Australian ETFs are more expensive than their global peers, but BetaShares wants to change that. But just how cheap can Aussie ETFs get?

With BetaShares listing the cheapest Australian ETF ever at 7 basis points (A200), many have wondered how cheap Aussie ETFs can get.

ETFs are more expensive in Australia than in the US and Europe. In the US, Charles Schwab charges 3 bps for plain vanilla exposure. In Europe, Lyxor charges 4 bps. Yet in Australia, up until this week, the cheapest was Vanguard's VAS at 14 bps.

"Australia is one of the few markets where investors, prior to the launch of A200, had to pay mid-teen management fees at the absolute lowest," Alex Vynokur, the CEO of BetaShares, told ETF Stream.

"If you look at similar products in other markets - whether North America or Europe - those products are cheaper."

So why have Australian ETFs been so expensive?

Lower Asset Bases

Part of the explanation - and one favoured by Mr Vynokur - is that the Australian market has not been ready for ultra-low fees. But as ETFs have become more mainstream in recent years, lower fees now make more commercial sense.

"My perspective on this is that it's really not about a fee war so much as how the market is changing," he said.

"Previously Aussie investors would allocate only a small portion of their portfolio to ETFs because ETFs were new and investors inexperienced. But now, vanilla exposure is viewed by many as a core portfolio building block, meaning fees matter more and we need products that are priced competitively by global standards."

Exchange Fees

Another reason ETF fees have been higher in Australia is that it costs more to keep them on exchange. The Australian Securities Exchange charges slightly more than other exchanges around the world—which arguably helps it provide better services than its global peers.

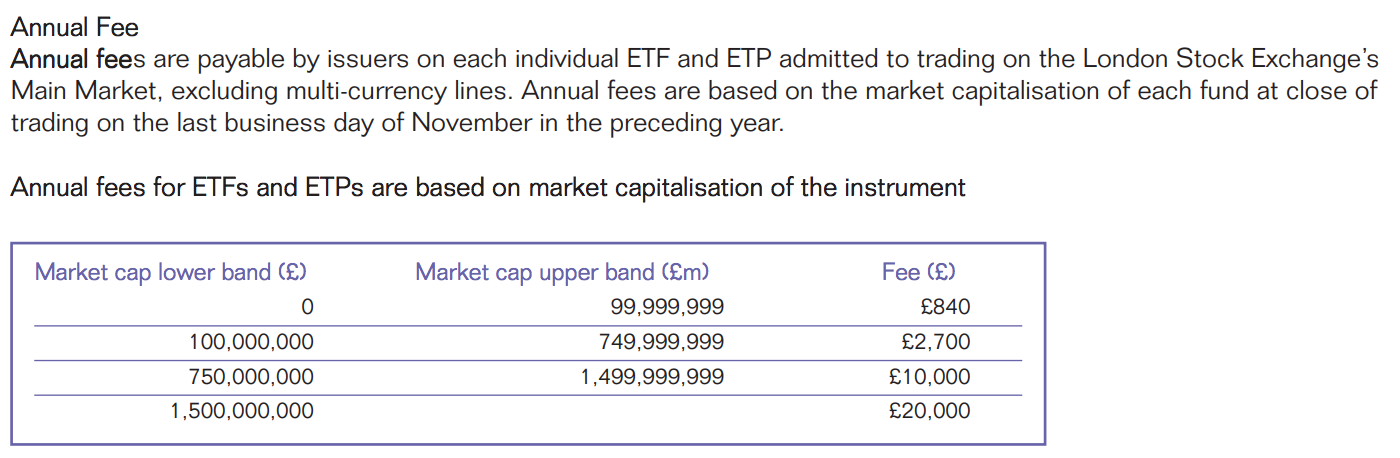

The London Stock Exchange caps fees at roughly A$36,000 a year per ETF.

