The argument that actively-managed funds thrive during periods of volatility is on shaky footing after the product class achieved only momentary outperformance during the height of COVID-19, according to a report from the European Securities and Markets Authority (ESMA).

The regulator said the actively-managed European equity funds it examined – net of ongoing costs – on average failed to outperform their related benchmarks in the period from 19 February and 30 June 2020.

It said: “More than half of the active UCITS analysed underperformed their benchmarks during the stressed period (between 19 February and 31 March) and more than 40% during the post-stress period (between 1 April and 30 June).”

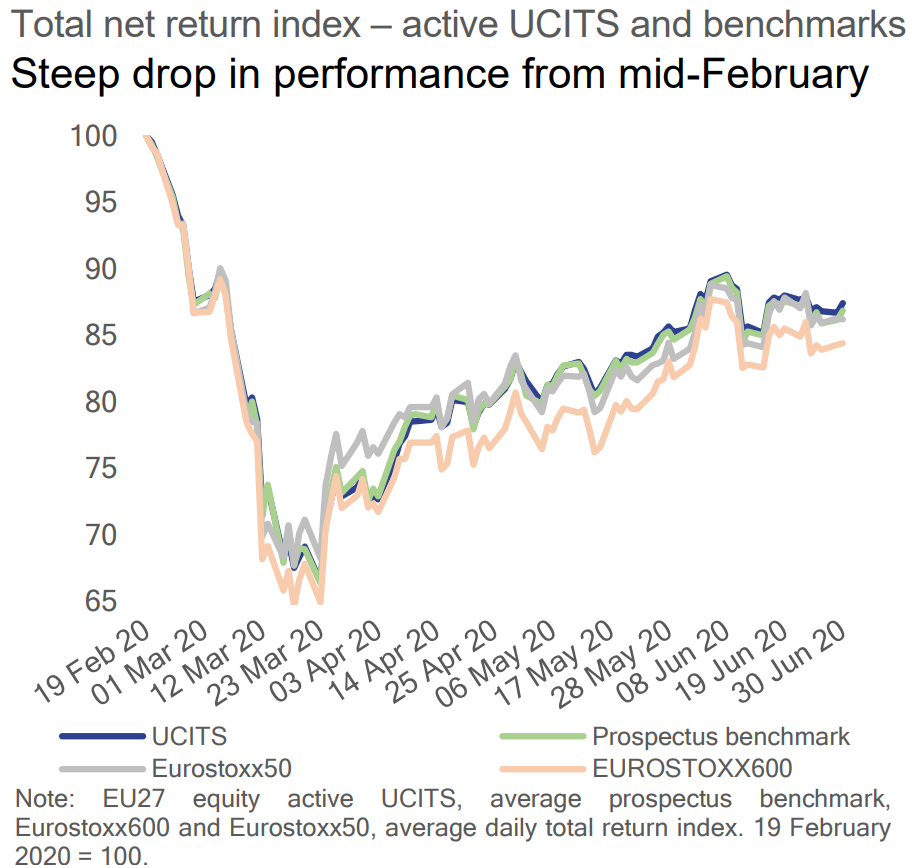

The research found active funds, their related prospectus benchmarks and broad Europe equity benchmarks all declined in March 2020 and bounced back strongly until mid-May.

A key disparity was between active European equity funds and the Euro Stoxx 50 and Euro Stoxx 600 benchmarks between 1 April and 19 May, with the former returning 11% and the latter pair returning 7% and 8% during the period. However, active fund performance was matched by their related benchmarks, meaning they failed to outperform during this period.

ESMA said this inability to find active alpha continued during the stabilisation period through 30 June, with active funds, their benchmarks and broad market indices all averaging returns around 5%.

