At 123 years old and still fighting fit. This is the incredible longevity of moving averages. Their use is widespread in all scientific disciplines, although they are rarely studied in traditional university courses (at least in Italy). From statistical applications to the measurement of physical or chemical phenomena, moving averages successfully help those who need to assess an ongoing trend.

They are also indispensable in financial market research, where they have been used for many decades. MAs have been through several major economic crises without any questioning of their usefulness. Sophisticated investment models and trading algorithms owe their popularity to complex applications of the idea behind them.

As Professor Jeremy Siegel wrote in his famous book on finance, Stocks for the long run: “A moving average is simply the arithmetic average of a given number of past closing prices of a stock or index over a fixed interval of time.

“For example, a 200-day moving average is the average of the closing prices over the past 200 days. For each new trading day, the oldest price is dropped, and the latest price is added to calculate the average. Analysts claim that a moving average allows investors to see the underlying trend of the market without being distracted by the day-to-day volatility of the market.”

Now this wonderful algorithm may have a second life.

I had a look at the 21-day moving average of the S&P 500 index and suddenly thought it would be a brilliant index. Moving averages are smoothed, always close to the index from which they are derived and perform better during market downturns. During the upswings of the index, depending on the length of the moving average chosen, they will remain close to the index, although below it. In the long term, they closely track it. Moving averages would be the perfect index to use in low volatility strategies. So, I decided to look at their mathematical properties.

Using the general formula for moving averages, it is possible to disentangle the reasons for their lower volatility compared to the underlying index. It all depends on the variance of the moving average, which is always roughly a slice of the variance of the index. Specifically, the variance of a moving average is the ratio of the variance of the underlying index to the number of days of the moving average chosen. A one-day moving average is known to coincide with the trend of the chosen index. So is the variance. That of a 20-day moving average is one-twentieth of the index’s variance. Variance is the mother of standard deviation and standard deviation is the mother of volatility. This property is deterministic. It is not probabilistic. This means that it can be replicated.

The fact that the variance of the moving average is only a small fraction of the variance of the index results in an exceptional risk-return ratio. Hence the idea of turning it into a new and more brilliant low-volatility index and strategy.

Therefore, the TRENDYX strategy proposes an original application of the leading mathematical properties of moving averages to create a new generation of financial instruments, the first of its kind.

It transforms moving averages into an autonomous investment tool capable of isolating the trend from the short-term random fluctuations, the signal from the noise. It is therefore characterised by lower equity volatility, comparable to that associated with investing in bonds. TRENDYX therefore represents a change of perspective: from investing with trends to investing directly in trends.