London Stock Exchange: schedule of annual ETF listing fees

[caption id="attachment_3600" align="alignnone" width="606"] Source: London Stock Exchange[/caption]

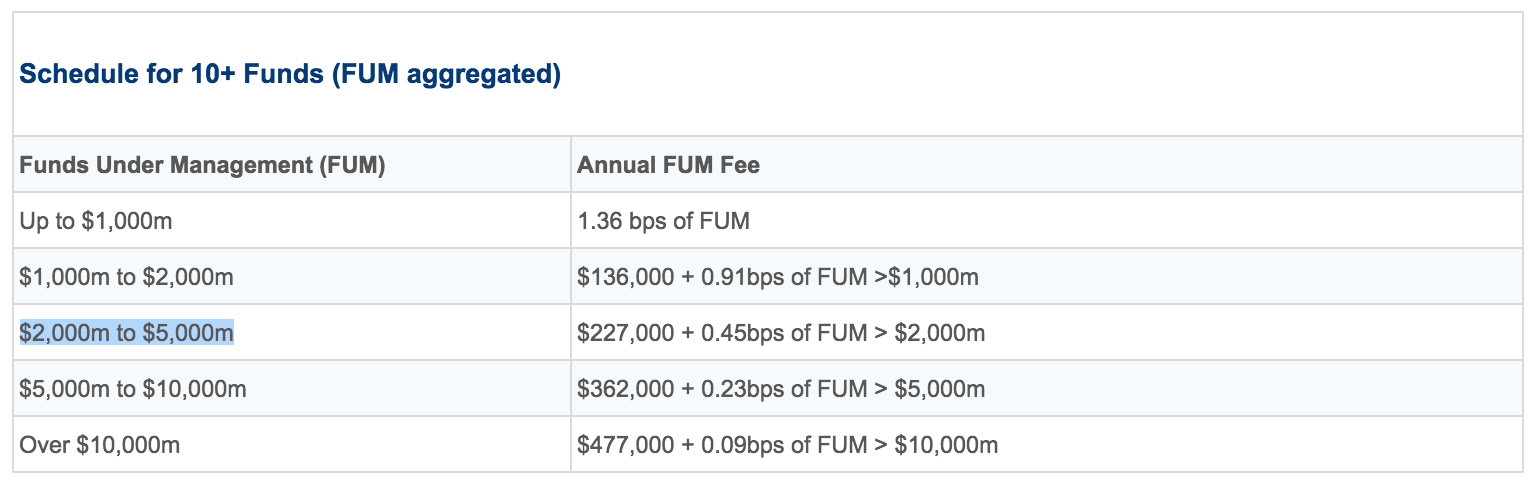

The ASX by contrast charges slightly more and does not cap its fees. These exchange fees can be passed on to investors and raise the cost profile of ETFs in Australia.

Australian Securities Exchange: schedule of annual ETF listing fees

[caption id="attachment_3601" align="alignnone" width="602"] Source: Australian Securities Exchange[/caption]

The ASX also brings in tighter regulation - which makes sense given the Australian market is heavily retail driven.

In Germany, for example and by contrast, the ETF market has a much more institutional leaning. This means German regulators are happy for any broker to sponsor any ETF onto a German local exchange, helping to keep fees low.

But the ASX is an issuer sponsored exchange and regulated by the Treasury (under advice from ASIC) with retail investors in mind. This means getting an ETF on the board can be harder and can come with higher compliance and legal costs.

No Securities Lending Market

Another reason Aussie ETFs are costlier is the absence of any real securities lending market. (This, again, owes to the prevalence of retail investors).

Securities lending is where ETF issuers rent out the securities in their ETFs to short sellers. Short sellers then pay a rental fee and give the security back at a later date.

In the US, the securities lending market is large and deep and ETF issuers typically make between 1 - 4 basis points a year from rental fees. As such ETF issuers are usually happy to lower the fees they charge investors because they can make money gouging short sellers instead.

But in Australia there is no such solve.

"A200 is not planning to engage in securities lending. The market for securities lending here is not at all well developed," Mr Vynokur said.

And it's likely, for the foreseeable future at least, to stay that way.

So How Cheap Can They Get?

One of the criticisms thrown BetaShares way when it listed A200 was that it was too cheap to be profitable. And while a too-cheap ETF would be great for investors, some suggested that A200 was intended partly as a marketing initiative - a suggestion Mr Vynokur firmly rejects.

"I'm very happy to report that we have enough scale and buying power to launch a product like this and to launch it profitably. Competition is good for investors and in this case, it will deliver real savings which we have passed on to investors."

He added that he was unsure if there was a floor on pricing, but for now A200 was as close as it gets.

"It's hard to answer whether there is a floor or not and it's hard to know how cheap things can get, but A200 is a lot closer to the floor than any other Australian ETF."