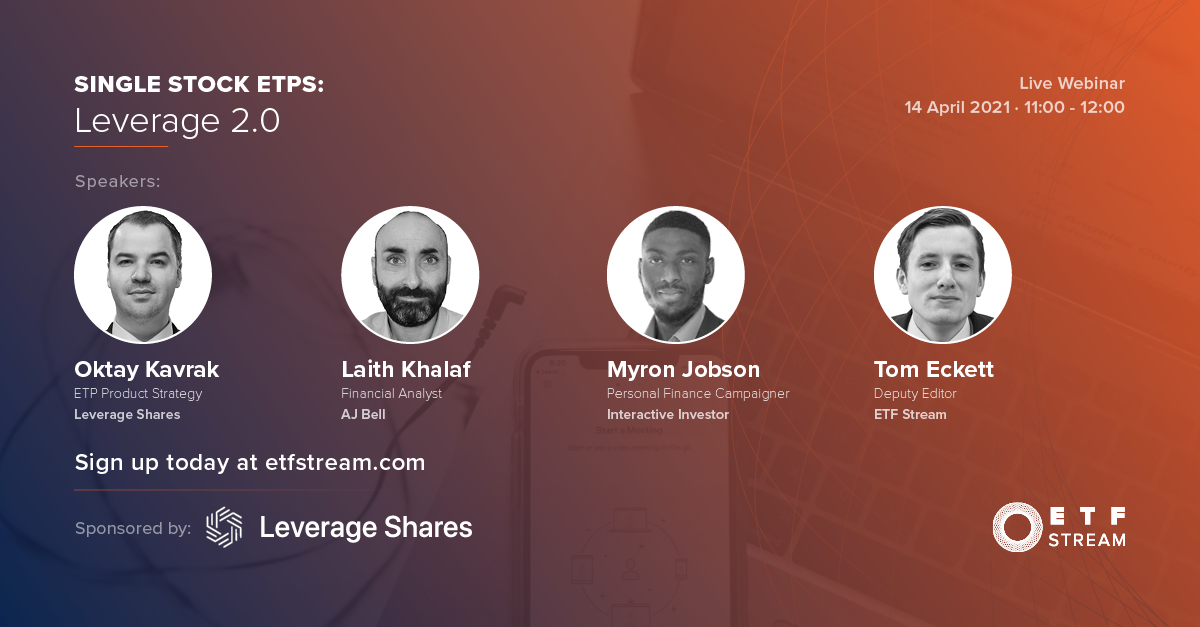

Changes to retail investor behaviour and preferences, alongside how individuals should handle their asset allocation and trends to watch, were some of the key areas covered during ETF Stream’s recent webinar on single stock ETPs in partnership with Leverage Shares.

The webinar, entitled Single stock ETPs: Leverage 2.0, started by discussing the expansion of retail participation over the past decade and the forces driving this change.

The rise of the consumer demographic has been particularly pronounced in recent years, according to Oktay Kavrak, ETP strategist at Leverage Shares.

“In 2019, retail investors made up around 10%,” Kavrak continued. “Today, that number is around 20% and on good days around 25% of trades.”

Myron Jobson, personal finance campaigner at Interactive Investor, agreed, stating the surge in retail investment activity during the pandemic saw his company book 40 days of record performance during 2020.

Looking back on the years leading up to the pandemic, Kavrak said one of the factors that facilitated this retail involvement were lower barriers of entry. With no minimum initial investments, the proliferation of fractional shares, and low or no fee platforms, individuals have felt less daunted by taking their first steps into investing.

Another facilitator has been the advent of the internet, providing readily available information via company performance profiles, media coverage and of course social media.

“Social media has had a huge role to play in how engaged young investors have become”, Jobson said. “Unfortunately, many have taken the hard route of investing in ridiculously risky investments.”

Naturally, the volatility created by the pandemic saw new entrants flood in to make bets on cut-price securities and burgeoning sectors. With this came a wave of young investors, and an increased following of investment blogs and social media.

Laith Khalaf, financial analyst at AJ Bell, noted: “We saw a record number of customers joining the platform in 2020 with an average age of 39 versus 42 beforehand.”

Retail investor behaviour

Jobson said while many investors are proactive in carrying out their own research and many social media posts tell investors to exercise caution, he stressed the online investment community needs to be navigated with a pinch of salt.

