There was an increase in demand for ETFs during the turbulent investment environment in 2018, according to Greenwich Associates' latest report. The study surveyed 127 institutional investors throughout Europe and found ETFs' characteristics such as speed of execution, single-trade diversification and liquidity were the reason for the increase in demand.

Source: Greenwich Associates

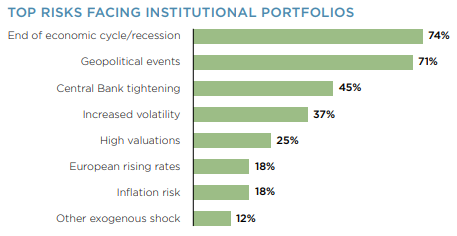

The institutional investors were asked what risks they are positioning their portfolios against the most. Nearly three-quarters (74%) said a recession is the biggest risk currently faced. Second and third to a recession was geopolitical events (71%) and Central Bank tightening (45%), respectively. Leading economies Germany and China faced significant deceleration to their economic growth in 2018 which has led to the concerns of a pending recession, says Greenwich Associates.

Investors are adopting the use of ETFs to address these potential risks. This is due to the products implementing lower operational risks at a lower cost, according to one of the correspondents. Investors are using ETFs more and more as institutions which already invest in the funds increasing their allocation from 10% in 2017 to 15% in 2018.

Source: Greenwich Associates

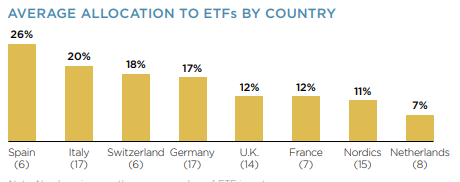

Surprisingly, the leading country in terms of average ETF allocation is Spain with 26% followed by Italy with 20%. Germany and the UK only allocate on average 17% and 12%, respectively, in ETFs. Despite the turbulence faced in 2018, the global ETF market still saw its second largest volume of inflows. $315.8bn was invested in 2018, second only to 2017 which recorded $467.1 of inflows.

As investors readjust their portfolios to minimise their risk exposure, the most common investment vehicle replaced with ETFs is active mutual funds (72%). Index mutual funds (39%) and individual bonds (33%) are also the most common products being replaced by ETFs, smart beta and factor ETFs.

The study suggests the recent adoption of ETFs is more tactical (short term) rather than the common purpose of ETFs which is strategic (long term). Two-thirds of the correspondents said they use ETFs for tactical adjustments with nearly a quarter saying their reason being a temporary cash position.