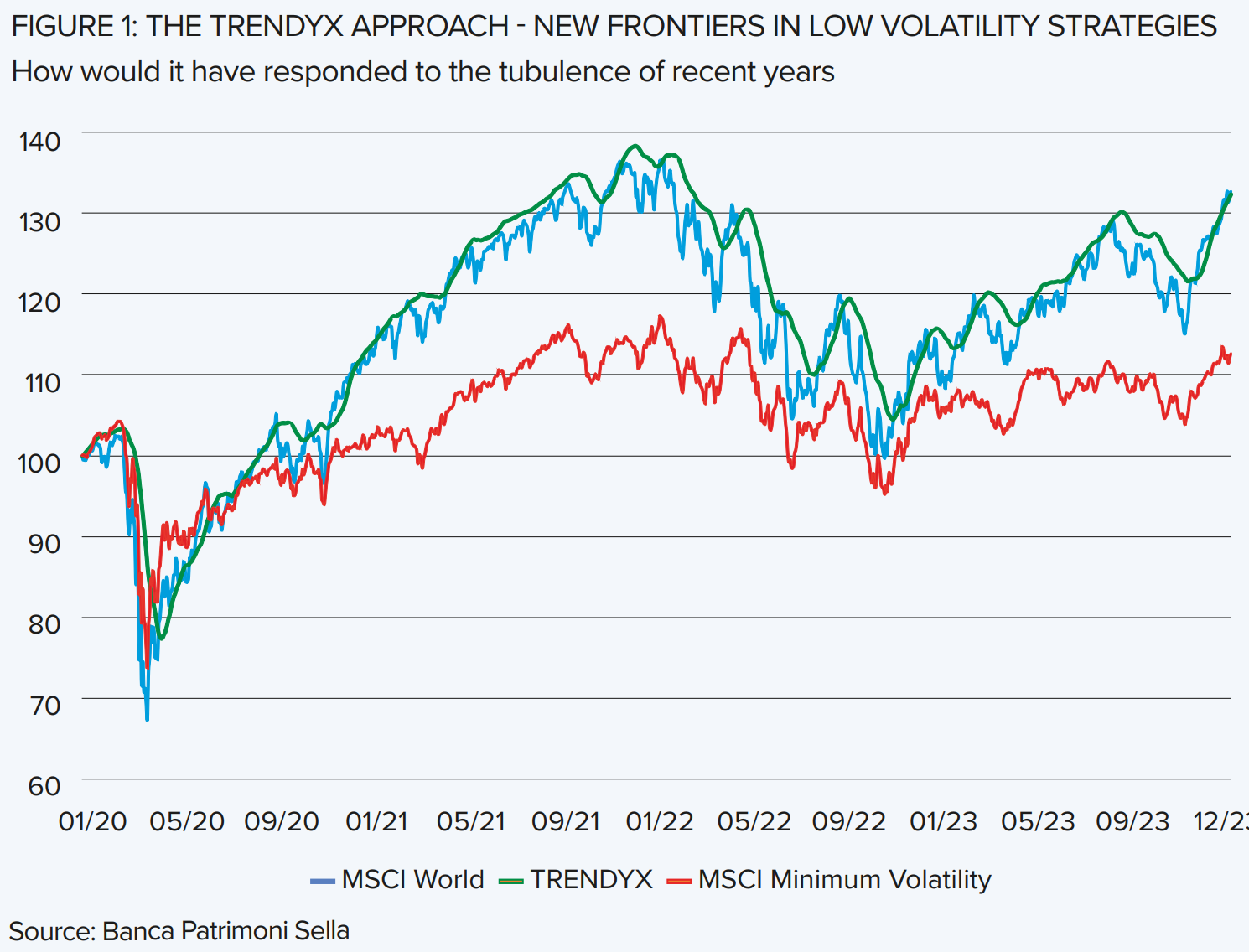

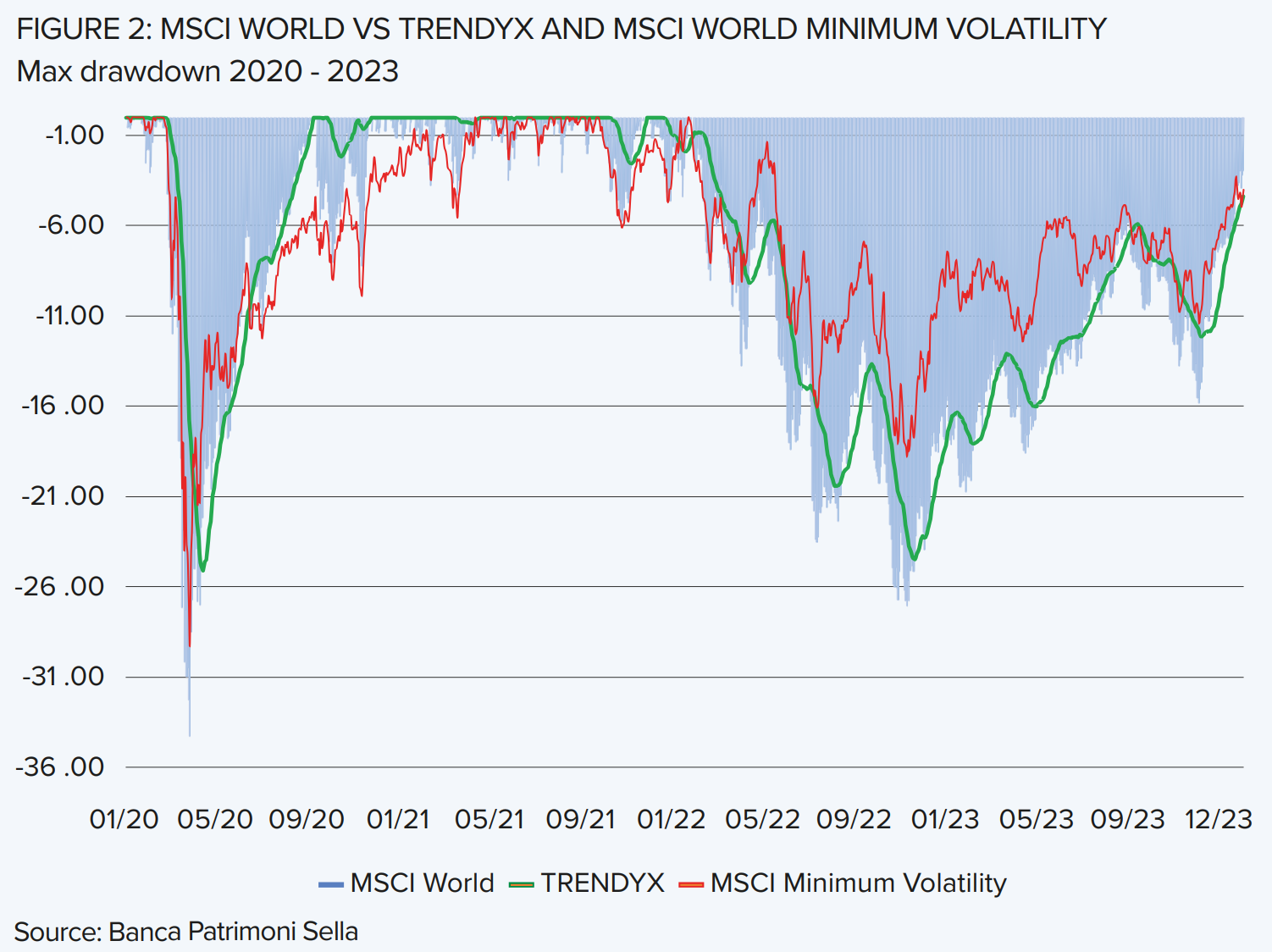

Over the 2020-2023 period, which was dominated by an unusually devastating series of adverse events, low-volatility strategies delivered very modest risk-adjusted results. The MSCI World – in US dollars – delivered an annualised performance of 7.38% with a volatility of 19% while its low-volatility version delivered an annualised performance of 3% with a volatility of 14.8%. Over the same period, the TRENDYX strategy would have generated an annualised return of 7.3% with a volatility of only 4.6%. No less interesting is the size of the drawdowns.

They are much smaller than those typically experienced by traditional indices. This is a significant advantage. The law of compounding makes it easier for the TRENDYX to climb back up and regain previous highs. Moreover, it has an additional advantage in the de-escalation phases of the index. TRENDYX moves at a slower pace and therefore gives the investor time to decide whether to stay in the market or to get out instead. On a risk-adjusted basis, it is a no-brainer. The TRENDYX strategy has consistently been the most efficient and best performing.

Data shows that this innovative idea would have reassured investors during the worst period without causing them serious underperformance against traditional indices.

Of course, if TRENDYX is ever created, it will be through ETFs, which I believe to be the best financial instruments ever invented.

However, there is still a long and difficult road ahead. First, a family of TRENDYX indices will need to be created. Since the ETF that replicates this strategy will inevitably have to be synthetic, it will also be necessary to assess the willingness of swap providers to supply the flows generated by TRENDYX movements. Most importantly, it will be necessary to understand the extent to which the ETF industry is interested in introducing this new family of low volatility strategies.

At the end of the day, TRENDYX was born by chance. I have just been lucky enough to get out of the conventional box of using a widely known metric. Sometimes I like to think of Oskar Barnack, who designed the Leica, the first small-format camera. Barnack simply took advantage of the existing cinematographic film, which ran vertically, and used it horizontally, shooting one frame at a time. This is the idea behind the TRENDYX strategy. Using a tool designed for one need for a different one.

Edoardo Mezza is director at Banca Patrimoni & Sella and author of The TRENDYX Approach: New Frontiers in Low Volatility Strategies

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To read the full edition, click here.