UK Chancellor Kwasi Kwarteng’s widely criticised ‘mini budget’ last Friday locked in the largest tax cuts since the 1970s, sent cable to its lowest level since the collapse of Bretton Woods and saw UK gilt ETFs plunge as yields shot up across the curve.

Deutsche Bank’s head of global fundamental credit strategy Jim Reid said UK gilts had their “largest one-day increase in decades” last Friday as two-year yields shot up 44.7 basis points (bps) while five-years and 10-year yields spiked 50.3bps and 33bps, respectively.

Inversely, UK gilt prices moved in a downward trajectory more severe than any one-day period seen during COVID-19, Brexit or even the Global Financial Crisis in 2008.

Responding to recent yield volatility, the largest broad UK government bond ETF, the $1.3bn iShares Core UK Gilts UCITS ETF (IGLT), has fallen 16.1% over the past month, as at 23 September.

Over the same period, the longer-dated $67m SPDR Bloomberg 15+ Year Gilt UCITS ETF (GLTL) and Europe’s largest inflation-shielded UK government bond ETF, the $691m iShares £ Index-Linked Gilts UCITS ETF (INXG), returned -23.2% and -21.8%, respectively.

These stark changes were a reaction to Kwarteng’s (pictured) unfunded tax cuts, which are set to cost £87bn over the next two years and sit alongside the £150bn initial Energy Price Guarantee. BlackRock estimated in its weekly market commentary the two measures will amount to 10% of UK GDP over the next five years.

The cost of the policies also does little to assist the Bank of England in its mission to manage inflation. Having implemented a 50bps hike last Thursday, money markets have priced in a further 200bps of emergency hikes before the policymaker’s next meeting in November, according to Bloomberg.

The central bank also plans to offload £80bn of UK gilts from its balance sheet over the next 12 months, a goal that may have to be revised after the glut of new issuance to finance the government’s new spending plans.

Commenting on the Chancellor’s opening gambit and its immediate aftermath, former US Treasury Secretary Larry Summers told Bloomberg: “It makes me very sorry to say, but the UK is behaving a bit like an emerging market turning itself into a submerging market.

“I hope that at some point this policy package will be reversed, or that somehow I am misjudging the situation. But I am very fearful for the UK on the path that it is travelling.”

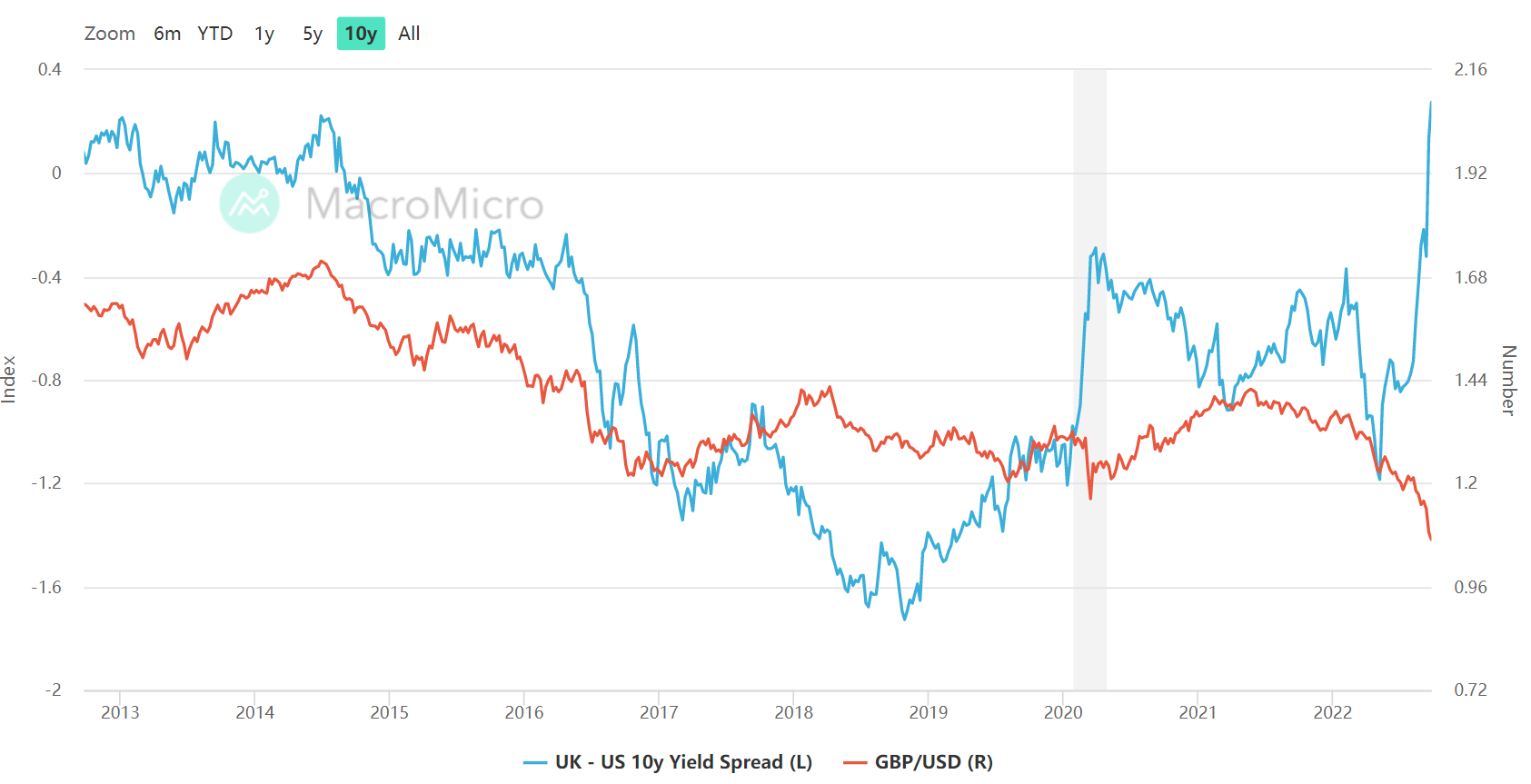

On Monday, sterling fell 3.6% against the US dollar to hit $1.03 in Asian trading, its weakest exchange rate against the greenback since going free float in 1971.

Source: MacroMicro

Illustrating sterling’s weakness, the WisdomTree Long USD Short GBP ETC (GBUS) has returned 22.9% this year, as at 23 September.

Further highlighting this, while the $11.1bn iShares Core FTSE 100 UCITS ETF (ISF) – based on sterling-denominated securities – fell 11.8% in a month, the $127m iShares Core FTSE 100 UCITS ETF USD Hedged (ISFD) dropped by a more modest 5.8%.

Commenting on the UK’s economic situation and its policy response, BlackRock said the Bank of England accepts pushing inflation down quickly requires a recession but the UK now faces different challenges which “change fundamentally” the asset manager’s view of UK assets.

“The UK government revealed a fiscal splurge on Friday that effectively throws money at an inflation problem, in our view,” it said.

“After last week’s hike, this means the BoE will have to hike more and leave rates elevated for longer than it planned to, we think. But more importantly, the fiscal splurge puts the UK’s fiscal credibility into question.”

As Kwarteng and the Bank of England go head-to-head on further tax cuts and interest rate hikes down the line, the world’s largest asset manager has reduced its UK gilt stance to underweight.

Related articles