Star Wars day (4 May) marked the return of volatility in the markets and like the Death Star, could the S&P 500 be facing a blow up?

The global equity market faced a harsh final quarter in 2018 as volatility hit, causing the S&P 500 and the FTSE 100 to fall 14.3% and 10.2%, respectively.

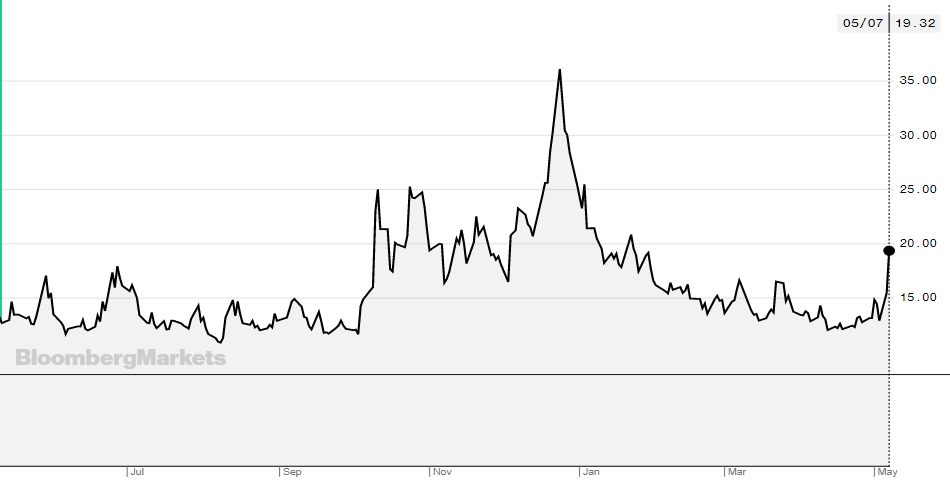

A popular measure of the S&P 500’s volatility is the Chicago Board Options Exchange Volatility Index (VIX). During this difficult period in Q4 2018, VIX more than tripled, reaching a high of 36.07, surpassing the previous high of 29.06 in February of the same year.

VIX 12-month performance – Source: Bloomberg

At the turn of the year, volatility settled, and the S&P 500 and index related ETFs have performed significantly well. This was the case up until the beginning of May.

On Monday, following 4 May, the S&P 500 suffered its worst losses in months. This was the result of news of the trade war between the US and China facing further complications as President Donald Trump threatened to ramp up tariffs on all Chinese imports.

Since Monday, the S&P 500 has fallen 1.6% in tandem with VIX jumping 50% to 19.31. While the volatility remains significantly lower than what it was back in Q4 2018, it is a significant spike currently on an upward trend.

Prior to the S&P 500 dip, the iShares Core S&P 500 ETF (IVV), Lyxor S&P 500 ETF (LSPX) and SPDR S&P 500 ETF (SPY) saw cumulative outflows of more than $440m, according to data by Ultumus.

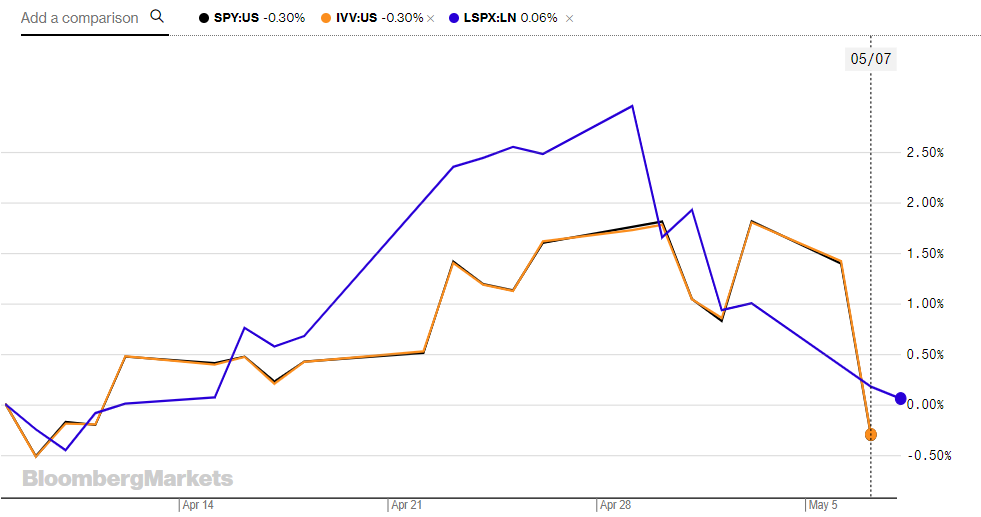

SPY, IVV and LSPX 1-month returns – Source: Bloomberg

As a result of the S&P 500’s disappointing week so far, all gains made in the last month have been wiped out. SPY and LSPX are currently at a loss of 0.3%.