Geopolitical events have had significant impact on the equity market this month, causing the popular benchmarks to have the worst performing weeks of the year so far. Since the beginning of May, the S&P 500 and the FTSE 100 have fallen 4.8% and 2.3%, respectively. But when the equity market struggles, the bond market tends to strive.

The equity market’s underwhelming performance in May has been the result of the ongoing trade war between the US and China as well as the UK’s continued Brexit debates. The trade war has resulted in phone manufacturer Huewai being banned from doing business in the US over security concerns as well as China potentially restricting its rare earth minerals to the US.

Consequently, the world’s largest ETF, SPDR S&P 500 ETF Trust (SPY), has seen its Net Asset Value (NAV) fall 4.4% over the last month. At the other end of the performance spectrum, it is fixed income ETFs which are booming, in particular, long term treasury bond ETFs.

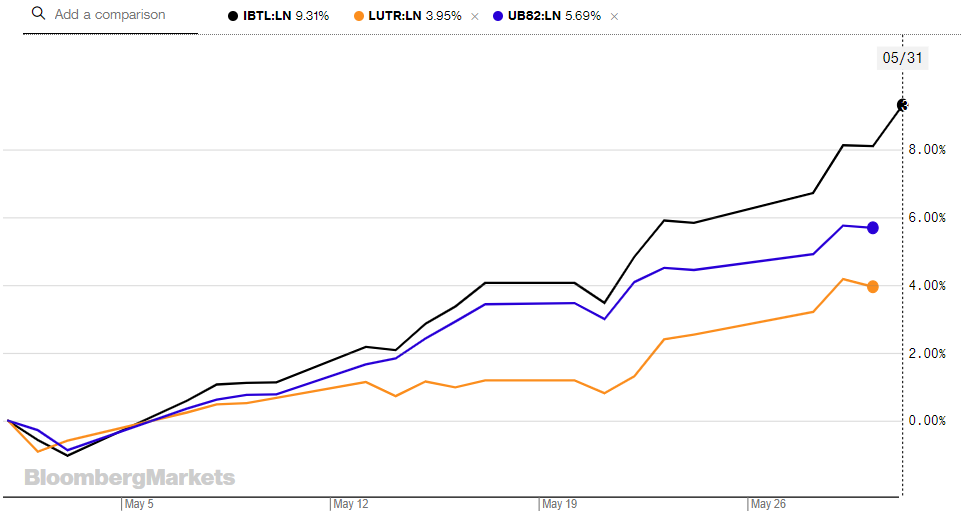

The iShares USD Treasury Bond 20+ Year UCITS ETF (IBTL) has spiked 9.3% over the same period. Additionally, shorter duration treasury bond ETFs have been performing significantly well. The SPDR Bloomberg Barclays 10+ Year US Treasury Bond UCITS ETF (LUTR) and the UBS ETF Bloomberg Barclays Capital US Treasury 7-10 UCITS ETF (UB82) have seen their NAVs rise 4.0% and 5.7%, respectively.

According to BlackRock’s Brett Pybus, ETF issuers are making it more accessible for investors to buy fixed income ETFs by focusing on expanding the products share classes rather than launching new products. This enables investors to invest using their preferred currencies in a larger and more popular funds.

Other positive performing fixed income ETFs include iShares GBP Index Linked Gilts UCITS ETF (INXG) and the iShares EUR Government Bond 15-30yr UCITS ETF (IBGL) which have both risen 4.2% for the month.