Do you ever think sector definitions are subjective? Do you think you could do as good a job on your own, and have fun in the process? This new ETF certainly does.

Syntax, a small new ETF provider that specialises in do-it-yourself sector exposures, is listing its second ETF. The Syntax Stratified MidCap ETF (SMDY), which lists this week, will track a modified version of the famous US medium sized companies index, the S&P MidCap 400 Index.

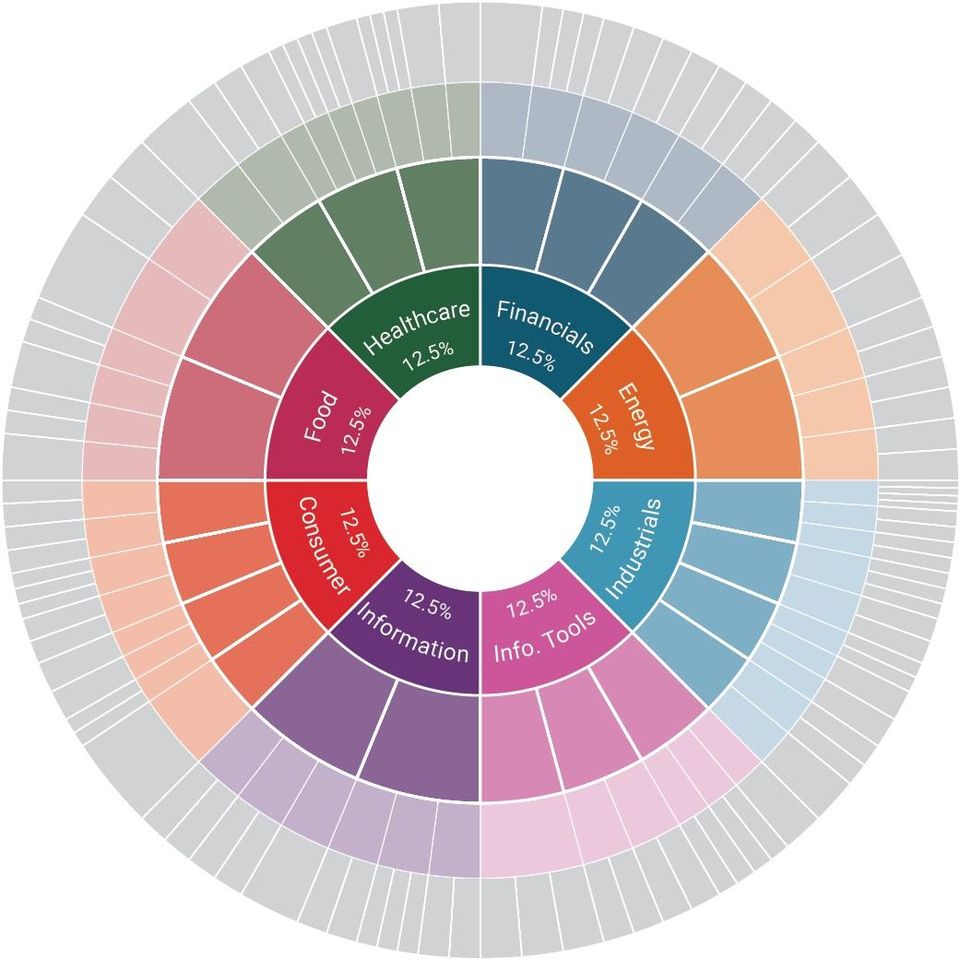

SMDY will invest in every company in the S&P 400. But will vary the amount of each company it buys according to its own definitions of sectors in the US economy. The sectors that SMDY uses are made by assessing companies’ common business risks, suppliers, functions, and other criteria.

In the end, the eight sectors SMDY will end up tracking are: consumer, energy, financials, food, healthcare, industrials, information, and information tools. Sectors each get an equal weighting. However, how companies are weighted within these sectors is kept secret.

Syntax' first ETF, the Syntax Stratified LargeCap ETF (SSPY), has $27 million under management and was listed in January 2019.