Scaling clean energy capacity and the role of smart grid infrastructure in a low carbon economy were some of the topics discussed in ETF Stream’s webinar in partnership with First Trust.

The webinar, titled Smart grid infrastructure and the shift to clean energy, started by looking at the rapid uptake of renewable sources of energy over the last decade or so.

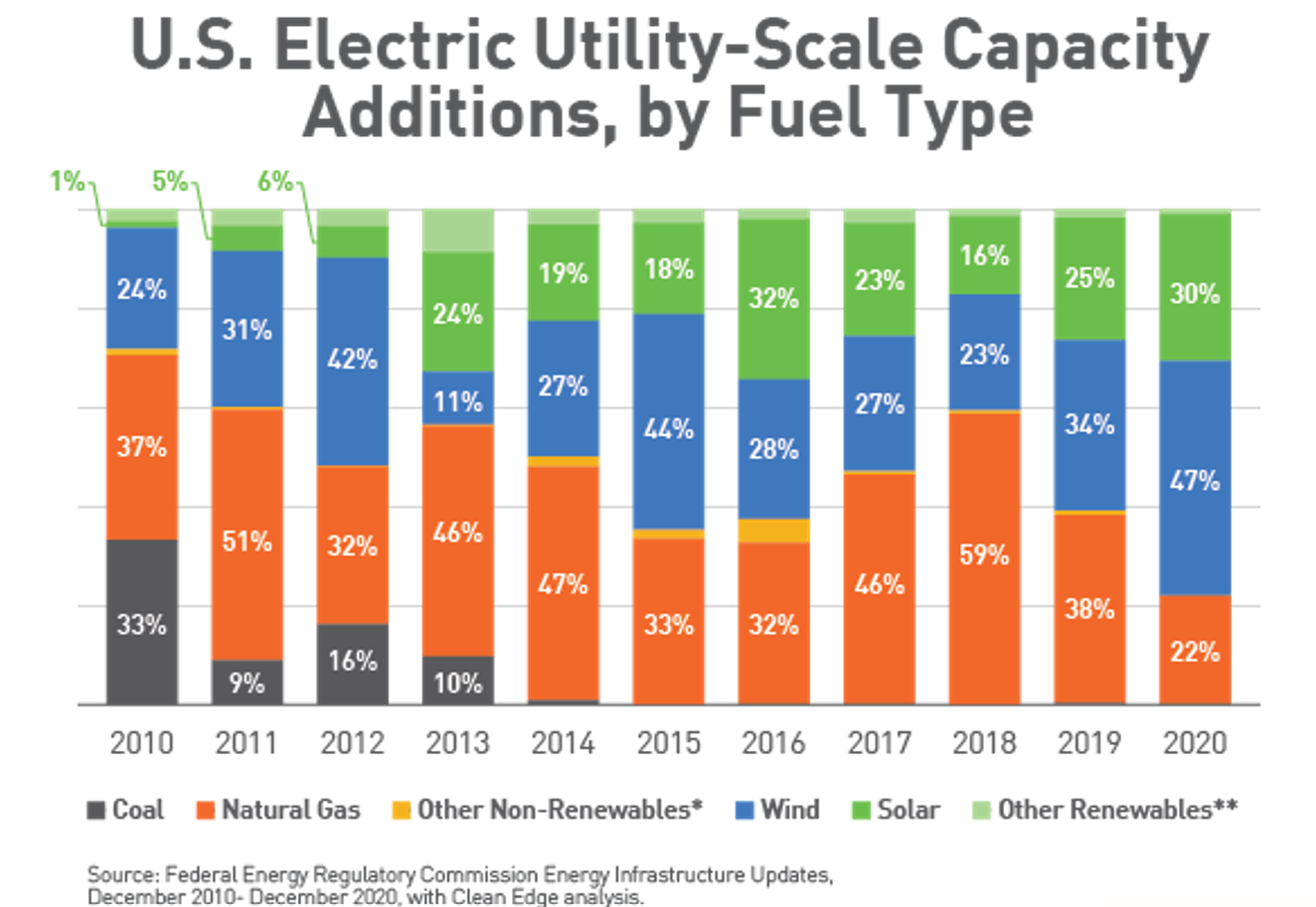

In 2010, more than 75% of new additions in new energy capacity in the US came from natural gas or coal as renewable utilities such as wind and solar were seen as relatively inefficient, temperamental and high cost.

By 2020, this had shifted to 75% of US new additions being made up of solar and wind, with coal largely erased from the picture altogether, according to Ron Pernick, managing director at Clean Edge.

“Today, solar and wind are now the lowest-cost form of new electricity capacity additions in the world,” Pernick continued. “Most new assets are going into energy sources that are clean, resilient and not based on fossil fuels.”

Storage as the key to a green grid

Traditionally, these sources have been looked down on their variable availability and other challenges, Pernick said.

