In a sign of how out-of-favour local banks are, the VanEck Vectors Australian Equal Weight ETF (MVW) has hit the coveted $1 billion mark, as investors seek to diversify their exposure away from bank-heavy ETFs that track the S&P ASX 200 index.

The fund, which launched in March 2014, gives investors exposure to Aussie shares, but in a very different way from ETFs that track the S&P ASX 200 index, the country’s most popular share market gauge.

MVW uses the MVIS Australia Equal Weight index as its benchmark, an index which is owned by VanEck’s parent company. This helps ensure the fund is more profitable.

It tracks the performance of the largest and most liquid Aussie shares. However, unlike ASX 200 trackers, MVW only uses 80 stocks – not the full 200. It then gives them an equal weight of about 1.25% each, rather than weighting them by size.

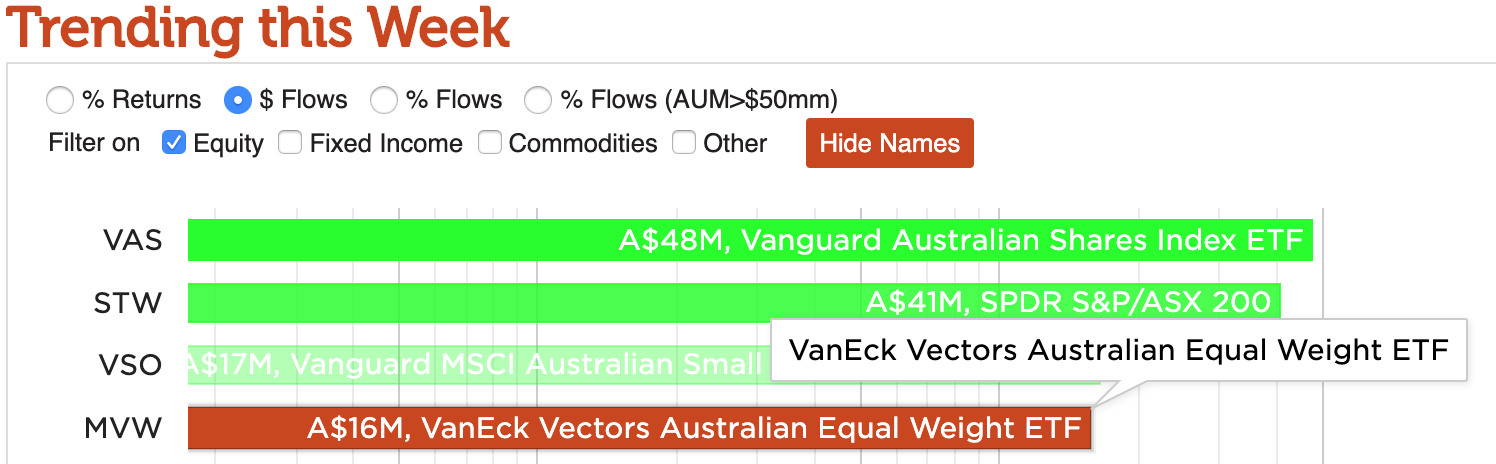

MVW has been the fourth most popular ETF with investors this week. Source: Ultumus, ETF Stream

The fund has delivered a total return of 10.9% a year on average since inception, while the index has delivered 11.3% a year on average across the same period. The tracking difference very probably owes to the fund’s 0.35% fee.

By contrast, the S&P ASX 200 index turned in 8.4% a year on average over that time. Meaning that VanEck’s fund has very comfortably beaten the ASX 200.

Arian Neiron, head of VanEck Asia Pacific, says the fund offers exposure to growth stocks. “If the banks are not performing, if you do not have credit growth, if the banks cannot continue to invest and get you the higher return on your investment capital, then you are really limited.”

Smart beta beyond dividends: VanEck's equal weight gambit

Neiron says when the team set up the fund, it looked into, but ultimately rejected, starting an ETF that equally weighted all the stocks in the ASX 200. “We did not like that idea, because stock number 200 is far smaller and less liquid than other stocks in the index and gives you that tail risk.”

The ETF includes a range of mid-cap companies, especially those in the ASX 50. Says Neiron: “That is where your growth is. You have the benefit of management teams that understand what is required from public companies, but they are still agile. They get a higher return on investment capital and their earnings’ growth is solid.”

An important consideration in the ETF’s construction was the liquidity of the underlying securities, given that the fund rebalances hard and often. This prompted VanEck to choose an index with strong liquidity criteria, in order to lower transaction costs and potential tracking error.

Neiron says early fans were independent financial advisers looking for investments to help their clients reduce their exposure to the ASX 200 in a cost-effective way. The fund attracts a management fee of 0.35% a year. Despite the substantial rise in funds invested in the ETF, there are no plans to reduce fees. “At this stage, it's premature to consider any fee reduction.”

“The fees are relatively high compared to other traditional, passive ETFs in this asset class,” says Victoria Habra, a financial adviser with professional services firm Nexia.

She says the fund is likely to outperform the S&P/ASX 200 index when mid-cap stocks outperform large-cap stocks. “If financials and materials fall, the impact won’t be as severe compared to passive investments tracking the S&P/ASX 200.” Conversely it is likely to underperform when large-cap stocks outperform mid-cap stocks.

MVWVASYear-to-date total return27.77%26.22%

MVW has outperformed VAS in 2019. Source: Morningstar Direct

There are other potential downsides, says Habra: “As the equal weightings are consistently drifting due to share price movements, the fund has relatively high portfolio turnover of around 30% a year compared to the S&P/ASX 200, which historically has a turnover of about 10%. This may have negative tax consequences for investors as the ETF is more likely to incur capital gains tax.”

Competitor response

Despite MVW’s success, Ilan Israelstam, head of strategy, BetaShares, says they have no immediate intention to launch an Australian-shares ETF using an equal-weighted methodology.

“Our BetaShares EX20 Portfolio Diversifier ETF (ASX: EX20) provides many similar features to an equal-weighted methodology such as diversification and reduction in exposure to individual market sectors.

“But EX20 excludes stocks to which many investors are already heavily exposed, such as the big four banks and miners such as BHP Billiton and Rio Tinto. These are included in equal-weight products, albeit at a lower weight than ETFs that follow a market-cap based benchmark.”

Australia's best ETF: Vanguard's VAS: or VanEck's MVW

EX20 attracts a management fee of 0.25% a year and has returned 11.94% a year on average since inception in October 2016. It has around $147 million in funds under management.

Although BetaShares has no immediate plans to launch an equal-weight ETF, Conaill Keniry, a financial adviser with What If Advice, says he expects competitors to emerge.

“Given MVW’s track record compared to the ASX 200 index and growth in funds under management, it is likely other competitors will emerge in this space.”

Editor's note (29/11):An earlier version of this article ran a graph with incorrect performance figures for MVW, showing it performing in-line with VAS. The performance figures have been updated to show MVW outperforming VAS in 2019.