For ETFs, the pot of gold is still at the end of the SMSF.

In the early days of the ETF industry, it was all about self-managed superannuation funds. Families running SMSFs tend to be rich, well-travelled and financially literate. They could see opportunity in Aussie ETFs ahead of time and were the early adopters in the 2000s.

Seventeen years later what's changed? Not much.

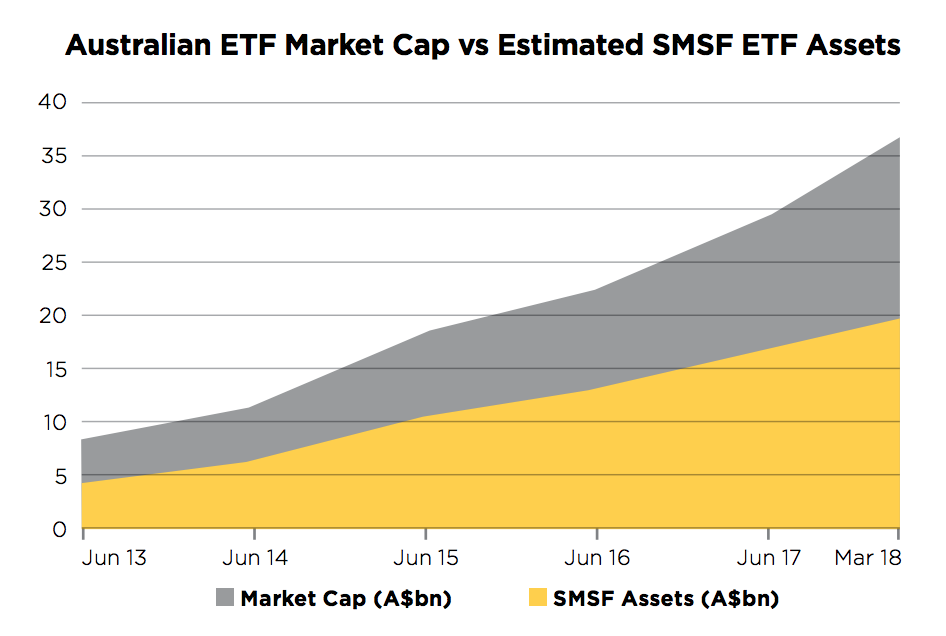

According to a new report from software company Class Super, SMSFs remain the driving force behind ETFs, with more than half of all ETF assets being owned by SMSFs.

And their propensity to use ETFs is growing, with the total assets invested in ETFs by SMSF quadrupling since 2013.

"One third of ETF investors were SMSFs and this SMSF investment equated to over 50% of total ETF asset value," the report said.

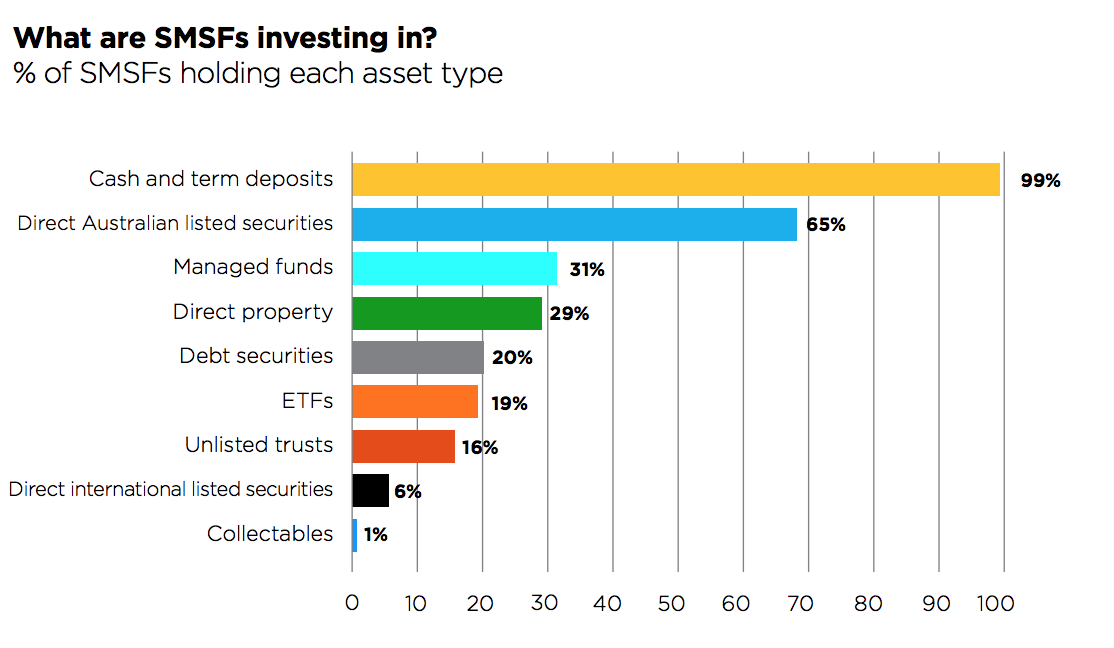

"Over the last 5 years… the percentage of SMSFs using ETFs has more than doubled from 8% to 19%."

A major reason SMSFs like ETFs, the report found, is that they make investing in overseas markets easier because they trade on exchange. They're also significantly cheaper than most international managed funds.

Among international markets, the US remains the most popular with Australian investors by far, the report found. But emerging markets - thanks to their exposure to China - are popular too.

