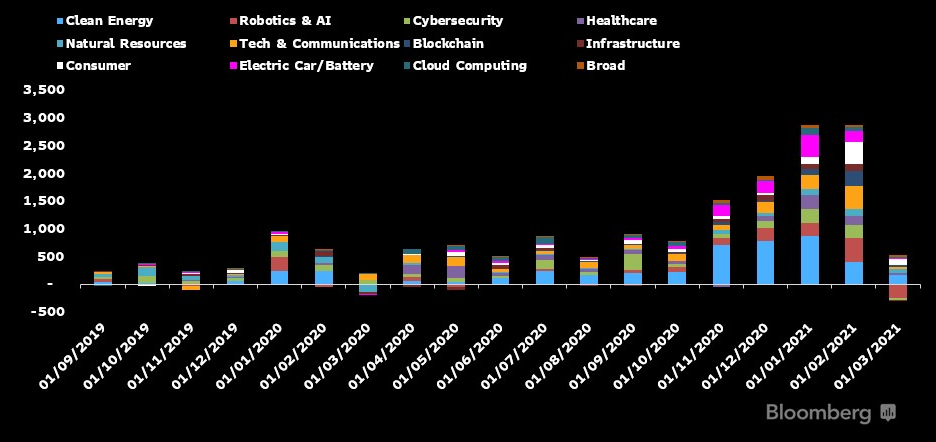

European thematic ETFs began the year by posting their two strongest months of inflows, having enjoyed record asset growth in 2020.

According to data from Bloomberg Intelligence (BI), thematic ETFs saw €2.8bn inflows in January and February, respectively, the two strongest single, and consecutive, months of asset growth.

This adds to the record €10bn inflows and 23 new launches in 2020. While the majority of new assets were captured by older strategies, BI said 20% of flows went into ETFs launched from 2019 onwards.

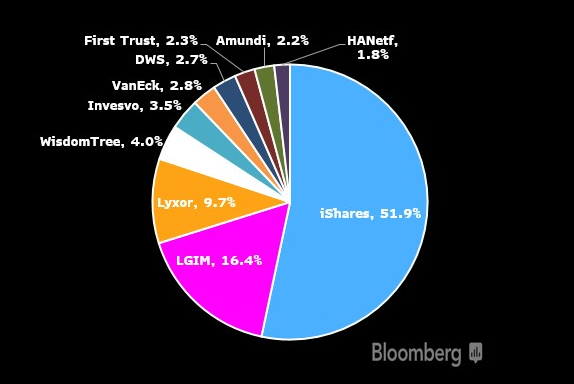

Despite the newly popular thematics stealing the limelight from older, targeted segments such as smart beta ETFs, it has been the usual suspects benefitting most from their ascendence.

Two issuers, BlackRock and Legal & General Investment Management (LGIM), have 25 of the 80 thematic ETFs available in Europe. While issuing 32% of the products, the two providers claim a combined 68% of European thematic ETF assets, with BlackRock alone holding 52%.

Although these established issuers have a dominant stake in thematics, BI said it expects this to gradually wane as other issuers gain footholds in newer and more niche themes such as blockchain, gaming, and cannabis.

Thematic ETFs are evidently being viewed as a significant growth area in Europe as highlighted by the two issuers entering the market in 2020; Rize ETF and Global X.

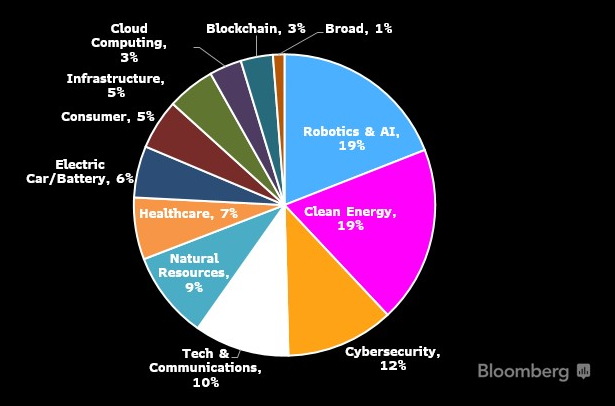

Unsurprisingly, investors are primarily seeking exposure to well-established secular trends such as the energy transition and rising tech integration. This is reflected with clean energy and electric vehicle ETFs make up 19% and 6% of thematics assets, while robotics and AI, cybersecurity, and tech and communications claim 19%, 12% and 10%, respectively.

Despite seven themes holding 75% of thematic ETF assets, however, BI noted 11 out of the 12 themes with UCITS coverage have at least €1bn of investor backing.

The pronounced bull run of thematics since November 2020 appeared to lose a fair amount of steam in March with the cyclicals rotation bringing about the much-anticipated correction of growth equities.

In this environment, thematics outflows were particularly pronounced with the predominant tech and clean energy themes among the worst affected.

This spite of this downturn by 2020 winners, average outflows across thematic categories over the month to 19 March came to 6%, only a fraction of the 90% average growth witnessed across all categories over the trailing 12 months.

BI said they expect inflows to resume their uptick going forwards with an increased dispersion among funds leading to greater support for newer and less established categories.

With Brown Brothers Harriman finding 69% of European professional investors plan to increase their thematics exposure, BI said an increase in retail investor activity during the pandemic may continue to be a boon for thematic products going forwards.

Eric Balchunas, senior ETF analyst and Bloomberg Intelligence, said thematic ETFs currently represent just 3% of total European ETP assets, and therefore have ‘ample’ growth potential.

He predicted thematic ETFs could hit $300bn within the next five years.

“Theme ETFs have taken in more money over the past three years than all other sector ETFs combined,” Balchunas continued.“The recent sell-off showed their durability with minimal outflows. With $170bn AUM, they already exceed the assets of any single sector and are more than double the size of any outside technology.”

Further reading