Source: ESMA and Morningstar

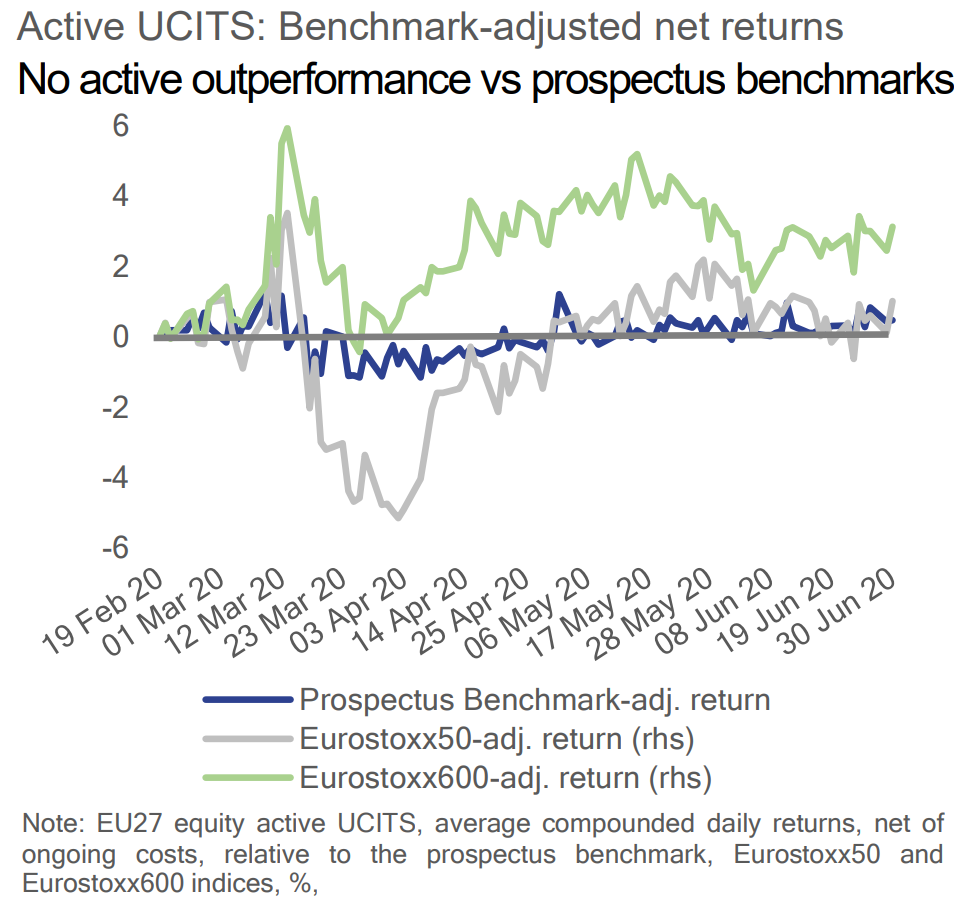

The only comparison which displayed clear active alpha was against the Euro Stoxx 600 index, with active funds outperforming the large, mid and small-cap European equity index by 3% over the four-month period.

During the period of peak market stress in the final week of March 2020, active funds underperformed their benchmarks by 0.9% and the Euro Stoxx 50 by 4.4%.

Notably, active funds outperformed their benchmarks and the Euro Stoxx 50 following the recovery and stabilisation periods – but only by margins of between 0% and 1%.

Source: ESMA and Morningstar

ESMA commented: “The finding of no sustained outperformance for active funds, throughout H1 2020, is in line with the outcome of recent analyses and financial news focusing on the unfolding of the COVID-19 crisis.

“The Morningstar Active/Passive Barometer shows that only around half of active equity funds outperformed compared to their average passive peer during H1 2020.”

Interestingly, ESMA said active fund performance during the pandemic varied greatly across domiciles, with S&P Dow Jones Indices’ SPIVA Europe scorecard showing 34% of French-domiciled active equity funds underperformed their relevant benchmark versus 55% and 61%, respectively, in Italy and Spain.

The regulator’s findings are damning for one of the active community’s key calling cards – that their funds’ usually higher costs can be justified by their ability to be more agile and outperform the market during downturns.

Their inability to do so by any notable margin should raise serious question marks, especially when set against the year following COVID-19 volatility and the years preceding it.

The recent SPIVA Europe scorecard highlighted how the percentage of Europe equity funds outperformed by their benchmark increased by 37.4% between 2020 and 2021.

“From this we can surmise that, on average, fund managers in this region may have utilised their skills better during more volatile market conditions than in a comparatively stable environment,” argued Andrew Innes, head of global research and design, EMEA at SPDJI.

“However, as SPIVA frequently witnesses, any short-term success typically dissipates as the time horizon increases.”

Evidencing this, 83.2% of euro-denominated and 74.2% of sterling-denominated Europe equity funds were beaten by their respective S&P benchmark over the past 10 years to the end of 2021.

Even more concerningly, just 53.2% of 1085 euro-denominated and 39.8% of the 93 sterling-denominated Europe equity funds survived this 10-year period.

Related articles