Vanguard Australia does what Vanguard Australia does.

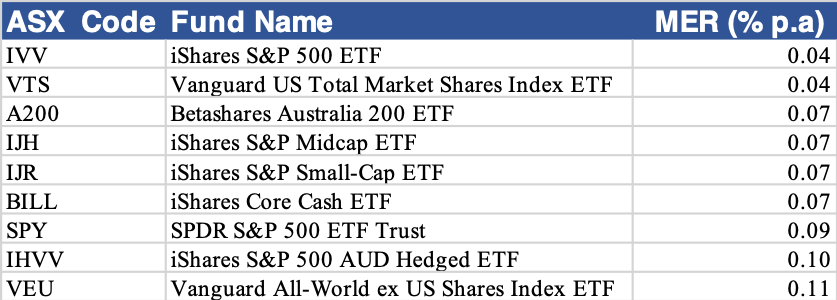

Vanguard Australia is lowering the fees on its $1.5 billion Vanguard All-World Ex-US ETF (VEU) from 0.11% down to 0.09%.

As a result, it will be one of the cheapest products on the market, in line with State Street’s famous SPY, and one of only eight products with fees in the single digits.

Source: ASX, ETF Stream

“VEU has seen continued strong cash flow and asset growth. Coupled with operational efficiencies that have led to lowering the cost to serve our clients, Vanguard has been able to reduce the expense ratio for VEU,” Vanguard said in a statement.

Like most of Australia’s cheapest ETFs, VEU is a cross listing of an American fund of the same name.

Under the rules of the ASX, cross-listed ETFs are traded as “Chess Depository Interests” (or CDIs).

As far as fees are concerned, CDIs have advantages in that global asset managers can piggy back off their US parent companies. CDIs allow them to bring American-style (ultra-low) fees to the Australian market despite the Aussie market, on its own, being too small to provide the scale required to launch products at ultra-low fees.

Read: BlackRock Australia kills off CDIs

However CDIs also have weaknesses. Crucially they don’t allow dividend reinvestment, which limits compounding for end investors. They also require filling out tedious American tax forms, such as the W8BEN.

The VEU fee drop will bring the Australian cross-listing’s price in line with the American fund, which also charges 0.09%.

The fee drop comes at a time that BlackRock Australia, arguably Vanguard's major competitor, has moved away from CDIs. Last year, BlackRock replanted all of its cross-listed ETFs under Australia-domiciled feeder funds, which removed the need for filling out US tax forms and allows dividend reinvestment.

Photo: Evan Reedman, boss of Vanguard Australia's ETF division