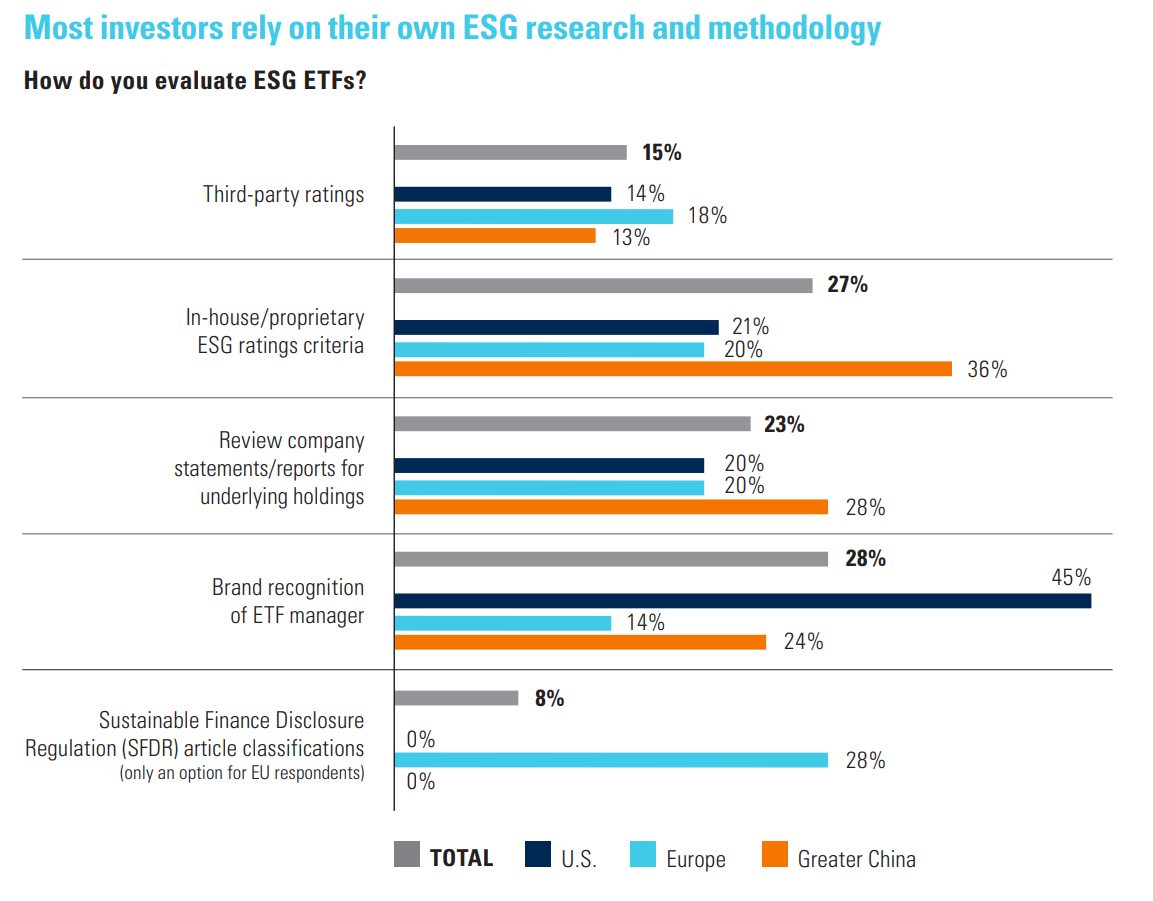

The Sustainable Finance Disclosure Regulation (SFDR) is the most important factor European investors take into account when evaluating ESG ETFs, according to a survey conducted by Brown Brothers Harriman.

The survey, which interviewed 386 professional investors globally, found 28% of European investors rely on SFDR article classifications when selecting ESG ETFs, more than any other tool.

Looking at SFDR, 47% of investors in Europe said they select ETFs classified under the ‘lighter green’ Article 8 category while 27% select products under the ‘darker green’ Article 9.

This behaviour highlights just how much institutional investors, financial advisers and fund managers care about having a recognised authority when measuring the credentials of an ESG fund.

It is also interesting given it has only been a year since phase one of SFDR came into effect, with phase two – which will further develop the body of regulation – not expected until next year.

