Investors are piling into value ETFs in hope the resurgence into cyclical stocks is set to continue following a decade of underperformance.

According to data from Ultumus, $1.4bn iShares Edge MSCI USA Value Factor UCITS ETF (IUVL) saw $229m inflows in the week to 13 November, the seventh-highest across all European-listed ETFs, while investors poured $138m into the iShares Edge MSCI Europe Value Factor UCITS ETF (IEVL).

Furthermore, iShares Edge MSCI World Value Factor UCITS ETF (IWVL) and the USB Factor MSCI USA Prime Value UCITS ETF (UBUS) also saw combined inflows of $233m.

The inflows come after value stocks have shown some signs of life since Democratic candidate Joe Biden’s victory in the US election earlier this month and news Pfizer had successfully tested a coronavirus vaccine on 9 November.

Following the double boon for markets, cyclical stocks shot up with the Russell 1000 Value index outperforming the Russell 1000 Growth index by 6% on 10 November, the highest daily excess return over the past decade.

Investors turning to value ETFs last week will be expecting this outperformance over growth stocks to continue towards the end of the year.

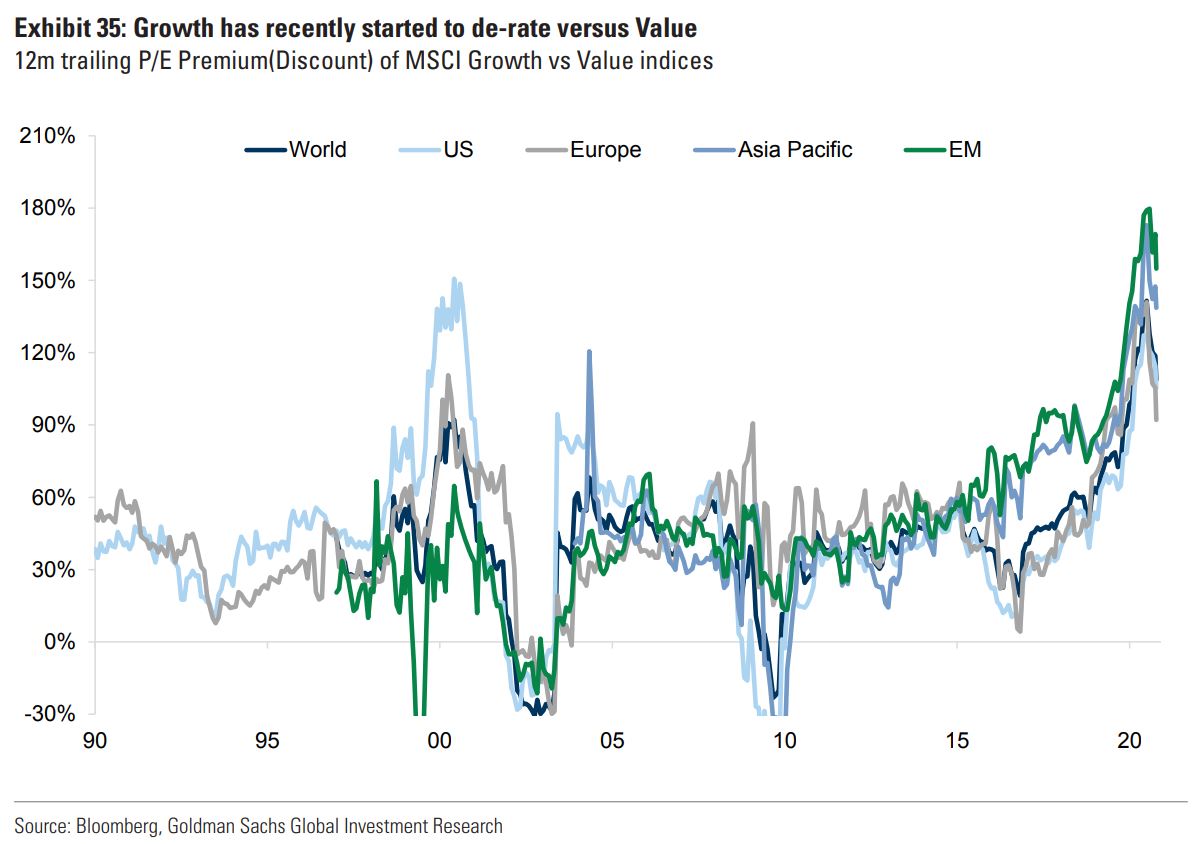

With spreads between value and growth at their highest levels since the ‘dot com’ bubble in the early 2000s, analysts at Goldman Sachs are predicting the rotation to continue amid rising inflation expectations and a spike in oil prices.

Along with forecasting Brent Crude to hit $63 a barrel over the next 12 months, Goldman Sachs has called for higher break-even inflation from Q2 amid a combination of low interest rates and an increase in fiscal support from governments.

This environment will be supportive of value stocks which are positively correlated with rising inflation expectations.

Performance shows not all value ETFs are created equal

Peter Oppenheimer, chief global equity strategist and head of macro research in Europe at Goldman Sachs, said: “We expect to see a continued rotation of leadership in the markets supported by stronger growth, steeper yield curves and higher commodity prices.

“This does not mean that growth stocks should suffer (and the secular attraction of stable, strong balance sheet companies is likely to continue), but record valuation spreads and an inflection point in growth and bond yields point to a period of outperformance of cyclical and value areas of the markets, and we would suggest more diversification across sectors and factors.”