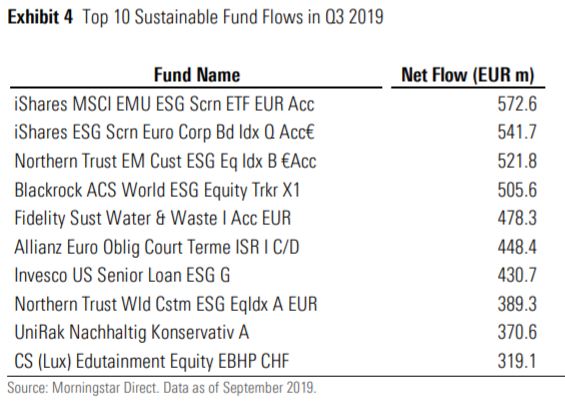

ETFs and index funds dominated the top 10 inflows for European environmental, social and governance (ESG) products in Q3, a sign of the growing popularity of ESG in the passive space, according to data from Morningstar.

The iShares MSCI EMU ESG Screened ETF EUR (SMUD), which launched just over a year ago, saw the most inflows across all ESG funds listed in Europe with €573m positive flows in the last quarter.

This was closely followed by the iShares ESG Screened Euro Corporate Bond index and the Northern Trust EM Custom ESG Equity index which witnessed €542m and €522m inflows, respectively.

BlackRock pulled in the most net new assets in the previous quarter across all fund providers with €3.5bn inflows.

UBS and BNP Paribas in second and third behind the US giant with €2bn and €1.6bn inflows, respectively.

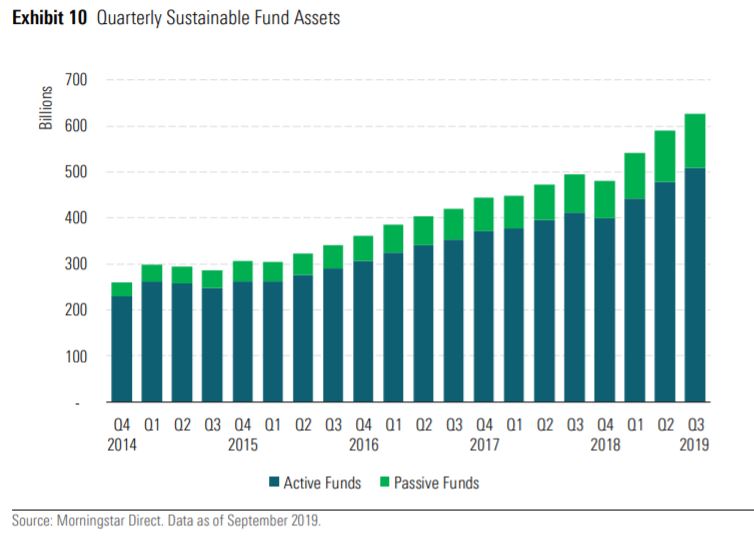

Overall, assets in sustainable funds grew by 6% to €626bn versus a growth rate of just 2.6% for the overall European fund market.

Of this, index funds and ETFs continued to take a greater share of the inflows with net new money standing at 29% in Q3, up from 22% in the previous quarter.

Hortense Bioy (pictured), director of passive strategies and sustainability research, Europe, at Morningstar, commented: "Continuously strong flows into sustainable funds in Europe are evidence that investors are increasingly putting their money where their mouth is.

"Many surveys and studies on the topic show that investors are interested in sustainable investments but are not turning their interest into action. Our data proves that the gap between interest and action is narrowing."

ETF Insight: Are ETF and index providers taking ESG seriously?

Passive funds have nearly doubled their market share over the past five years representing 19% of the European sustainable fund market, up from just 10% in 2014.