Outside of Europe, the main way investors select an ESG ETF’s merits is by brand recognition of the ETF issuer while in Greater China, 36% use in-house ratings criteria.

Source: BBH

Overall, ESG remains front and centre for professional investors. In Europe and the US, 90% and 89% of investors expect to increase their allocations to ESG investments over the next year, respectively.

Both of these were up year-on-year but the increase was significant for Europe where only 67% expected to increase their ESG investments a year earlier.

Regarding the headwinds facing the asset class, 36% said concerns around performance were the main factor stopping them from using ESG ETFs while 27% pointed to a lack of client interest and 18% bemoaned a lack of consistent methodology or framework.

Active ETFs increasingly in focus

Next is a product class – active ETFs – that has once again enjoyed a jump in demand in 2022. Last year, 50% of European respondents planned to increase their exposure to actively-managed ETFs.

This number shot up to 71% this year, with only 10% planning to reduce their exposure to active strategies over the next 12 months.

Regarding where this allocation will occur, 19% of European investors said they would use active to target global equity while 17% plan to seek out active fixed income exposure.

This differs greatly from the US and China, where 22% and 25%, respectively, plan to add active exposure to buffered or defined outcome ETFs, compared to only 10% in Europe.

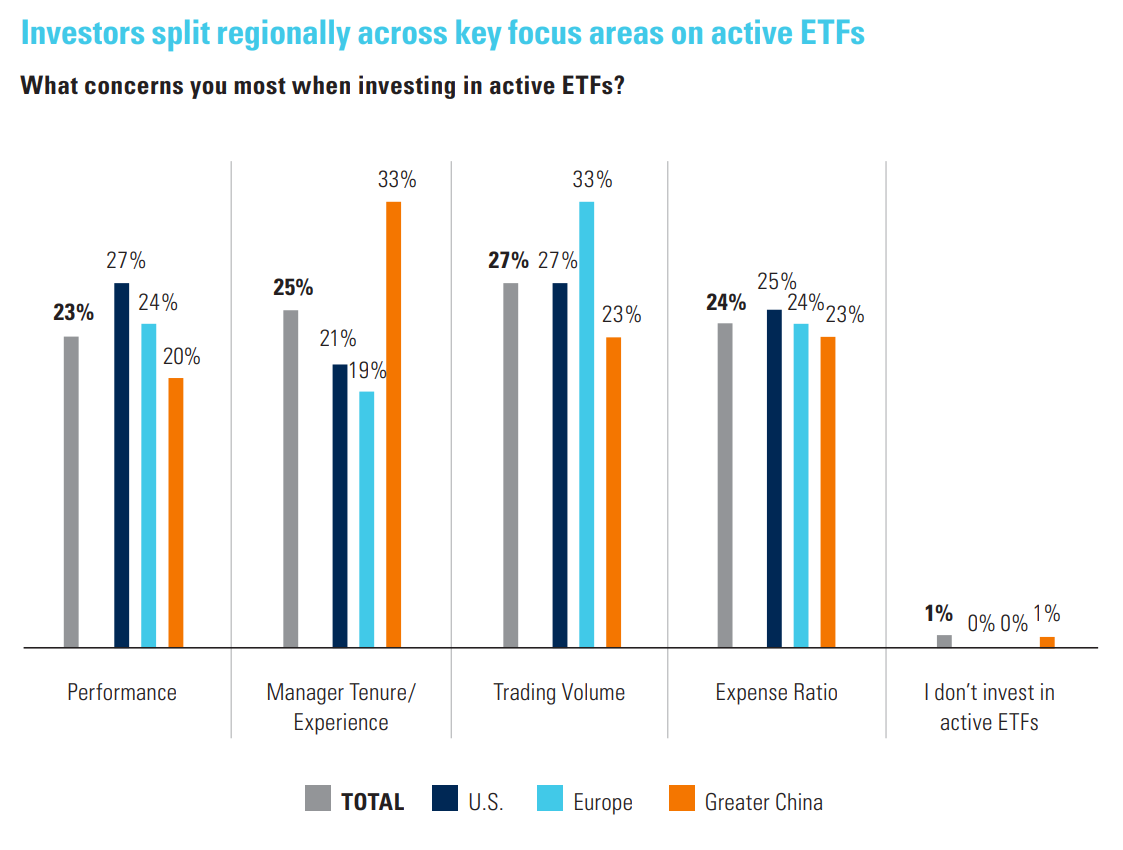

There was also a split in the biggest concerns when allocating to active, with 33% in Europe naming trading volume as their greatest concern while 33% of China investors highlighted manager experience and 27% of US respondents pointed to fund performance and trading volume in an equal split.

