed income ETFs is seen as the biggest challenge to uptake.

“While factor ETFs have expanded and grown, there is significant unmet demand and a need for further product development in fundamental areas such as fixed income” Elsaesser added.

Strong demand has seen factor allocations continue to rise with 42% of respondents upping their allocation over the past year, drawn in by the possibility of stronger returns and better control sources of risk.

Investors have also increased allocations towards value with 42% increasing their exposure to the factor over the past 12 months and 48% doing so in preparation for a post-pandemic recovery.