Smart-beta ETFs will continue to grow as old school stock-pickers are driven to extinction by investors tiring of their fees.

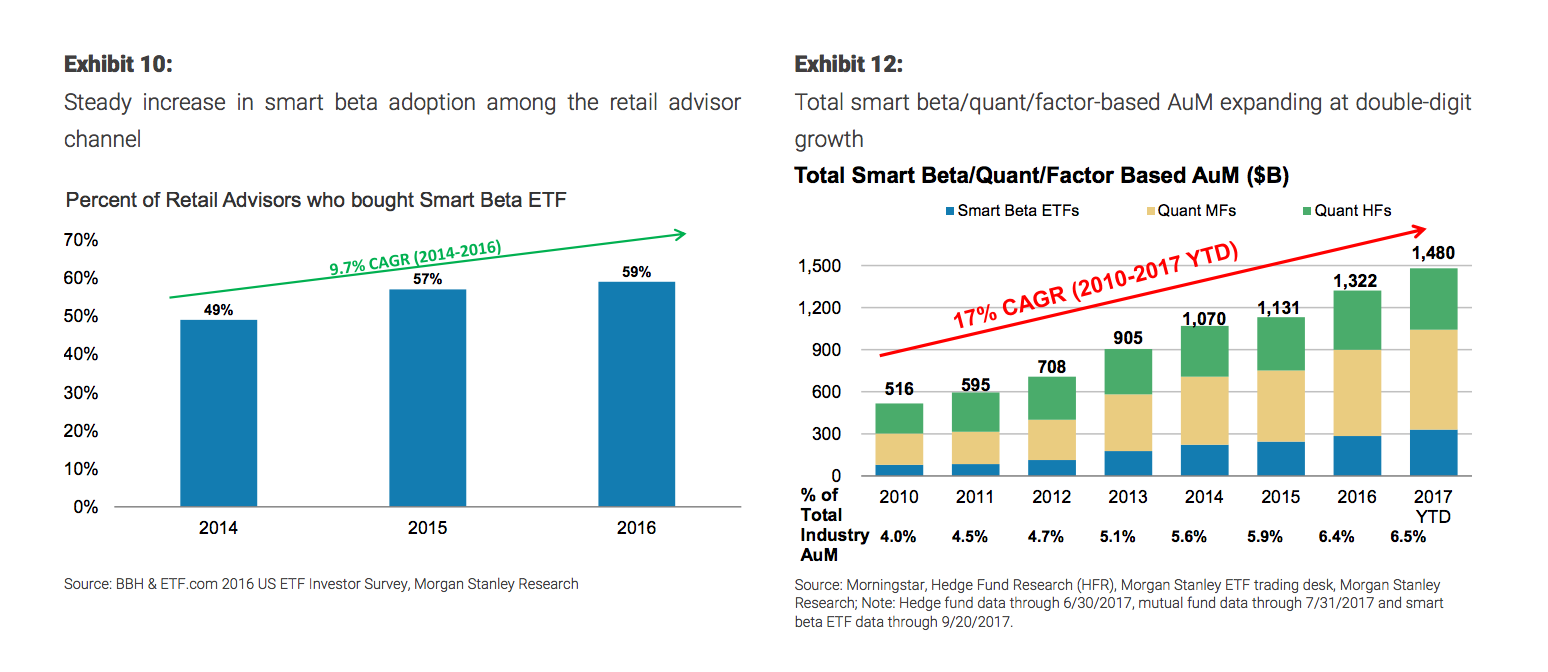

While still young and small, smart beta ETFs have grown their assets by 25 percent a year since 2010, well above the 18 percent averaged by the ETF industry as a whole, new research from Morgan Stanley has found.

"Not only has the AUM growth been extraordinary, but the scale of actual ETF products has followed closely behind," the report said.

"The intersection of passive and active management is converging around smart beta. As smart beta strategies become more mainstream, smart beta ETF launches are accelerating."

The report, titled "Quant Investing - Bridging the Divide," claimed the main driver on smart beta ETFs was underperformance and overcharging from active management, like the rest of the passive investing industry. But smart beta has been a late bloomer because the technology underpinning it is relatively new.

Despite its late entrance, smart beta has a bright future as both institutional and retail investors increasingly want factor exposure, the report claimed.

As much as two thirds of institutional investors have increased their factor exposure the last three years and more than half planned to increase their holdings going forward, the report said.

Among retail investors there was something of a knowledge gap, however. Only 60 percent of retail investors had ever touched smart beta products. Those who had have kept their holdings small, it said, with smart beta usually accounting for less than 5 percent of retail investors' total portfolios.

Smart beta is not immune to the fee war, the study found. As in corners of the ETF universe, new smart beta providers are using price as a tool to gain assets and brand recognition.

Offering advice on how to break into smart beta, the report said that ETF providers should try to be different and smart.

"Ticker awareness, marketing, brand and thought leadership are key ingredients to succeed, in our view. Newer entrants over the past few years have also been offering more alternative type smart beta products at a higher fee rate as a way to gain share through niche products."