It didn’t take long.

Vanguard, the silverback gorilla of Aussie passive investing, is cutting the fee on its $3.7 billion Vanguard Australia Shares ETF (VAS).

The new fee will be 0.10%, down from 0.14%. Vanguard will forego almost $1.5 million a year in revenue to make the fee cut possible. The move dovetails with the fee cuts on two cross-listed ETFs, VEU and VTS, earlier this year.

ETFReductionOld feeNew feeEffective dateVanguard Australian Shares Index ETF (VAS)0.04%0.14%0.10%1-Jul-19Vanguard US Total Market Shares Index ETF (VTS)0.01%0.04%0.03%29-Apr-19Vanguard All-World ex-US Shares Index ETF (VEU)0.02%0.11%0.09%26-Feb-19

“Vanguard takes a lot of pride in being able to pass along the benefits of increasing scale in our funds and driving costs down over time for our investors,” said Evan Reedman, boss of ETFs at Vanguard Australia.

“We welcome recent announcements from other product issuers who are also moving to lower costs...While some issuers may offer lower prices on select products, Vanguard is committed to delivering high value and low cost across our broad range.”

The cut comes 24 hours after a similar announcement by BlackRock, which lowered the fee on its iShares Core S&P/ASX 200 ETF (IOZ) yesterday. The timing, together with Mr Reedman’s statement, suggest that Vanguard’s fee cut could be a response to Blackrock’s cuts.

Related: iShares lowers fees as Aussie "core war" sets in

VAS’s new-look fee will doubtless endear it further to financial advisors, which provides the fund with the bulk of its assets.

“One of the great things about Vanguard is they’re a mutual. They don’t have shareholders. So there is no disconnect between the outcomes for investors and shareholders,” Paul Barrett, an advisor at Absolute Wealth Advisors, told ETF Stream.

“The bigger they get the more efficient they get the more they lower fees, which is great for investors.”

“The VAS fee cut doesn’t make a difference to us: we’re not getting anything from Vanguard. What it means is a better return for our clients.”

"The more cost efficient the investment process… the more room there is in the client’s budget for other advice. There is more to financial advice than just investment management.”

The discount will doubtless delight VAS’s, many, many unit holders.

Source: ASX, ETF Stream

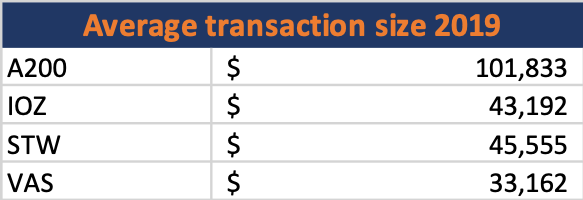

Among Australian share ETFs, VAS often sees the highest number of monthly trades, ASX data indicates. As the fund was not expressly built as a trading tool (unlike STW), the numbers suggest VAS has a broader investor base than its competitor funds.

More interestingly, VAS also has a lower average buy and sell size on the ASX compared with its competitors. This suggests that the fund attracts lower net worth investors. This is not to say Vanguard’s clients are poor. On the contrary: many big super funds and high net worth individuals use Vanguard ETFs.

However, the bite-size transactions suggest popularity with young salaried professionals – many of which are coming direct – who are dollar cost averaging their savings.

The fee cut will also work to validate the judgment of several high-profile VAS advocates. These include research firm Morningstar, Chris Brycki, boss of Australia’s biggest robo-advisor, and plenty of others.

Also read: BetaShares shirtfronts Vanguard

*****

Image: Evan Reedman, Source: supplied