Since trade reporting for ETFs has become compulsory under Mifid II, the European ETF industry has witnessed record trading volumes and improved liquidity, a new report from BlackRock has revealed.

The visible liquidity ETF provide has quadrupled the past year from roughly $500bn in 2017 to in excess of $2tn in 2018, both through exchanges an in over-the-counter markets.

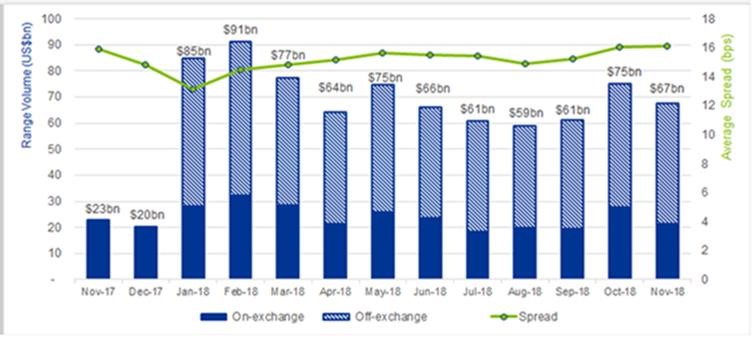

iShares EMEA range spread and flow evolution

Source: BlackRock

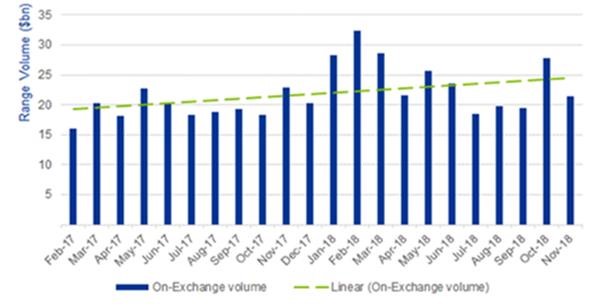

While there has been a slight increase in the volume of ETFs traded through exchanges, there is a significantly large volume of ETFs traded through non-exchange platforms. These figures would not have been recorded before the introduction of MiFID II, BlackRock said.

Helping ramp up liquidity has been the growth of registered market makers, which have increased 25 in Europe since the policy was introduced. This partly comes down to liquidity providers being obliged to register with exchanges and market makers since the introduction of the policy. The more market makers available, the more liquid the market.

Transparency has massively improved over the last year and investors have access to more data, but there are still improvements to be made. iShares is demanding an easier way for portfolio managers to access the volumes of ETFs traded by consolidating the data into one place.

*****

Image Source: BlackRock