Investing in the best stock in a sector may be less important than owning the entire sector, according to research conducted by S&P Dow Jones Indices (SPDJI).

The report, entitled Sector Effects in the S&P 500: The Role of Sectors in Risk, Pricing and Active Returns, found the S&P 500 Utilities sector delivered 10% annualised returns over 10 years to December 2018. This means a better performing stock in the utilities sector should deliver one-year excess returns over the sector of around 10%.

However, the research also found over the same 10-year period the average difference between the one-year return of the S&P 500 Utilities and S&P 500 indices was also 10%. This means selecting the best utilities stock "may be less important" than simply investing in utilities.

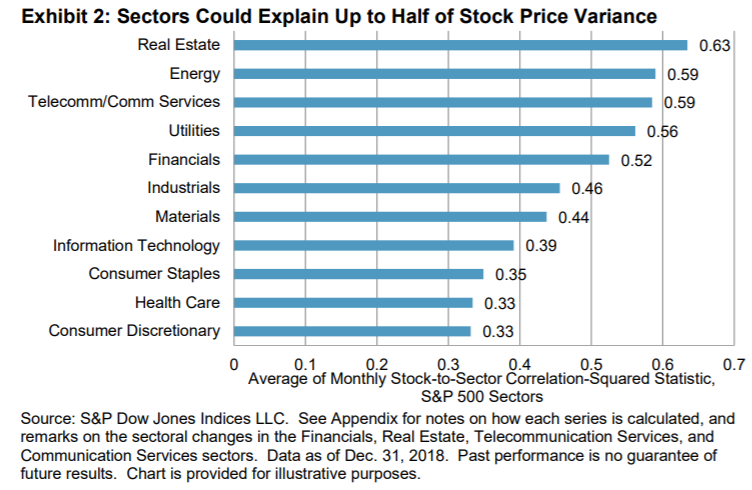

Furthermore, SPDJI said on average half of the daily variation in stock prices could be down to changes in sector prices.

Through measuring daily price changes in S&P 500 securities and their respective sectors over a 15-year period from January 2004 to December 2018, the report found stocks in real estate, energy and telecom/comm services were impacted the most by overall sector moves while consumer discretionary, health care and consumer staples were the least impacted.

Tim Edwards, managing director, index investment strategy at SPDJI and co-author of the report, commented: "Sometimes, the sector composition of an equity portfolio is of primary importance.

"[Even if] a manager selects which securities to avoid, [he] faces equal and opposite difficulties; an energy stock with poor prospects relative to its competitors might soar in price if there were a sudden shortage of crude oil."

'Passive products, active applications'

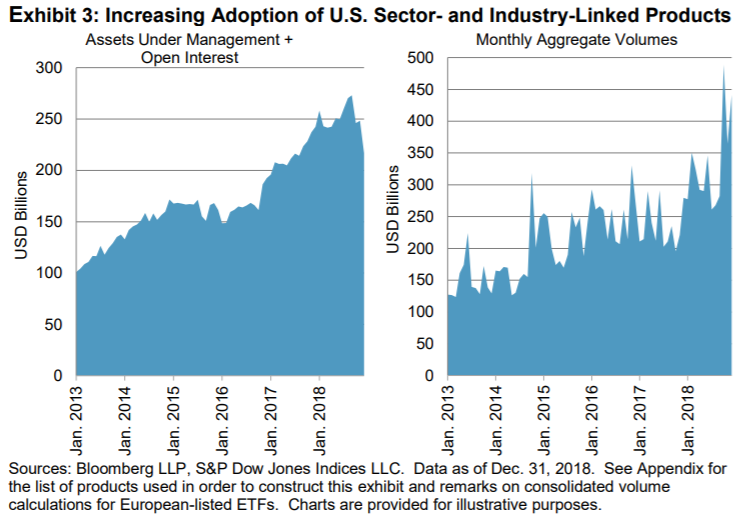

The research also highlighted a considerable increase in the usage of sector products. For example, in 2018 the aggregate trailing average daily volume for sector ETFs listed in Europe and the US amounted to $4trn in traded value, which is the equivalent to more than 10x the average amount traded each day in all stocks listed in the US.

Edwards said the increase in allocation to sector ETFs shows US sector and industry index-based products are not always being used in a "passive" way: "Index-based products linked to equity sectors are hardly antithetical to "active" investing and we think that market participants are using them precisely to express active views."

Allocation to sector ETFs, he continued, could be used for several uses including making direct active bets on one sector over another or hedging a concentrated position in a single stock with an opposite position in the relevant sector.

At this moment in the market cycle, SPDJI's analysis suggests the importance of sectors is increasing from an "unusually diminished" position relative to history.

"If this trend continues, it may benefit the investment practitioner to consider a sectoral perspective in the context of security selection and portfolio construction," Edwards concluded.