Source: BBH

Smart beta enthusiasm not as strong in Europe

Meanwhile, in smart beta – or factor investing – European investors were less enthusiastic than other regions.

While 45% of US and 59% of Chinese investors had between 11-20% of assets under management (AUM) in smart beta products, this number fell to 30% in Europe. Likewise, 47% of European respondents had 10% or less in smart beta versus 31% and 28% for US and China investors, respectively.

Both European and Chinese investors pegged actively-managed mutual funds as the product most likely to have been replaced by smart beta products – at 31% apiece – while the biggest casualties in the US were index mutual funds at 34%.

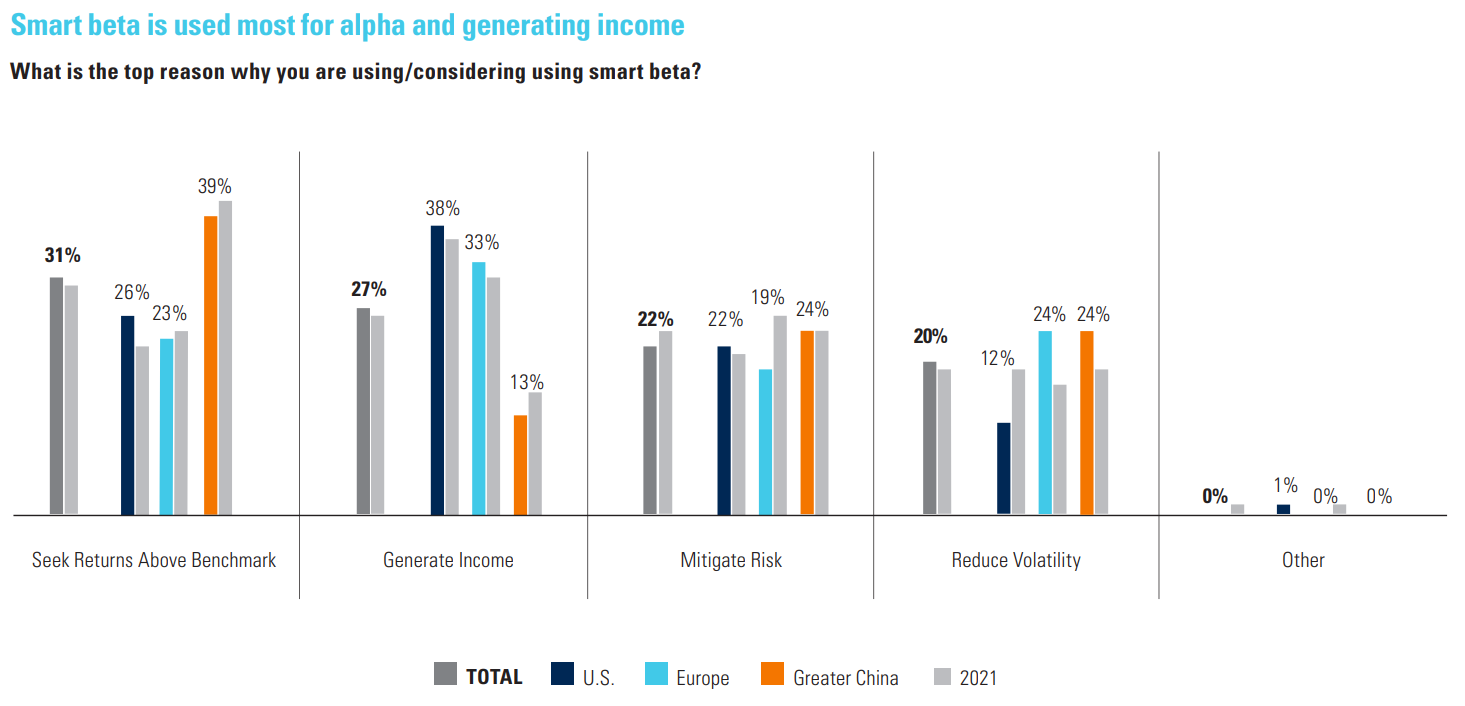

There was also some agreement on the function smart beta is performing within investor portfolios. Some 38% of US investors and 33% of European investors use these products for their income-generating potential while 39% of respondents use smart beta to chase alpha.

