Investors poured into gold exchange-traded commodities (ETCs) last week as the price of the precious metal hit three-month highs following the spike in US inflation.

According to data from Ultumus, Europe’s largest gold ETP, the $13.9bn iShares Physical Gold ETC (SGLN), collected $356m assets in the week ending 14 May.

Furthermore, the Xtrackers IE Physical Gold EUR Hedged ETC (SGDE) and Invesco Physical Gold ETC (SGLD) saw $170m and $159m inflows over the same period, respectively.

With the US posting its sharpest increase in inflation since 2008 last Wednesday – and a monthly CPI reading four times ahead of forecasts – the yellow metal has regained favour as investors’ confidence in the strength of the pandemic recovery appears shaken.

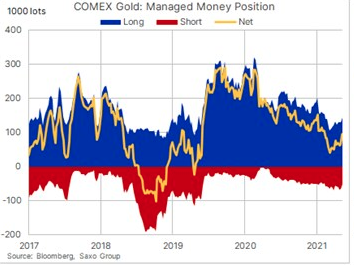

Illustrating the perceived desire for the safe haven asset, money managers are currently undergoing their longest duration of net long positions on gold since the start of 2020, with US hedge funds increasing their number of long-only positions by 12% in the week to 17 May, according to data from Saxo Bank.

Ole Hansen, head of commodity strategy at Saxo Bank, said: “The combination of a weaker US dollar and falling real yields – on rising inflation expectations – helped drive a 45% increase in the gold net long to 95,600 lots, a 13-week high.”

It is also worth making the link between inflation and volatility. With monetary policy the central driver of market sentiment this year, gold optimism last week coincided with the VIX volatility index hitting a 69-day high.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, added: “Inflation is still top of our mind, but we also tend to see flows to gold funds during market volatility like we saw last week. Also, the drop in bitcoin might be moving some investors into gold as well so you have quite a few tailwinds working for it right now.”

Having traded in an upward trajectory since early April, moving above $1,800 was a symbolic milestone but the precious metal may face resistance as it moves towards $1,876, which would mark a 50% recovery of the August-March correction.

Source: Saxo Group

Whether gold maintains its current favour with ETF investors ultimately depends on crypto price movements and the European CPI reading on Wednesday, which will either soften or intensify the market’s latent stagflation concerns.

Further reading