For instance, the challenge of moving electrons from where they are generated to where they are used. Also, the question over how to store energy for use either onsite in a distributed situation or utility-scale storage at the generation site.

These issues are continuing to be addressed at centralised and nodal utility levels and in other areas such as clean transportation, with advances in increasingly capable and cost-effective energy storage.

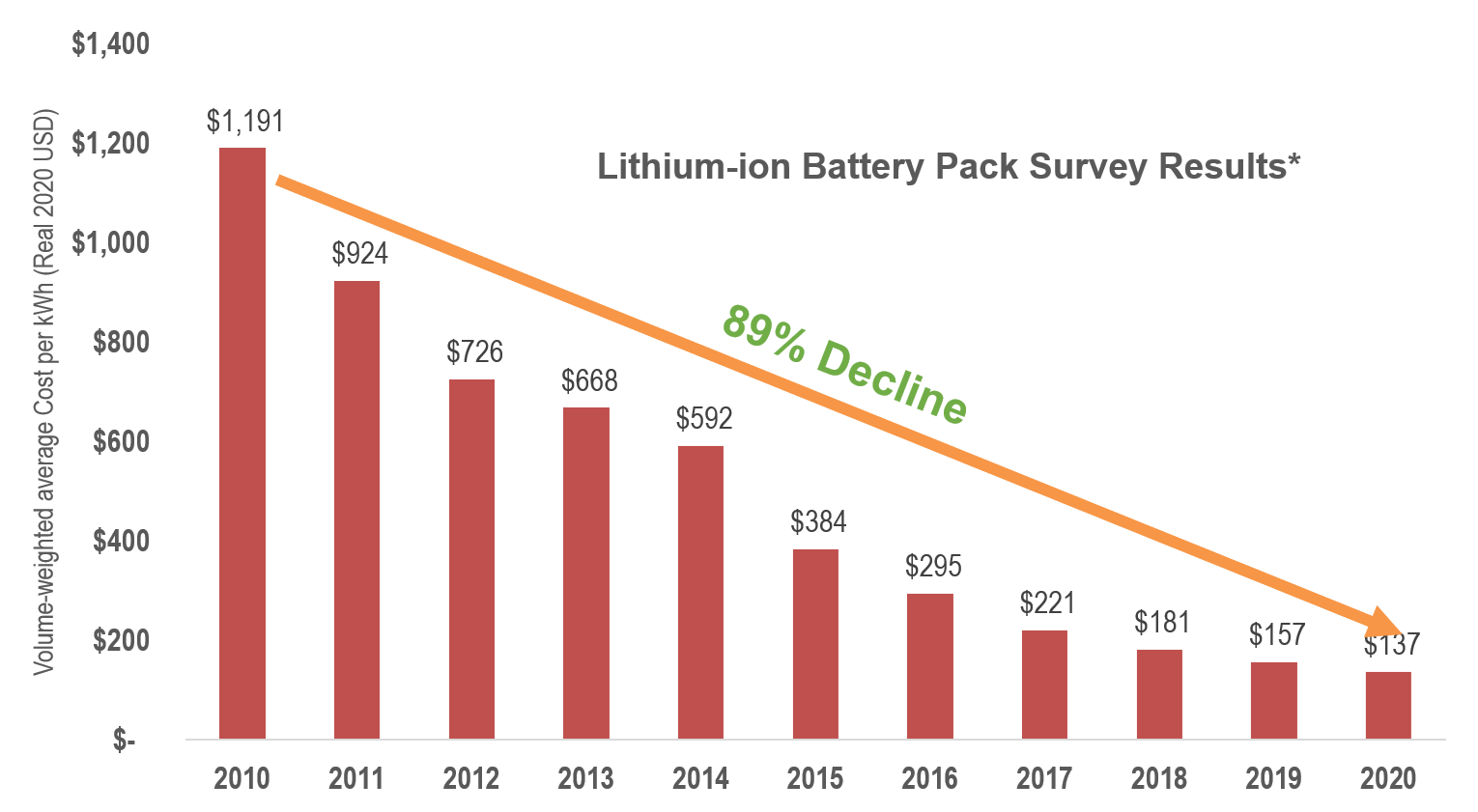

“What we have witnessed over the past decade is an 89% cost reduction in energy storage using lithium-ion battery packs, which is similar to the cost trajectory of solar PVs,” Pernick added.

Source: BloombergNEF, 2020

While some headwinds will be faced in the short-term – with supply chain strains and price inflation – he argued further price reductions can be expected as the sector scales and innovates further.