Source: BBH

Thematic ETFs are the future

While just 69% European investors planned to increase their exposure to thematic ETFs in 2021, this jumped to 82% this year, highlighting the dramatic rise in demand for the asset class.

This number was even greater in other regions, with 84% planning to increase their thematic allocations in China and 88% in the US.

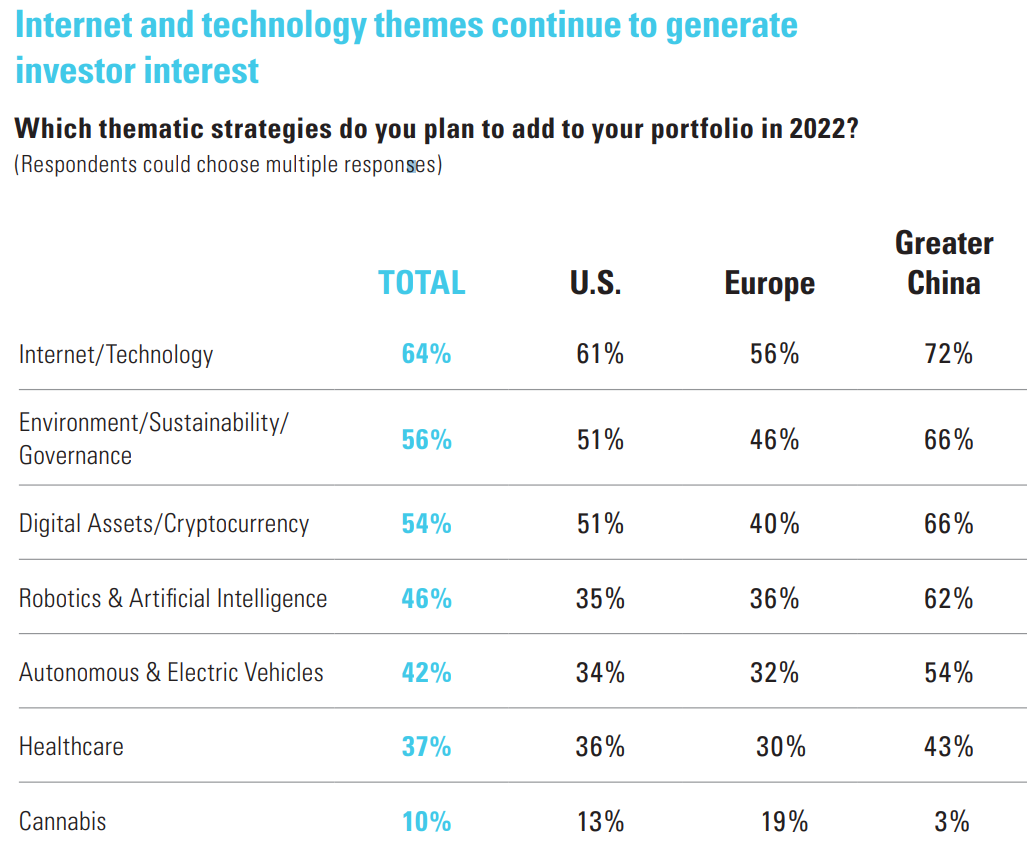

On where these assets will go, the top three theme picks in Europe were internet/technology, environment/sustainability/governance and digital assets/cryptocurrency with 56%, 46% and 40% of respondents expecting to invest in each, respectively.

Incidentally, these themes were also the top three future investments globally.

Source: BBH

Much like smart beta, European investors remain the most cautious about thematics, evidencing their reluctance to move away from more traditional exposures.

