Hedge funds have had a rough time the past 10 years.

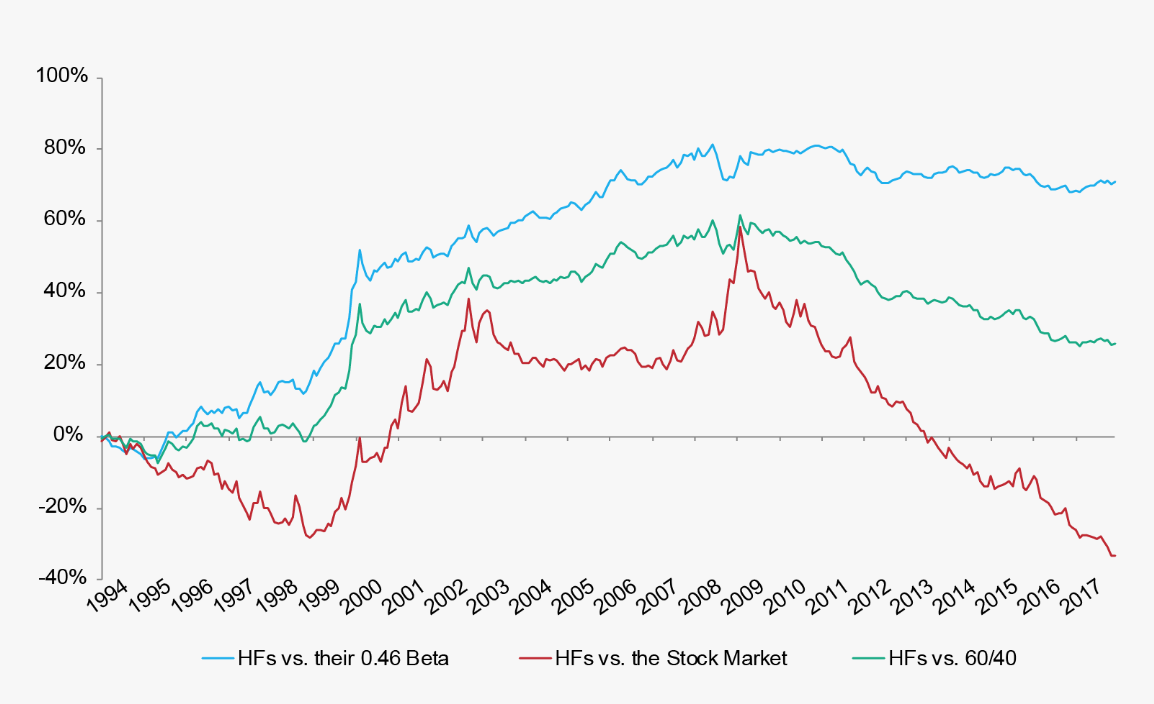

Using one measure, the HFRX global hedge fund index, they’ve underperformed the S&P 500 by 70% since March 2009. Using another measure, one preferred by AQR boss Cliff Asness, they’ve underperformed equities by 20% since 1994.

Looking over their performance and high fees, the Financial Times concluded: “No wonder exchange traded funds are so popular.”

But has the failure of hedge fund bosses helped the rise of ETFs? It certainly has – or so says Petra Bakosova, an ETF manager determined to cram hedge fund strategies into the ETF wrapper.

“Some of the hard time that hedge funds have had has been warranted,” Ms Bakosova said.

“If you’re charging a 2% management fee and a 20% performance fee you know how much alpha you have to produce every year. And that’s been a fleeting concept because not many fund managers can accomplish that.”

Ms Bakosova is one of the drivers behind the Hull Tactical US ETF (HTUS), which was one of the first ETFs to onboard hedge fund trading strategies.

The fund – which aims to “democratise” access to hedge funds – attempts to make formerly allusive and exclusive hedge fund trading strategies available to everyone – especially retail investors.

Most hedge funds are loath to tell anyone how they trade (in some cases, because their strategies are illegal). But HTUS makes many of its trading strategies public through a series of white papers. It even makes its holdings transparent.

“We like the transparency of the ETF wrapper and we like the price competition,” Ms Bakosova says.

“With the ETF we are signalling that we’re not a traditional hedge fund.”

While HTUS offers a hedge fund type of asset allocation, it’s of a peculiar kind. The fund uses an in-house model to time the market. And there is only one thing it appears to be timing: its degree of exposure to the S&P 500 (done mostly via SPY).

The fund uses a sliding scale, and can be anywhere between -100% to 200% exposed its index, depending on how the model reads the market.

However performance has been hit and miss. In the first year, it hit the index out of the park. Yet since inception, HTUS has underperformed the S&P, providing a return of -1.42% compared with the 36.26% return provided by SPY. It also underperformed during the correction in December 2018, despite being able to go inverse and take on a large cash position if necessary.

And like most hedge fund strategies, the fund charges more than most other ETFs: 0.96% a year. The asset weighted average ETF fee in the US is 0.21%, the Investment Company Institute Handbook suggests.

However there is more to the underperformance than meets the eye, Ms Bakosova says. Throughout the fund’s history she says HTUS has been “on average less than 50% long”.

Distribution: a different approach

Hull also takes a different approach to sales and distribution. Most ETF providers at the Inside ETFs conference, where we conducted the interview, are interested in meeting the advisors and getting their business cards.

To this end, most ETF providers rent out booths – in some cases very large ones – and buy ad spaces wherever they can. Yet Hull doesn’t appear to do that – or at least, not in the same way. Instead, like other small new ETF players like Cambria, it focusses on getting eyeballs with its research and trying, so far as possible, to go direct to investors and advisors.

“We do not have a dedicated sales force,” Ms Bakosova says.

“We have focussed on client education and perfecting the strategy and trading those white papers and blogs and videos. So we want to make sure that when people buy HTUS they know what we’re trying to do.”

***

Featured image: AQR