“Unfortunately, a lot of investors have followed Reddit and made GameStop their first investment and been burned.

“Overall social media should be seen as a blessing. A lot of the posts I have seen are actually telling people to be careful.”

Another trope associated with retail investors is their tendency to chase trends, often arriving after most meaningful value has been found and basing decisions on speculative narratives.

While this may ring true to an extent, it is also the case that individuals track many of the same sectors and themes as professionals.

For instance, Jobson said the number of ethical funds held in his company’s portfolios has roughly doubled in the last three years. He added the rise of bitcoin has been hard for retail investors to ignore.

Furthermore, having shifted away from UK equities in recent years, many individuals are now actively positioning themselves to take part in the rotation back to value equities.

Off the ropes: Value’s dramatic comeback

Kavrak agreed: “One of the main things a lot of people do not understand is there is not a huge difference between what retail investors and institutional investors are investing in.

“Individual investment allows people to express their own convictions.”

Regarding product preferences, Khalaf said while his company is interested in whether a reflation trade would spark interest in actively managed strategies, his firm noted their clients were not dogmatic about the active versus passive distinction.

On platforms, retail participation has certainly been buoyed by low fees and virtual formats putting transaction and account management into individuals’ hands.

Khalaf said, however, that while using a tech platform, there is still room for some of the traditional services offered by investment managers, such as advice and tax efficient structures.

“People are looking for simplicity, ease of use, tax wrappers like ISAs and SIPPs; they’re looking for a wide range of investments; they are looking for help and education, off the shelf fund solutions and guidance on what they should be buying.” Khalaf said.

Keeping a level head

In terms of the mantra and ethos individuals use during asset allocation, Khalaf said pandemic volatility had encouraged greater risk-taking. However, he added the best approach for retail investors is to establish a set of passive and low-risk habits that place consistency, diversification and a long-term mindset at their core.

“The reality is you have to get rich slowly. Diversity is key and when markets are falling, you should be prepared for that and not engage in knee-jerk behaviour.

“One way to do this is a drip-feed savings plan, investing money on a monthly basis like clockwork.”

Khalaf said this spreading out risk and being patient are key components for individuals to generate long-term returns.

“The longer you have, the more you have to benefit from compound growth – so get on it as soon as you can and starting early can give you a good head start.”

When approaching short and leveraged (S&L) ETPs, Kavrak said investors need to compare product fees versus their underlying holdings and figure out whether more expensive products are charging merely for attractive titles featuring qualities such as ESG and SRI, rather than differing materially from their counterparts.

When making leverage plays, however, he added the collateralisation of ETPs makes them less risky than CFDs, where an investor could lose all of their capital if their broker goes under.

Kavrak also said due to the complexity and high conviction nature of leveraged products, he would not recommend them to first-time or novice traders.

“The European leveraged space is very fragmented and compartmentalised. There are all kinds of leveraged products that are complex and difficult to understand,” Kavrak continued. “It is important to stress that leveraged products are just another tool in an investor’s toolkits – but they are certainly power tools.”

Trends to watch

Looking ahead, Khalaf said he is interested to see whether the popularity of UK stocks among share traders would begin to reflect more in fund traders. He was also interested in whether ESG products could maintain their 2020 momentum, or if investors merely piled in during the pandemic because the returns profile looked strong.

On this, Jobson said Interactive Investor expects to see efforts to launch ethical funds in the income space. He noted this had been a challenge to-date, given that many of the largest dividend payers were among the most widely documented polluters, such as miners and energy companies.

Looking at a broad economic forecast, Kavrak expects travel and hospitality stocks to continue enjoying their current rebound. He added investors should hedge their growth positions in the short-term but should not discard the remote working roster, as the return-to-normal narrative may be overplayed.

“Companies such as Microsoft, Zoom and Shopify will continue to benefit from this trend and I don’t think it will die out soon”, Kavrak noted.

Agreeing with this, Khalaf finished by saying a cyclicals recovery until the end of the year would be a reasonable assumption. However, he advised investors to be mindful of the desire for lockdown to be over – and how such high hopes bring the risk of complacency.

“The risk with this is that the pandemic may throw another curveball, and we should be cautious about buying into government rhetoric about this being the final lockdown”, Khalaf warned. “The recovery has legs to it, but there are also potential downsides.”

To watch the full session, click here.