US and Chinese investors are most likely to invest between 11-20% of their portfolio in future themes in five years, with 38% and 46% of respondents apiece. Meanwhile, 30% of European respondents expect to allocate between 11-20%, while 32% plan to invest between 6-10% of their portfolios.

Fixed income and warning signs for the 60/40 in Europe

From a popular product class to one relatively less in-vogue, BBH’s survey points to a potential comeback for bond ETFs.

Overall, some 78% of respondents plan to increase their allocations to fixed income in 2022, with just 6% planning to cut their weightings.

However, Europe was a clear laggard in this category. While 86% of US investors expect to ramp up their fixed income exposure, this number falls to 69% in Europe, with 11% planning to reduce their bond allocation.

Where bond investments are happening also illustrate a clear domestic bias. While 37% European investors named investment grade corporate bond ETFs their top pick, 54% of US respondents preferred US Treasury ETFs and 48% of China investors chose China government bond ETFs.

Moving onto a key issue in portfolio construction, survey results seem to indicate the 60-40 portfolio model is dead in Europe.

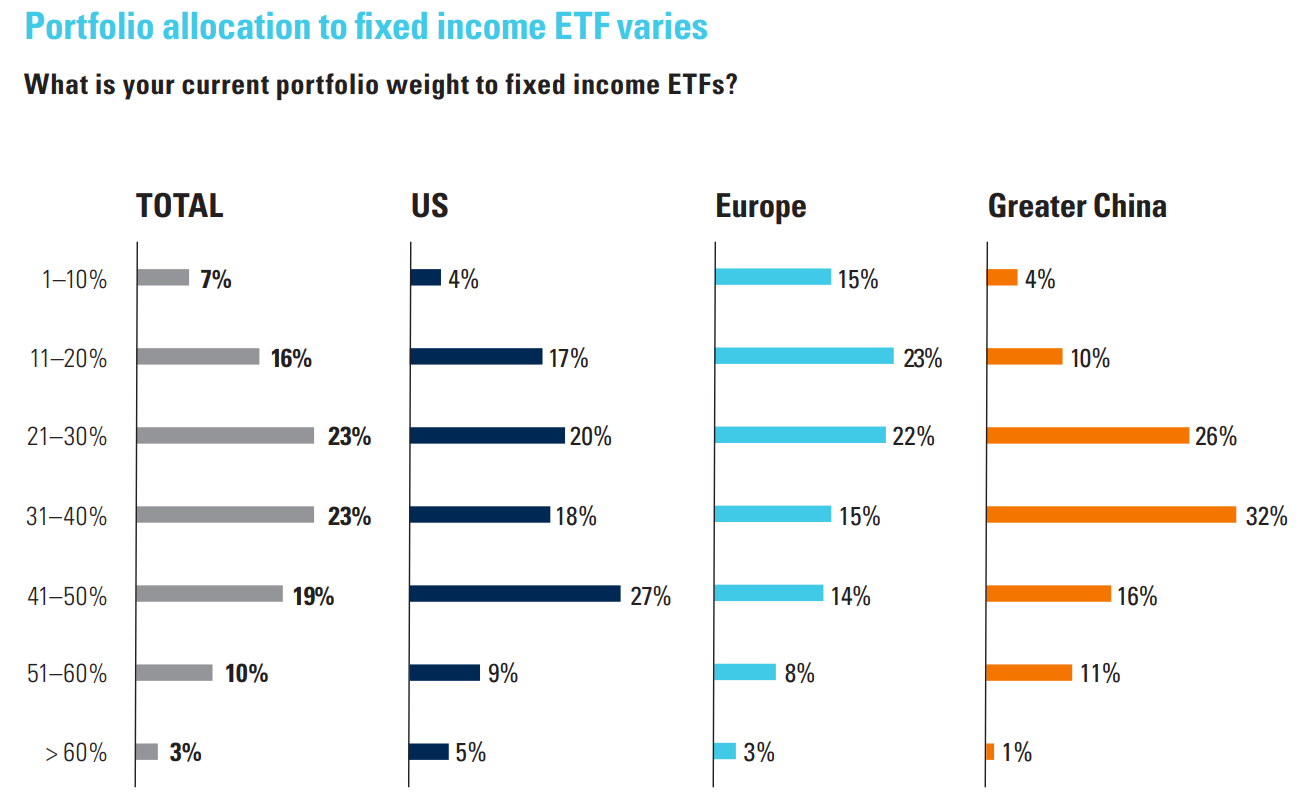

Some 32% of Chinese investors invest 31-40% in fixed income, with 27% of US respondents investing as much as 41-50% of their assets in bonds. Meanwhile, 22% of European investors allocated 21-30% to bonds – and 23% spare as little as 11-20%.

