Thematic ETFs have been on a wild ride over the past few years, from being lifted to new highs in the low interest rate era to taking a pummelling when the market shifted amid multi-decade high inflation.

The past year has not been much better for the space, with every single theme posting negative returns over the past 12 months, as at 15 March, according to data from Morningstar, as rising interest rates and stubborn inflation weigh heavy on many growthy themes.

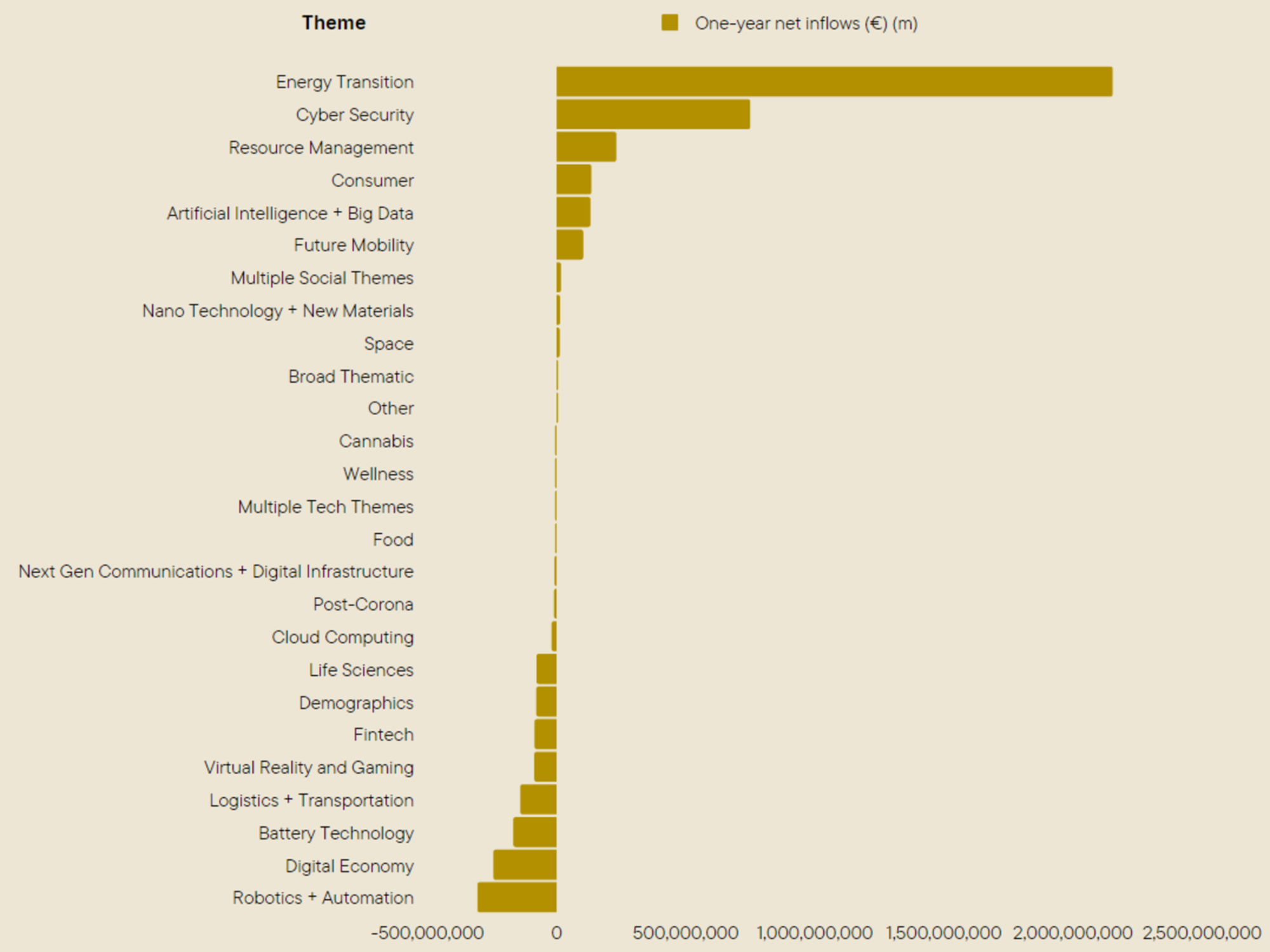

Despite this, inflows have been relatively robust, with €2.3bn flowing into thematic ETFs over the same period highlighting investor demand. However, a closer look reveals inflows are being propped up by one theme in particular, in a year that would otherwise be broadly flat.

ETFs tracking the energy transition theme recorded €2.1bn inflows over the past 12 months, accounting for 91% of overall thematic inflows over the period, with the iShares Global Clean Energy UCITS ETF (INRG) pulling in €816m alone.

Chart 1: Clean energy cleans up

Source: Morningstar Direct as of 28 February 2023

“We have not seen the stampede for the exit that some may have predicted when the market turned,” Kenneth Lamont, senior fund analyst for passive strategies at Morningstar, said. “The fact it has flattened out is interesting. We have only seen one-quarter of net outflows while performance has been pretty terrible across the board.”

Now, as we enter an era that will be defined by perpetually higher interest rates and volatility, thematic ETFs face a new set of challenges.

Weathering the storm

In many ways, the underperformance of thematic ETFs is easily explained. In a year where almost all asset classes were down, the growth orientation of thematic ETFs meant they were hit particularly hard as rising rates played havoc with debt-laden stocks.

