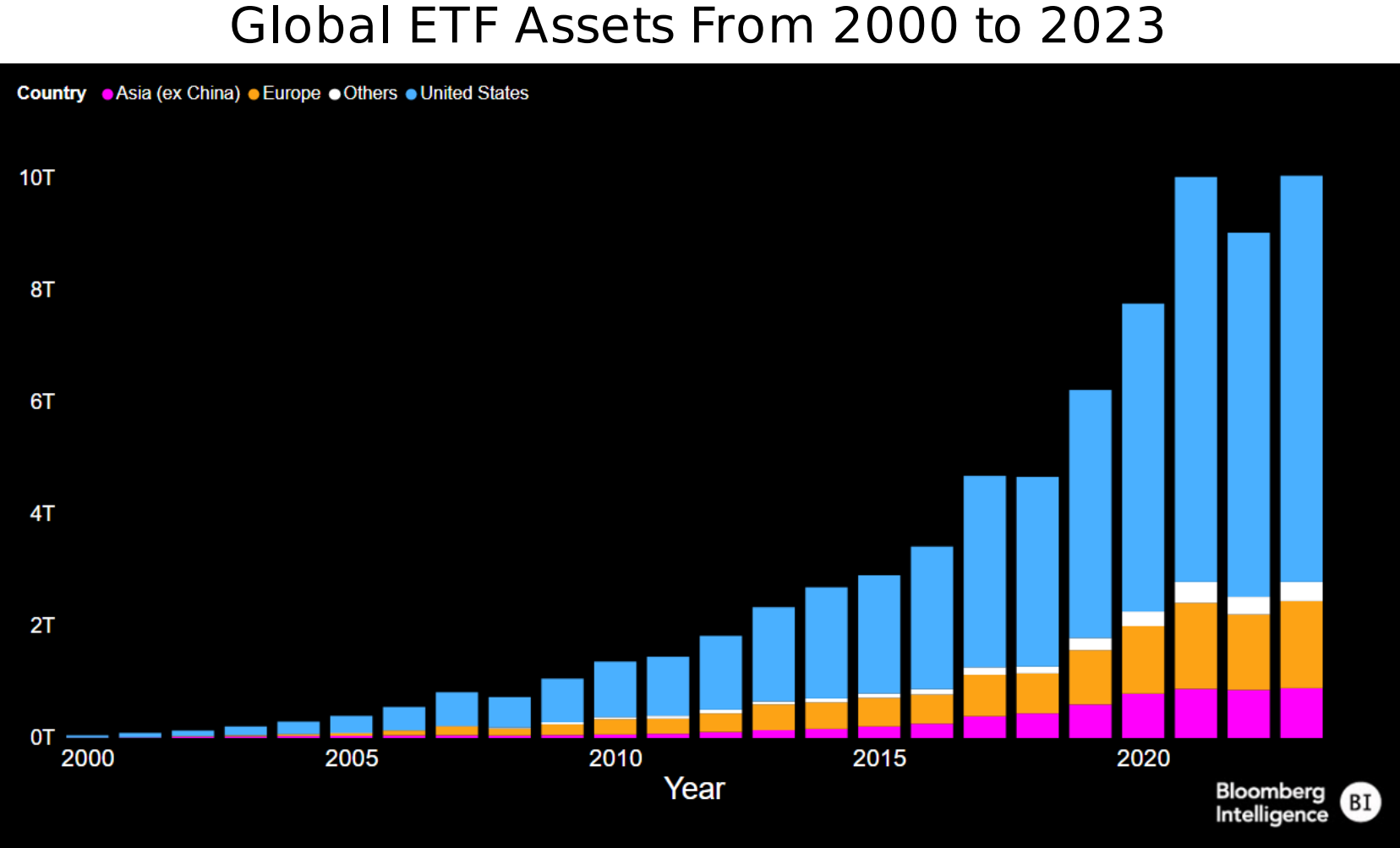

Global exchange-trade product (ETP) assets under management (AUM) have broken through the $10trn barrier for the second time as strong equity returns and H1 asset gathering in fixed income reverse the 2022 blip.

Interestingly, this year’s return to form for ETF AUM took a different shape to the speculative equity bets that saw the $10trn threshold passed for the first time in 2021, when more than $1trn flowed into global ETPs in just 12 months.

