As markets around the world get smashed by the coronavirus, many investors have turned to history to see what a recovery might look like.

Some have compared the virus to SARS and MERS provide clues. Others have, more seriously, suggested the best analogue is the Spanish flu of 1917-1918, which killed an estimated 20-50 million people, and ranks among the worst epidemics of all time.

But is the Spanish flu a reliable guide? Probably not.

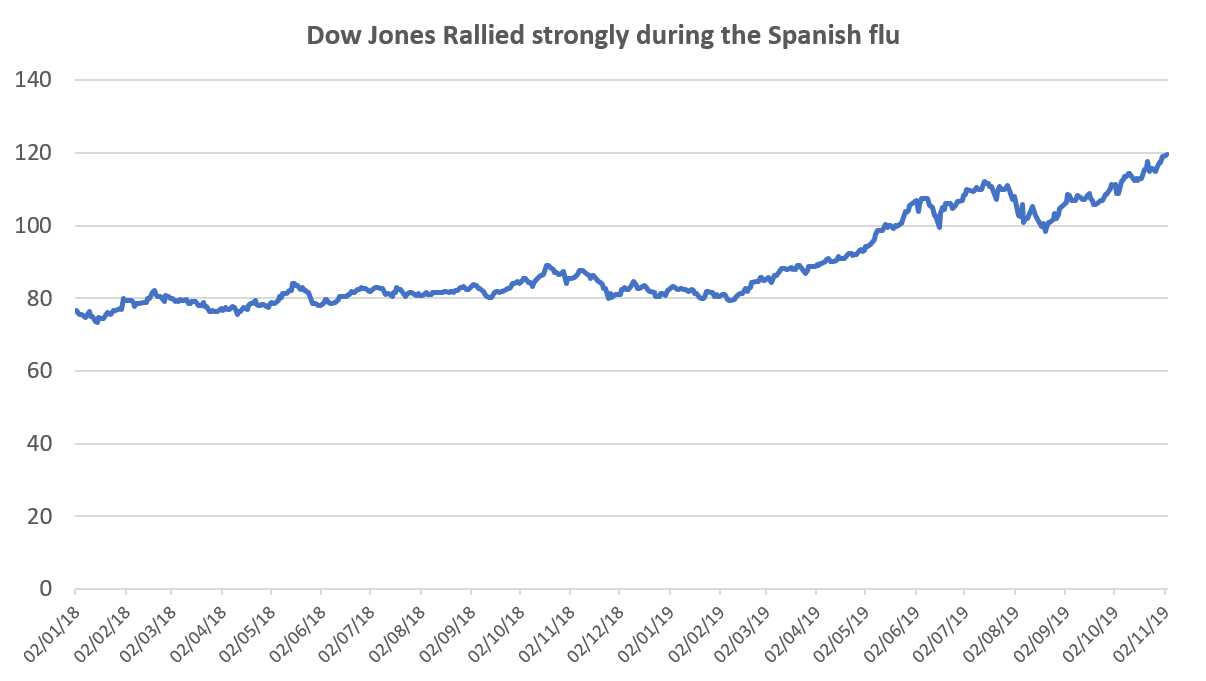

“The world’s stock markets actually boomed during the Spanish flu, the worst pandemic since the Great Plague. It is the opposite of the panicked selling we are seeing now and government actions to close down the economy,” UNSW Business School professor Peter Swan says.

He notes the government response to the Spanish flu was nothing like the actions being taken by governments today as governments back in 1917 were distracted with World War I.

“People practiced social distancing and wore face masks in public, but the economy was not closed down for a lengthy period.”

To put events into perspective, Swan says people were not so concerned about the Spanish flu given thousands died every day during the war. Its effects in Australia were also relatively mild compared with the rest of the world.

“Deaths from COVID-19 are miniscule at the moment and nothing like the deaths of the regular flu during most winters,” he says.

In 2017, flu killed 1,255 people, according to the Australian Bureau of Statistics. Although the death toll from COVID-19 could rise rapidly even with much of the economy closed. Swan notes closing the world economy has the potential to cause more deaths and hardship than the novel coronavirus.

He questions whether closing schools, small businesses, restaurants, sporting and so called non-essential facilities will really be effective in stopping the spread of the virus relative to strict social distancing.

“Closures with millions unemployed will certainly kill the economy and this could do far more damage than COVID-19 to both livelihoods and lives," he says.

“Morrison is doing a better job than most world leaders... [but] If world leaders succeed in closing the world economy for a long period they will do much more harm than COVID-19 will. US President Donald Trump is also alerting us to what continued closure of the US economy will do in terms of global destruction.”

Back to reality

It is a very different situation now, with globalised markets and the opposite to a sense of euphoria. Nevertheless, the principles of sound investing remain the same. A leading Australian exchange-traded fund (ETF) investor reminds market participants of the importance of diversification during times of market volatility. Year-to-date, the S&P 500 and the ASX 200 are down about 25 per cent.

Source: Google Finance

Chris Brycki, CEO of online investment adviser Stockspot, says the current investment climate is a great test for ETFs. “They may have followed markets down, but they have performed as expected.”

Brycki says the performance of the share market after the Spanish flu is not relevant because it is a totally different world. “The world is much more interconnected and we have had a 10-year bull market.”

He agrees diversification is key. “If you just owned banks at the moment, like many investors, you would have suffered a loss of between 40 per cent to 50 per cent. If you had owned the broader market your losses would have been reduced.”

Assessing the long-term impact of coronavirus

Despite share markets plummeting, Brycki says it is a great time to invest. “The Singapore, Chinese and Hong Kong markets have started to perform better. The Australian, US and European markets – not so much.”

Brycki says the Chinese and Hong Kong markets have underperformed over the last 10 years. But we could now be at an inflection points and some emerging markets may start to outperform.

Commenting on the effect of a falling local currency, he also notes international ETFs that are unhedged will benefit if the Australian dollar continues to fall.

It is a scary time for investors and, as always, difficult to pick the bottom of the market. Nevertheless, there will be money to be made in the weeks and months ahead.

Sign up to ETF Stream’s weekly email here