"SMSFs most commonly use ETFs to gain exposure to international equities and as a passive investment in Australian shares," the report said.

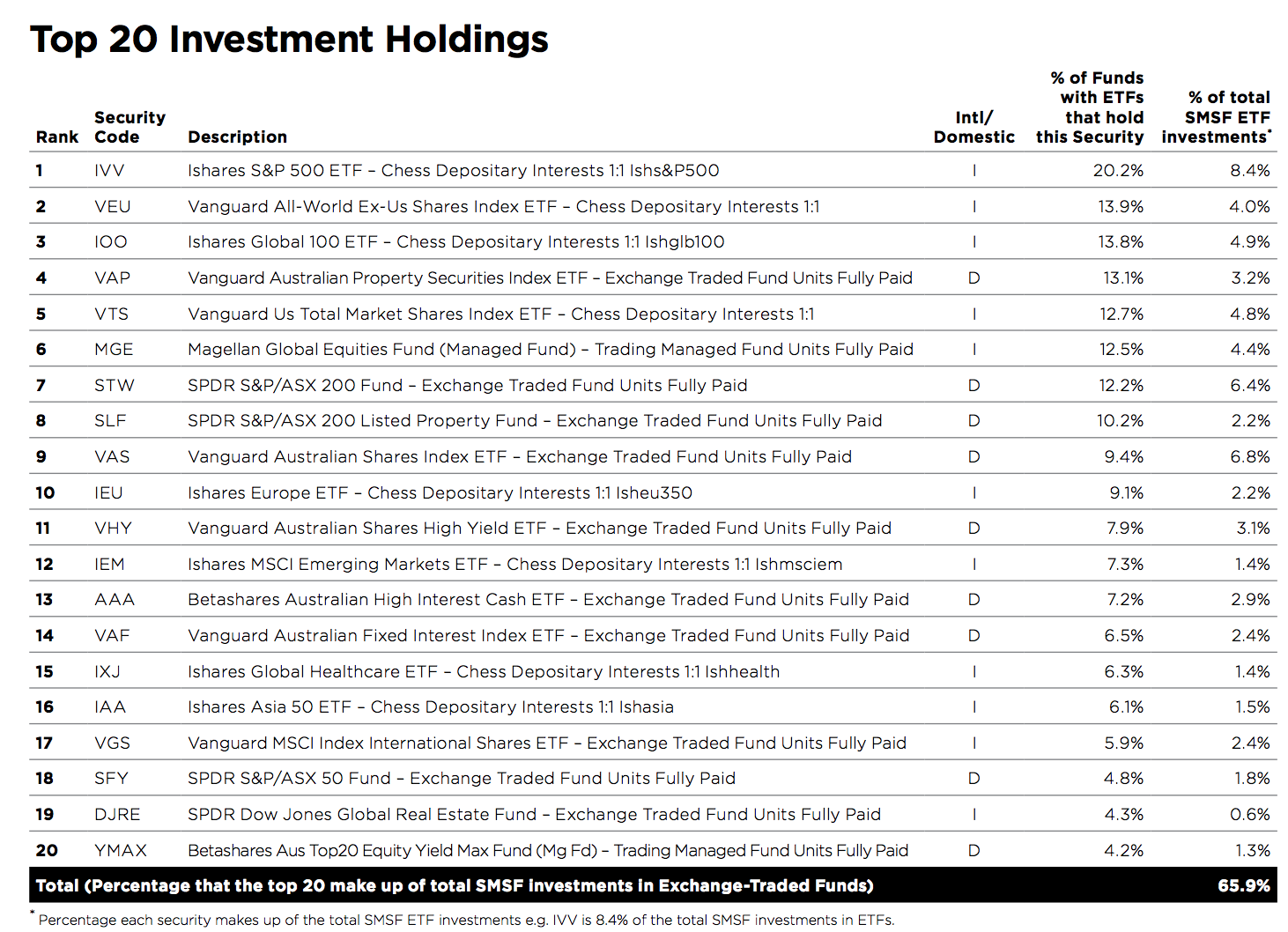

"Emerging markets and Australian listed property are also relatively popular. As at March 2018, international ETFs make up 54% of the top 20, and the top 3 positions are held by international holding."

However, the report found that while SMSF popularity was growing, adopters were still a minority. Only 19% of SMSFs used ETFs, compared with 31% that invested in managed funds and 65% that held shares.

BlackRock's S&P 500 tracker IVV was the most popular ETF with Aussie SMSFs, commanding a whopping 8.5% of total ETF investment. But among issuers, Vanguard stood above the rest, capturing more than one-third market share.

In an interesting sign, Vanguard's plain vanilla Australia ETF VAS appears to have overtaken State Street's STW, Australia's first and largest ETF, making VAS is the second most popular ETF among SMSFs.

On a phone call with ETF Stream, Class Super's CEO Kevin Bungard said he was unsurprised by Vanguard's dominance.

"Vanguard's market share did not really come as a surprise to us. Vanguard is well-regarded and you see that elsewhere in the market: their ETFs are popular with robo-advisors and they almost always get good reviews."

The report's findings come in contrast to a report by Investment Trends published earlier this year. The report found that SMSFs were becoming less relevant to ETF issuers looking to gather assets. The data, however, only took a nose count and did not look at ownership on a market cap basis.

But Mr Bungard said that it would make sense if SMSF's role in the ETF market were to decline in the future.

"The overall ETF market is growing faster than the SMSF portion of that market. SMSFs were early adopters of ETFs but the rest of the investors appear to be catching on now."