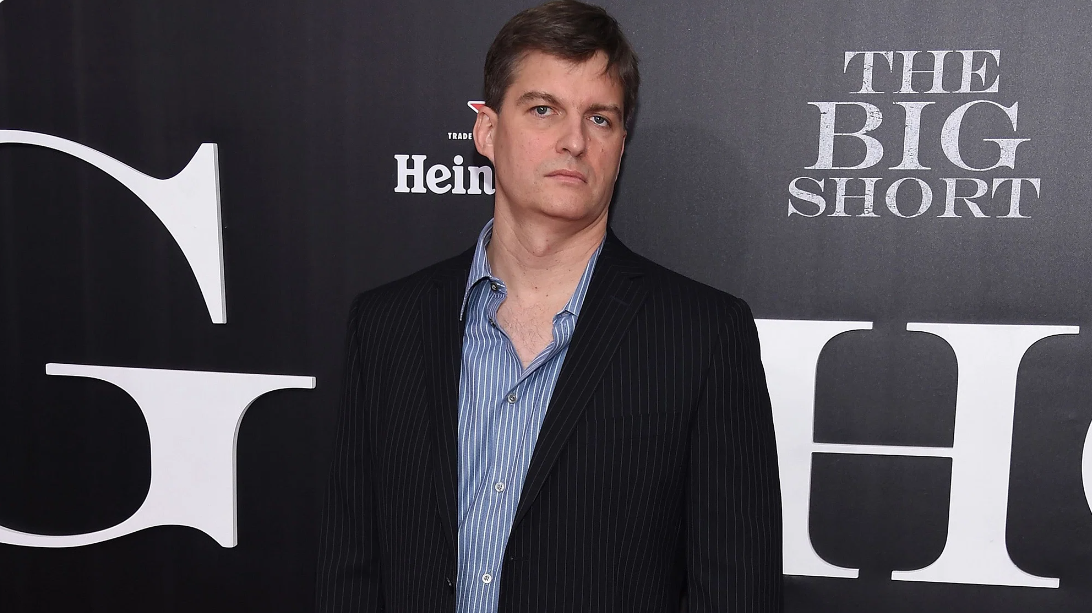

Michael Burry, hedge fund manager who inspired The Big Short, held more than $47m of bets against a BlackRock semiconductor ETF at the end of Q3 after manufacturers of the chips comprised much of the narrow group driving US equity gains so far in 2023.

According to its latest 13-F filing, Burry’s Scion Asset Management bought puts on 100,000 shares of the $9.6bn iShares Semiconductor ETF (SOXX) with a nominal value of $47.4m.

SOXX tracks the NYSE Semiconductor index of the 30 largest companies involved in the design, distribution, manufacture and sale of semiconductors.

Its top holdings are comprised of 9.2% to Advanced Micro Devices (AMD), 8.5% to Broadcom and 8.2% to Nvidia.

The latter of these, Nvidia, has made headlines for gaining 246.9% so far in 2023 and in May becoming he first chipmaker to hit a $1trn market cap.

Burry's recent filings also show Scion AM consolidated its portfolio, with its number of positions cut from 33 to 13.

This included closing the $1.6bn bet it held against popular US equity benchmarks in Q2 including the S&P 500 and Nasdaq 100, via $886m of puts against the SPDR S&P 500 ETF (SPY) and $739m against the Invesco QQQ Trust ETF (QQQ).

Scion AM’s allocations in Q2 and Q3 come after Burry took to X, formerly Twitter, at the end of March to say he was wrong to tell investors to “sell” at the start of the year.

“Going back to the 1920s, there has been no [buy the f****** dip] generation like you. Congratulations. I was wrong to say sell,” the hedge fund investor said.

The move continues a pattern of the Scion founder betting against frothiness in tech valuations in recent years.

Filings from Q2 2021 revealed the firm had taken out a $31m position against the ARK Innovation ETF (ARKK).

Outside of semiconductors, Scion AM’s recent 13-F revealed it had also re-entered positions in Chinese eCommerce firms Alibaba and JD.com, having liquidated these positions in Q2.