Tesla has lost its place in the S&P 500 ESG index only a year after being added amid concerns over safety, alleged discrimination and lack of reporting.

The index rebalance became effective on 2 May and was publicised on Tuesday, with Elon Musk’s (pictured) recently acquired Twitter and oil refiner Philips 66 being added to the benchmark while Delta Air Lines and Chevron joined Tesla in being chopped.

In a blog post, Margaret Dorn, senior director, head of ESG indices for North America at S&P Dow Jones Indices (SPDJI), said Tesla became ineligible for inclusion due to its low score on SPDJI ESG metrics, which fell into the bottom quartile of companies within its GICS industry group – automobiles and components.

Dorn added its wider GICS group experienced an overall increase in ESG scores while Tesla remained “fairly stable” throughout the year.

“While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens,” she continued.

Contributing to this are several concerns set out by S&P, including Tesla’s lack of explicit low carbon strategy or codes of business conduct.

The index provider also cited “claims of racial discrimination and poor working conditions” at its Fremont factory in California, as well as its handling of the NHTSA investigation after “multiple deaths and injuries” linked to autopilot vehicles.

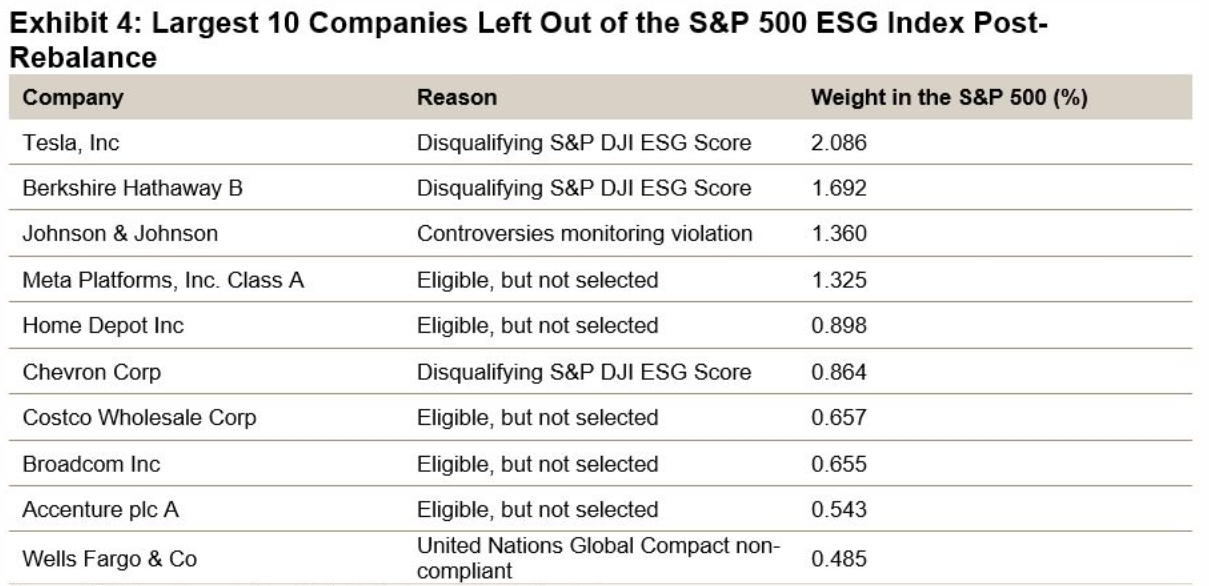

Following the changes, Tesla joins other vanilla S&P 500 mainstays such as Berkshire Hathaway, Johnson & Johnson and Wells Fargo in either being ineligible for index inclusion or being involved in controversies.

Interestingly, Meta, Costco, Home Depot and others were eligible for inclusion but were not selected by SPDJI, which once again raises questions about the discretionary nature of S&P 500 inclusion by the provider’s index committee. This was a problem Tesla faced prior to its delayed entry into the S&P 500 parent index in December 2020.

Source: SPDJI

Responding to the recent changes, Elon Musk took to Twitter to describe ESG as a “scam” while claiming S&P Global Ratings had “lost their integrity”.

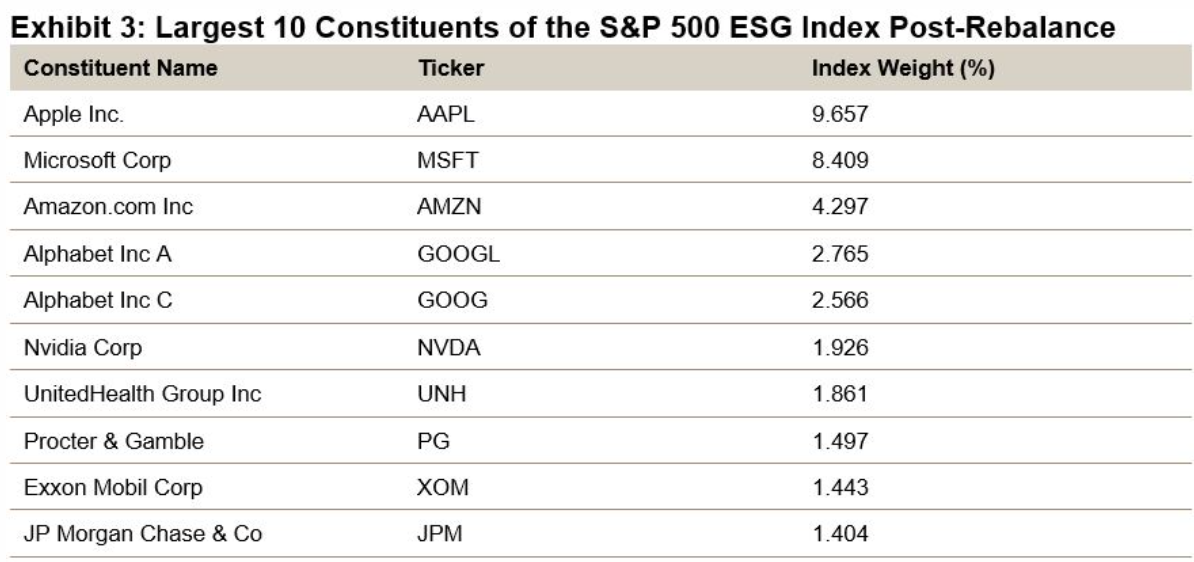

He also made the point that Exxon Mobil has retained its top ten spot in the S&P 500 ESG benchmark along with other fossil fuel companies, which currently make up 6.5% of index, according to non-profit As You Sow.

Source: SPDJI

In a statement, Tesla described ESG as “fundamentally flawed”, focusing more on the dollar-value of risk-return rather than the scope of a company’s positive impact.

The company added: “Individual investors, who entrust their money to ESG funds of large investment institutions, are perhaps unaware that their money can be used to buy shares of companies that make climate change worse, not better.”

This new development within the ESG space will certainly raise a few eyebrows about the validity of index providers’ sustainability metrics, as the world’s largest car company, electric vehicle frontrunner and solar panel manufacturer is given less preferential treatment than some of the world’s worst polluters and industrial-scale climate change deniers.

Tesla’s deletion also reminds investors of the frightening degree of power wielded by index providers, with the company’s stock falling 6% on Wednesday, the day after its removal was publicised.

However, the move also sets an important precedent – ESG is based on data and is only as good as the quality and depth of data that can be collected. Even Tesla – a figurehead for a more sustainable way of life – is not exempt from having to provide full data and perform corporate ESG best practice, as many of its peers do.

Related articles