Leverage Shares has launched two ETPs that offer a 2x leveraged exposure and an inverse exposure for the leading electric car company Tesla.

The Leverage Shares 2x Tesla ETP (TSLA2X) and the Leverage Shares -1x Tesla ETP (TSLASX) are available on the Cboe Europe exchange with a total expense ratio of 0.75%. They also incur an overnight cash balance interest rate of 1%.

TSLA2X and TSLASX are available in GBP, USD and EUR.

TSLA2X tracks the iSTOXX Leveraged 2X TSLA index which provides a 2x daily leveraged return of the Tesla stock using a physically replicated long-position. Therefore, if Tesla's share price rises by 1%, TSLA2X will rise by 2%.

Similarly, TSLASX tracks the iSTOXX Leveraged -1X TSLA index which provides a -1x daily leveraged returns of the Tesla stock using a physically-replicated short position. Therefore, if Tesla's share price rises by 1%, TSLASX will fall by 1%.

Leverage Shares' ETPs are debt instruments issued by a special purpose vehicle. Each ETP has physical ownership of the underlying stocks and avoids using derivatives, such as swaps, to achieve its leverage.

Raj Sheth, director solutions at Leverage Shares, said to ETF Stream: "During volatile markets as we have right now, Leverage Shares' products are meant for experienced investors and market participants for a variety of strategies.

"Some examples include responding to technical indicators on particular individual stocks, trading the volatility and the directionality of individual stocks, positioning or responding to earnings and news announcements, reacting to overnight movements in foreign markets, which may carry momentum into the home market, and hedging existing exposures in a portfolio."

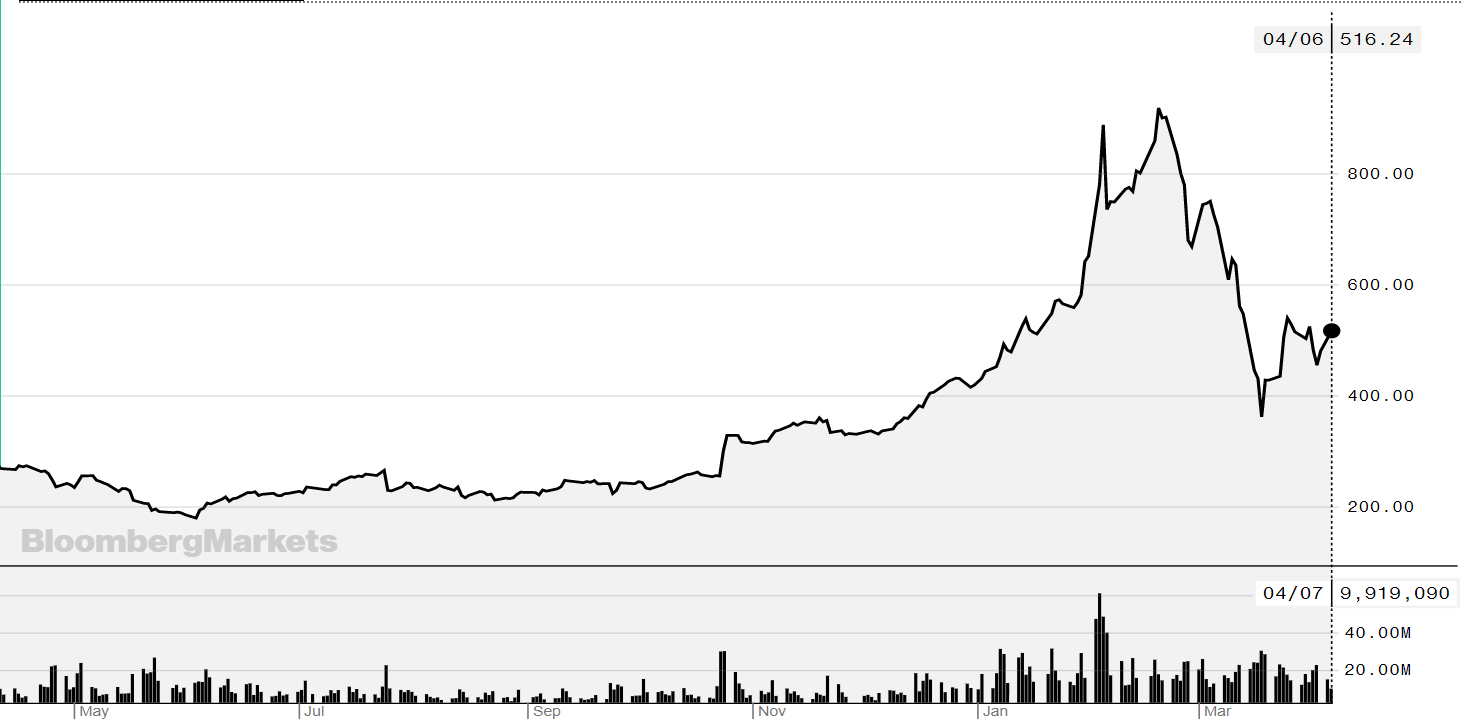

Before markets turned in late-February, Tesla's share price had a year-to-date (YTD) performance of nearly 120%. Even after markets turned due to extreme volatility, Tesla maintained a significantly high YTD performance by 6 April of 31.3%.

Tesla's one-year performance - Source: Bloomberg

In November 2019, GraniteShares listed a range of short single security ETPs which the firm said are just "another tool in the toolkit" for investors, however, some investors argued the products were too high-risk.

Sign up to ETF Stream’s weekly email here.