However, while European bond ETFs might have just booked their strongest H1 of inflows since 2019, it is hard to deny the predominance of equities in driving ETF growth over the past decade.

Equity strategies have accounted for $3.9trn new money or 68% of all inflows since 2013, according to Bloomberg Intelligence data.

Sebastien Cabral, equity research associate, ETF strategy, at Bloomberg Intelligence, said: “In the ETF world global equities have maintained an unbeaten 10-0 record against global fixed income as the industry hits $10trn again.

“The dependence on US domestic equity is still staggering and critical for support.”

Cabral noted ETPs have taken in around $797bn globally per year since 2019. His “conservative” prediction is ETFs will hit $30trn between 2030 and 2031, chiming with Brown Brothers Harriman’s (BBH) recent ETF investor survey which predicted this milestone would be reached by 2033.

Elsewhere, Bank of America’s Merrill Lynch made the outlandish prediction that ETF assets would hit $50trn by 2029, while JP Morgan forecast US ETF assets would break through $15trn by 2029.

In a recent report, Bloomberg Intelligence senior ETF analysts Rebecca Sin and Eric Balchunas said: “The fact that the biggest Wall Street bank is predicting this kind of growth shows the industry has evolved into the mainstream.”

Agreeing with the position taken by BBH, Sin and Balchunas identified a driving force of this shift being the convergence of ETFs and active management.

The pair noted active ETFs have taken in $64bn globally since the turn of the year – a 33% increase on the same period in 2022 – and are continuing to garner attention from legacy active managers, many of whom operate through mutual fund structures.

“In the past, an active manager would launch a high-cost clone ETF, which could be tough to grow,” they said. “New rules allow a manager to simply convert a mutual fund into an ETF or create an ETF share class.”

Sin and Balchunas also argued while favourable market conditions are important for headline ETF AUM, volatility tends to still benefit the wrapper in terms of its market share versus other fund structures.

In 2022 – regarded by many as one of the most challenging years for the 60/40 portfolio since WW2 – ETF assets may have fallen by $900bn globally due to negative returns, but US and Europe-listed ETFs welcomed almost $600bn of new investor money while mutual funds saw more than $1trn outflows.

The pair concluded by addressing the wrapper’s other prophesied bogeyman – direct indexing – which has claimed only 1% of retail investor assets to-date.

“Direct indexing is effectively trying to reverse powerful trends in investing – the move to low cost from high and to a lesser extent, to passive from active – while adding complexity.

“We would be surprised if direct indexing gets anything more than a 3% share of the investment vehicle market.”

AXA IM enters active fixed income

The asset management arm of French insurer AXA this week launched its first active fixed income ETF, the AXA IM Euro Credit PAB UCITS ETF (AIPE) on the Deutsche Boerse with a total expense ratio (TER) of 0.20%.

The ETF looks to offer exposure to the euro investment grade credit market, match the carbon emissions target of the Paris-Aligned Benchmark (PAB) and outperform the ICE Bank of America Euro Corporate Paris Aligned (Absolute Emissions) index.

The launch is interesting as the firm already moving into relatively underdeveloped parts of the European bond ETF market just 10 months after entering ETFs.

Olivier Paquier, global head of sales at AXA IM, said: “We live in a fixed income era. The fact that innovation comes through ETFs is a big key driver.

“It is active, it is thematic and now it is fixed income ETFs driving the market.”

BNPP AM continues its Irish adventure

Fellow French asset manager BNP Paribas Asset Management is lining up to launch two more ETFs on its Irish Collative Asset-management Vehicle (ICAV), ETF Stream revealed.

The BNP Paribas Easy MSCI World ESG Filtered Min TE UCITS ETF and the BNP Paribas Easy ECPI Global ESG Infrastructure UCITS ETF both registered with the Central Bank of Ireland (CBI) on 27 March – and are expected to have duplicate Irish and Luxembourg domiciled iterations once the products launch on BNPP AM’s ICAV.

The products follow the firm’s debut Irish-domiciled strategy, the BNP Paribas Easy S&P 500 ESG UCITS ETF (SPEEU), which listed last month.