The explosive entry of the ProShares futures-based bitcoin ETF puts it is at risk of hitting the Chicago Mercantile Exchange’s (CME) limit for the number of bitcoin futures contracts it is allowed to hold.

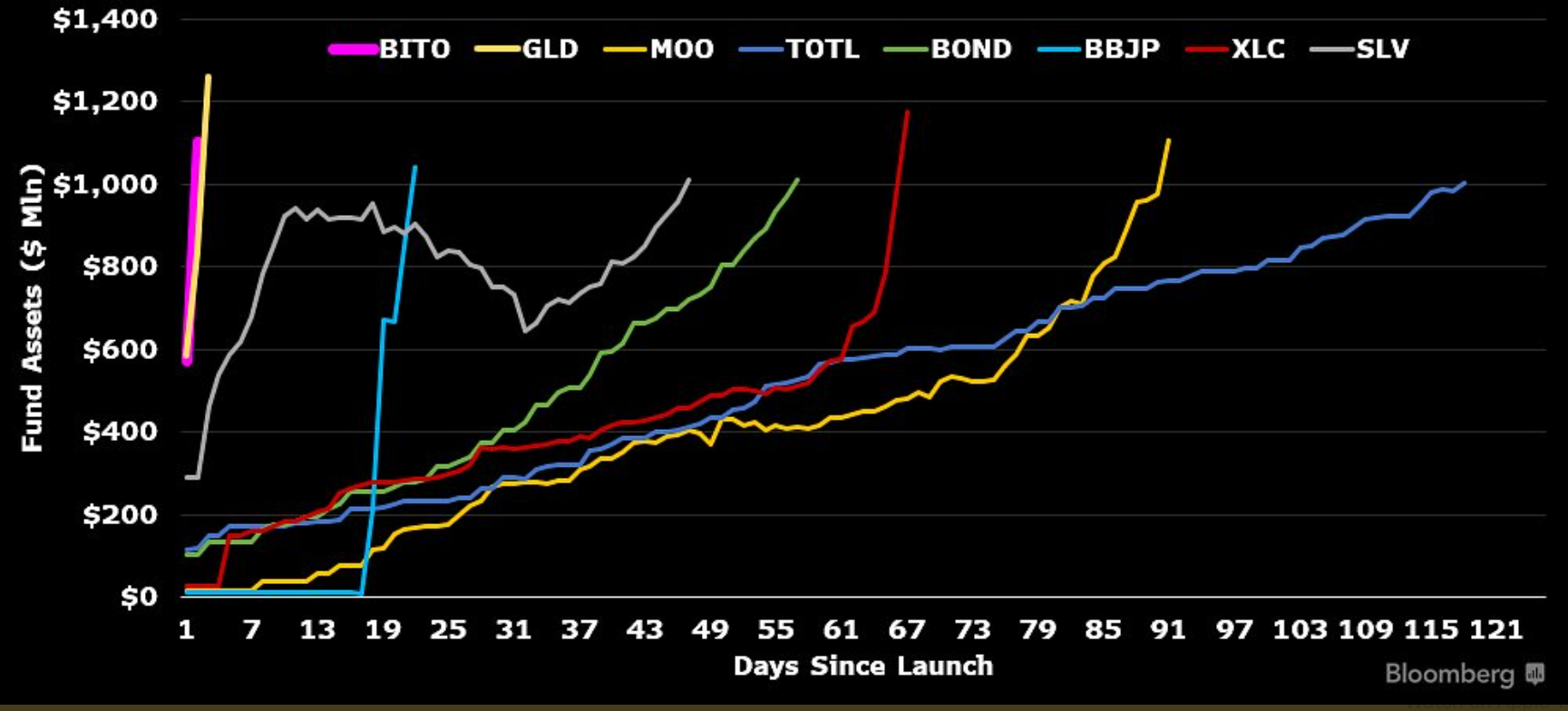

This comes as the ProShares Bitcoin Strategy ETF (BITO) hit $1.1bn in assets under management (AUM) in just two days, breaking an 18-year-old record set by the SPDR Gold Trust ETF (GLD) for the fastest ETF to break the $1bn mark.

Source: Bloomberg Intelligence

By the end of its second day, BITO hit 1,900 contracts sold in October, nearing the CME’s 2,000 front-month (position limit) cap.

While accepting some tracking error with bitcoin’s spot price, issuers can also allocate towards contracts for the following month. By the end of trading on Thursday, BITO already had 1,400 contracts for November, according to data from Bloomberg Intelligence, with the CME's overall maximum limit of 5,000 open contracts for all months combined.

At present, BITO has used up around two-thirds of this total capacity, meaning only $600m more assets are needed for it to hit the cap. According to Eric Balchunas, senior analyst at Bloomberg Intelligence, this could be reached in the “next day or two”.

Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, added: “It is a bit of cat and mouse because the CME can keep raising the limit but they may be worried if [BITO] owns way too much.

“Absolute worst-case scenario they halt new creations. It is rare but it has been done before.”

Inflows into BITO slowed to $100m on Thursday as ProShares raised its creation fee from one basis point to 10, however, the arrival of Valkyrie’s BTFD bitcoin product on Friday has prompted the issuer to revert back to the original fee level.

Should BITO close in on the CME limit, one suggestion is the issuer could choose to hike creation costs to discourage new entries.

Seeing this as an unlikely route, Townsend Lansing, head of ETPs at CoinShares, told ETF Stream: “I do not think they will look to impact the creation-redemption mechanism. They have more than enough flexibility to manage the portfolio and they do not have to track the spot price.”

“Shutting down creation-redemption more or less puts you into the premium-discount world which your authorised participants and others do not want to deal with.

“It is a much easier option, given the way they are structured, to manage their position between the front and next or further months to avoid the position limit. The only costs of that are the tracking of the spot price and the roll costs.”

Lansing continued, stating the only reason for shutting down creation would be if demand for BITO outstripped available liquidity in the futures market. This, he added, would be theoretically possible in a scenario where everyone holding currently available US product decided to switch into futures-backed products, however, he said any disruption on the futures exchange would be short-term.

Psarofagis said the arrival of Valkyrie’s BTFD and the anticipated arrival of a product from VanEck should hopefully alleviate some of the pressure on BITO.

In a worst-case scenario, Lansing said ProShares could go more cash-heavy, especially if the costs of rolling become too prohibitive.

Lansing added on the current situation: “I do not see this position being a show-stopper for them, I see it more being a drag on their performance compared to spot.”

Going forward, another risk for BITO will be the eventual arrival of a physical US bitcoin ETP able to track the cryptocurrency’s spot price.

“Futures tend to underperform spot, especially when the market is in contango," Lansing noted. "This is why people launch products on spot. When it can be done, do so."

“Clearly there are costs to futures and ultimately these costs end up ultimately affecting your ability to track the spot price.”

At present, the frontrunner for the first physical bitcoin ETP in the US is a product from GrayScale. The firm has already filed with the Securities and Exchange Commission (SEC) to convert their $39.8bn GrayScale Bitcoin Trust (GBTC) into an ETF tracking bitcoin’s spot price.