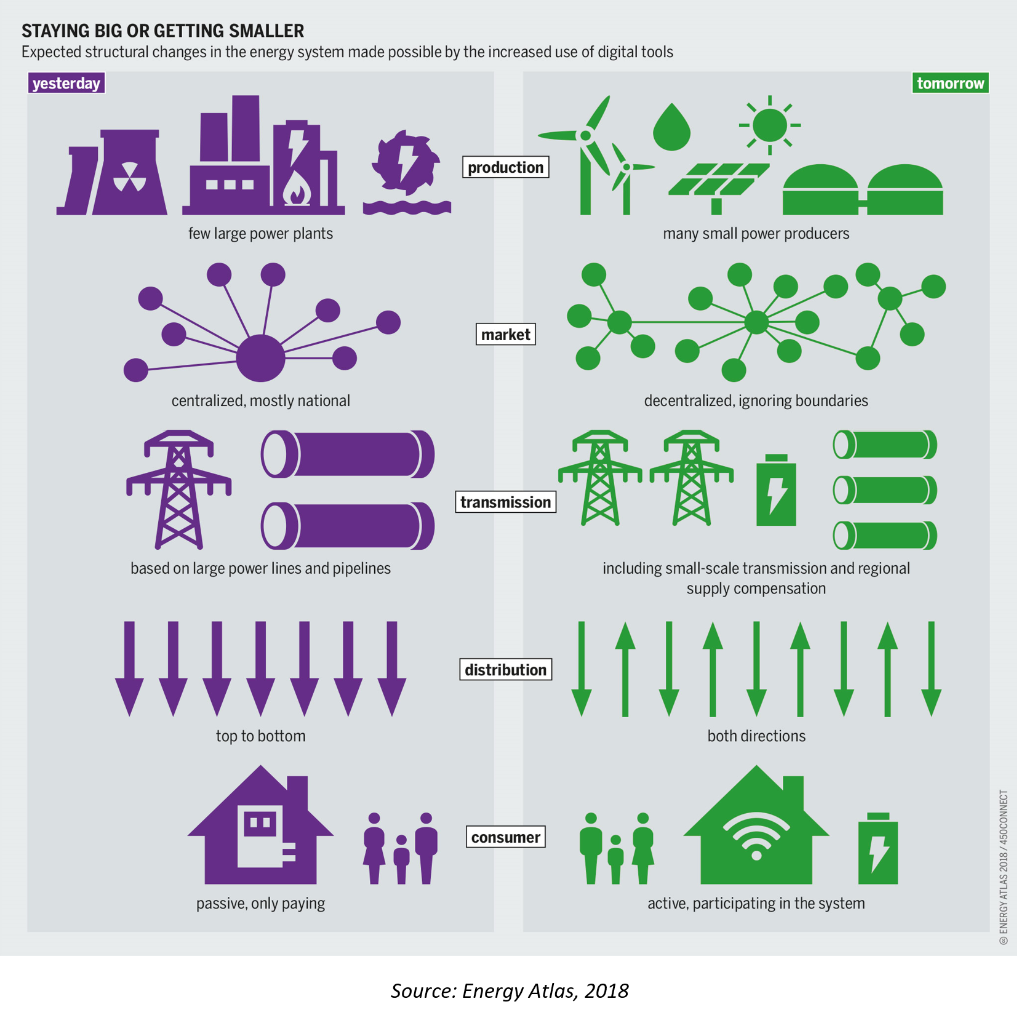

The next step is an increasingly decentralised and interconnected clean energy infrastructure, with networks of communicating electric vehicles (EV) and renewable ‘prosumers’ – those consuming energy and also contributing back to public supplies.

Clean energy and grid as investments

Looking at the investment angle, Gregg Guerin, senior product specialist at First Trust, expressed his enthusiasm for sectors supported by public policy and broad consumer reliance.

“One of my favourite types of investments are anything where you can find publicly traded securities that are getting forced revenues,” Guerin said.

Citing some examples, including traditional utilities, energy sources and electricity grids, Guerin argued the move to decarbonise economies while maintaining power capacity will force revenues into the early winners in clean energy.

Evidencing this, he pointed at the most recent earnings reports from the constituents of Clean Edge’s QGRD index, which have weighted-average sales growth of 18.6% over the year to the end of the last quarter versus “around 15%” for the S&P 500 index, Guerin said.

Impressively, the top 10 fastest-growing companies in the index had sales growth of at least 33% over the last 12 months, with Enphase Energy and Enel showcasing 97% and 91% sales growth, respectively.

Guerin noted near-term reliance on sources such as natural gas will remain but incidents such as Russia’s invasion of Ukraine – and the ongoing crisis in energy prices – continue to push the case for greener alternatives.

Agreeing, Pernick offered a fitting comparison. Talking about climate change is one thing, experiencing extreme weather, droughts and fires is another entirely. To the same effect, wanting energy security is one thing but having an autocracy driving up energy prices in real-time helps sharpen focus on the need for reliable, sustainable sources.

To watch the full webinar, click here.

Related articles