The wages of sin is exorbitant outperformance. Tobacco may be terrible, but tobacco companies have historically outperformed.

Smelly and carcinogenic, tobacco companies are the first to be fired from many ESG ETFs.

Several Australian ETFs to date have removed tobacco companies. And as the ESG movement builds out more followers, the number of tobacco-free ETFs in Australia is increasing.

But dumping tobacco can come at a cost - and a pretty significant one at that, new data suggests.

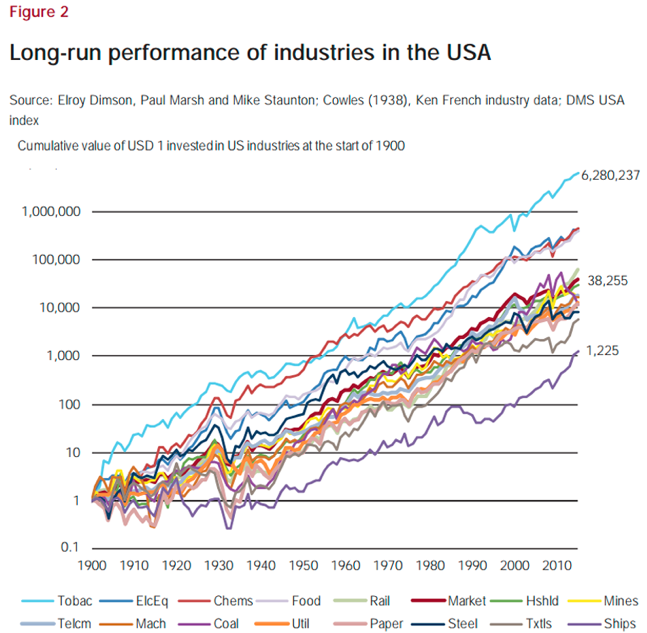

Tobacco is one of the oldest industries, with performance data stretching back 120 years. This data was recently crunched by Professors Elroy Dimson and Paul Marsh at the London Business School, two of the top experts in the asset management business.

What Profs Dimson and Marsh found was that tobacco has been a major outperformer in both the US and the UK for more than a century.

Cumulative returns on tobacco and on equities, 1900-2014

And not only has it been a major outperformer, it has been the major outperformer, beating all other industries and the market by a comfortable margin.

Not just in the US and UK

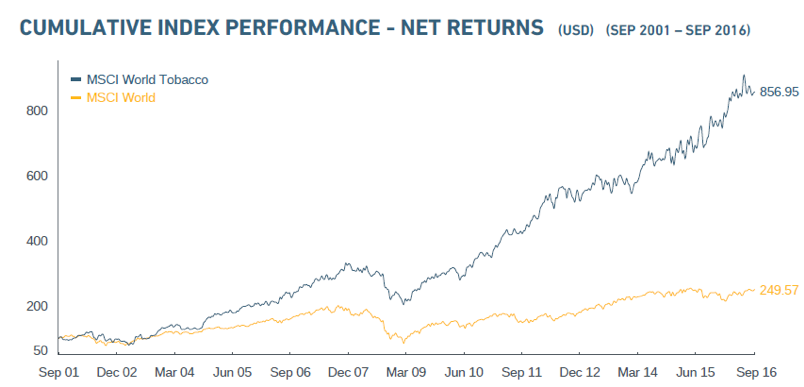

The success of the tobacco industry is not restricted to the US and UK either. According to MSCI it's been true worldwide.

Lessons for investors?

So what are the lessons for Aussie investors considering tobacco-free ETFs? The lesson might be that the best reason to exclude tobacco from your ETF is social: i.e. that you want a portfolio that reflects your values or worldview. And if investors are more performance-minded then it could be better to keep the tobacco in.