Source: BBH

On the key concerns for investors when approaching fixed income ETFs, 29% of European and 32% of Greater China investors cited liquidity of underlying bonds as their main focus, while 37% of US investors looked closest at expense ratios.

The broader view

Overall, 80% of European investors plan to increase their allocation to ETFs over the next 12 months, up from 62% from BBH’s survey in 2021.

Even more enthusiastically, 84% of Greater China investors and 88% of US investors plan to grow their ETF allocations this year.

Other interesting findings include only 16% of investors planning use a proprietary approach for their ETF model portfolio approach versus 34% planning to use models provided by ETF issuers themselves – highlighting the influential role asset managers end up having in shaping end investor outcomes.

Also significant, BBH found in China and the US, professional investors prefer individual stock picking while trying to gain sector exposure while the preferred approach in Europe is to use sector ETFs as per 26% of European respondents.

Taking a broader view, European investors still remain less committed to ETFs than their counterparts in other regions. While 61% of US and 66% of Chinese investors allocate more than a quarter of their portfolio assets to ETFs, this number falls to 48% in Europe.

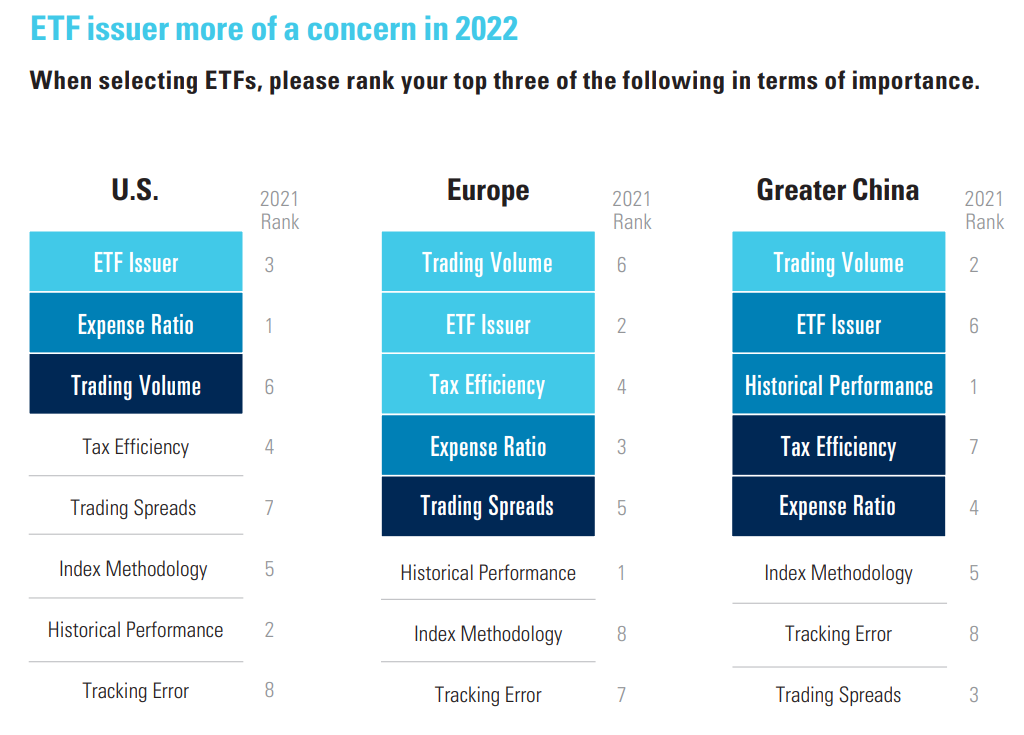

Looking at the key concerns in ETF selection, trading volume has become the key concern for European and Greater China investors in 2022 while the ETF issuer is the most significant characteristic for US professionals.

Source: BBH

Related articles