“The past 18 months has been a pretty awful market for tech and growth funds. The vast majority of thematic funds globally have an exposure to both of these things so it is really not surprising we saw these funds underperform on aggregate,” Lamont said.

In addition to their growthy outlook, many thematic ETFs will track small-cap stocks that tend to suffer more severely from equity drawdowns.

Wayne Nutland, fund manager at Premier Miton Investors, said: “In attempting to capture the perceived benefits of long-term structural growth, many thematic ETFs are overweight small stocks and stocks with short histories of profitability or indeed no history of profitability at all.

“This can make thematic ETFs more vulnerable during periods of market turmoil as small caps and stocks with low profitability tend to suffer from worse drawdowns.”

Despite this, he said there are specific factors that could be supportive of individual themes but added “defensive themes tend to receive much less attention from ETF issuers”.

John Leiper, CIO at Titan Asset Management, agreed, adding investors must be cognisant of where they are in the market cycle before deciding which theme to play. “Investors should ask whether the macro-economic backdrop is complementary to, or a potential detractor from, that theme.”

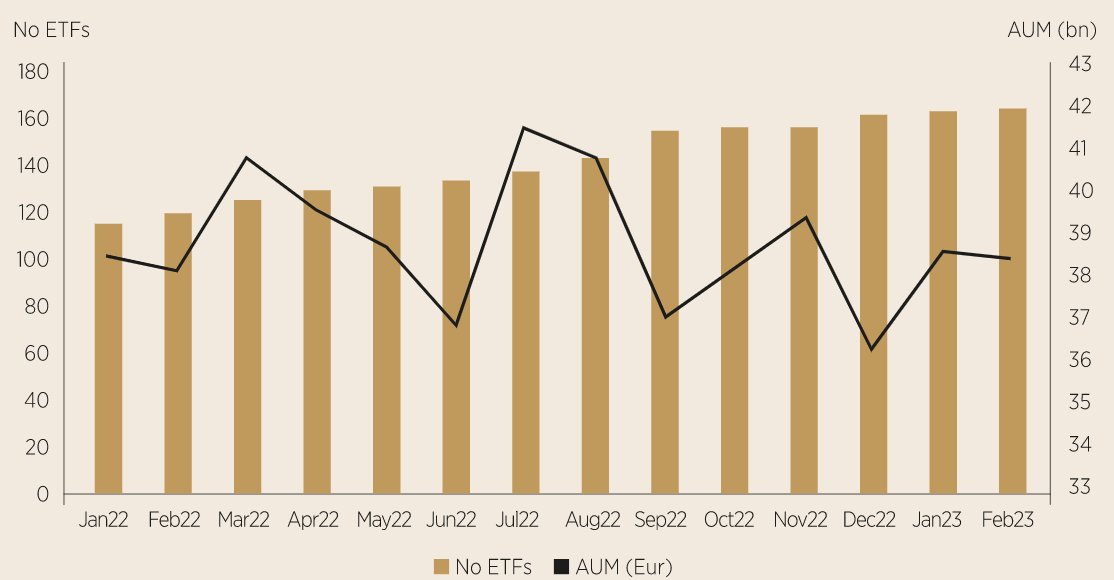

Investors have never had so much choice in deciding when and how to play a theme. The number of thematic ETFs in the market rose from 115 in January 2022 to 164 at the end of February, according to data from Bloomberg Intelligence.

Chart 2: Thematic ETFs continue to rise

Source: Bloomberg Intelligence

Despite this, Andrew Limberis, investment director at Omba Advisory & Investments, said he believes the proliferation of products will ultimately lead to numerous ETFs delisting over the next year and a half as demand fails to keep up with supply.

“The growth of ETFs has been driven by perceived demand. There are loads of products that are going to be delisted in the coming 18 months because of the lack of demand and low quality of the products,” he said.

Limberis, whose firm runs a thematic fund of ETFs, added one theme the firm has been bullish on for the long-term is China internet despite performing poorly over the past year.

“We are overweight China internet,” he said. “It has had a disastrous 18 months or so but long term we still like it. It has the growth angle and valuations are suppressed.”

Highlighting this, the KraneShares CSI China Internet UCITS ETF (KWEB) has amassed $397m assets under management (AUM) since launching in November 2018 but has returned -19.3% over the same period.

“It is all about the long-term. Some product’s prices will move over the short-term but that is the way we have always looked at it,” Limberis said. “The key aspect is valuations over the long term. It is not sustainable to pay higher multiples on revenue.”

For the long-term

Ultimately, thematic investing is designed for those who have a particularly strong conviction about how a megatrend will play out in the future, meaning that investors could be willing to ride out the volatility in the short term.

Alternatively, investors could use this to their advantage, using thematic ETFs as a tactical asset allocation play in a bid to generate alpha in the portfolio.

Leiper said investors are typically trying to capture long-term shifts in technology, society, the environment and demographics, but added the space also offered them a chance to optimise returns.

“Investors can focus on the long run, and ride through those cycles, or employ a more active approach and choose those themes best suited to the current or forecast environment,” he said. “We adjust our exposure throughout the market cycle to optimise returns but that is not necessarily the best approach, and it is up to each investor to determine the strategy best suited to them.”

This article first appeared in ETF Insider, ETF Stream's monthly ETF magazine for professional investors in Europe. To access the full issue, click here.