Insider trading is back in focus as selling by prominent CEOs spikes, however, the taboo practice can be turned into a systematic ETF strategy to outperform broad market indices.

Corporate insider selling in the US hit its highest level in three years in Q1, with tech executives including Jeff Bezos, Mark Zuckerberg and Michael Dell offloading $8.5bn, $1.6bn and $788m of shares, respectively, according to Verity.

While such behaviour is regarded as a bellwether for a negative share price outlook, research from Insider Sentiment Dashboard also suggested buying and selling activity by C-suites can form the basis of a sentiment-driven strategy to deliver excess returns.

In fact, the authors argued corporate insiders have been “consistently the most informed” equity traders over the past six decades.

“Insiders buy their own firm’s stock before the price goes up and sell before it goes down, beating the market by about 5% each time,” the research said. “In contrast, nearly 90% of actively managed equity funds fail to beat the market over 10 years.”

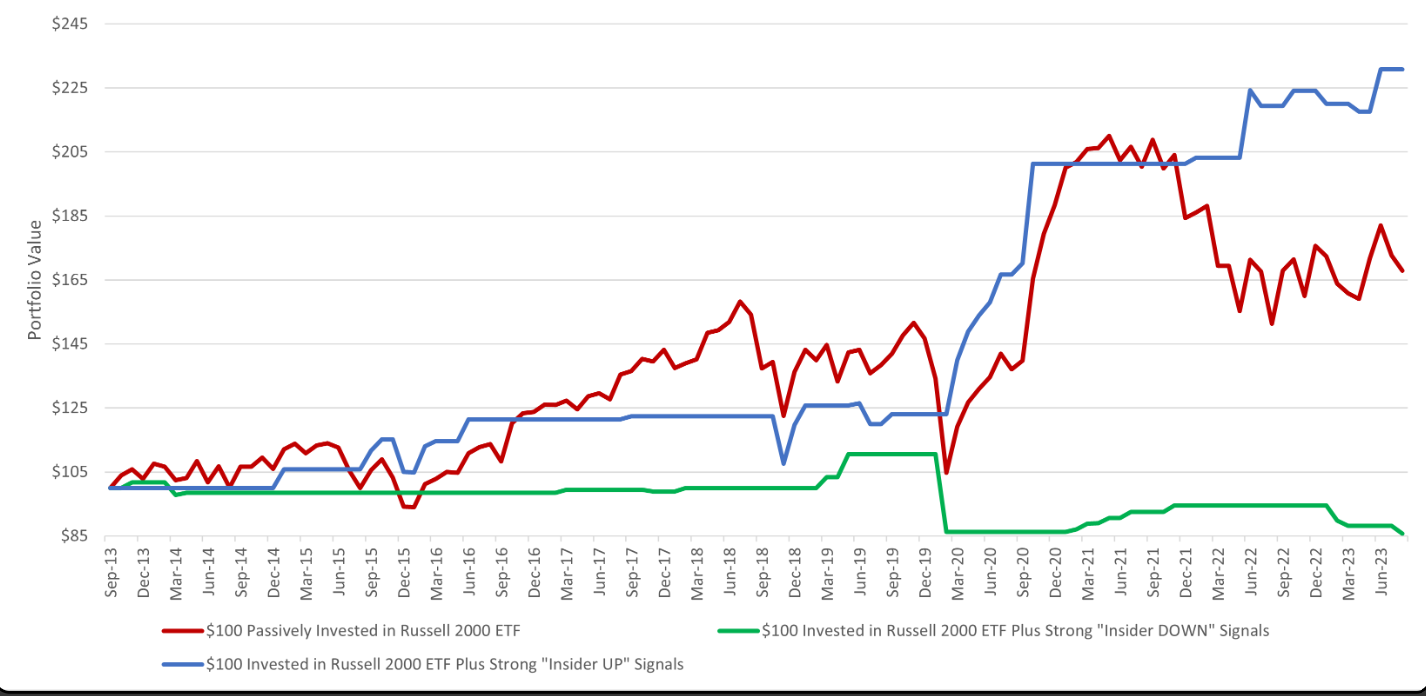

Testing their hypothesis, researchers tested two portfolios against the Russell 2000. One – the ‘strong insider up’ – invested monthly in a Russell 2000 ETF when their Insider Sentiment Tracker was 30% or higher and a non-interest-paying account when below this threshold. The second – the ‘strong insider down’ – does the inverse, but with a threshold of 20%.

The results illustrated buying in line with insiders yielded 130% versus 67% for the Russell 2000 index over the decade to June 2023.

Meanwhile, the strategy betting against corporate insider sentiment returned -15% over the same period.

Chart 1: A decade of Russell 2000 vs insider long and short strategies

Source: Insider Sentiment Dashboard

Interestingly, the insider sentiment ‘up’ tussled for leadership with the benchmark through the decade, gaining a pronounced edge during COVID-19 pandemic volatility, where strong insider sentiment saw the strategy go long on the index from March 2020.

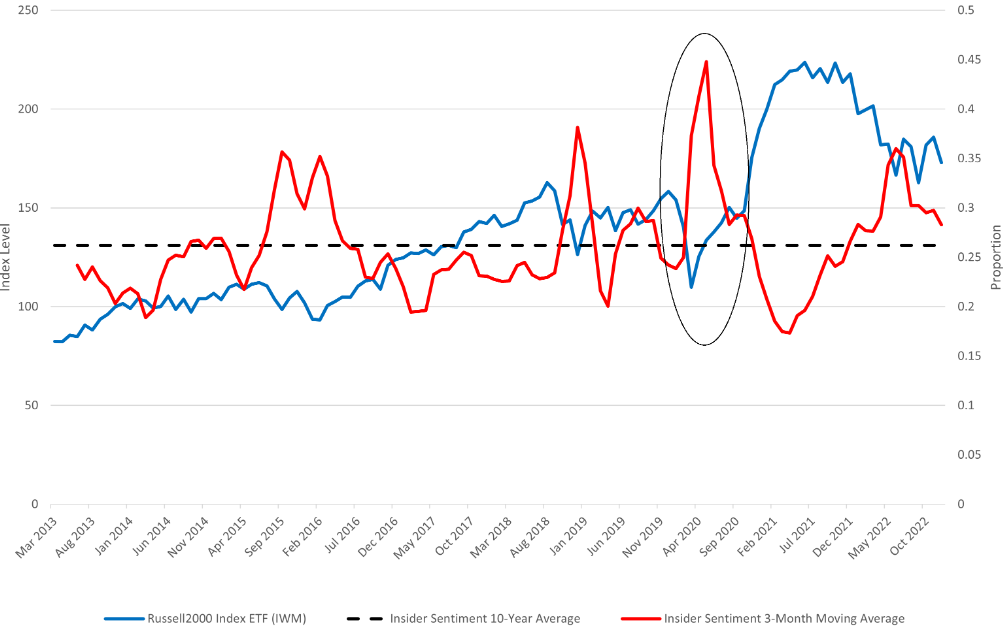

Chart 2: Russell 2000 price vs insider sentiment

Source: Insider Sentiment Dashboard

However, the greatest advantage for the insider sentiment ‘up’ strategy is that it managed to match or beat its benchmark over the 10-year period while reducing risk by 40%.

Having received 30 ‘buy’ signals over the decade, the ‘up’ strategy made only 30 monthly purchases spanning a period of two-and-a-half years. For the remaining three quarters of the timeline, the investment sat in a checking account.

“In moving in and out of the [Russell 2000 ETF] using insider sentiment, we were able to improve the Sharpe ratio of the portfolio from 0.21 to 0.68 in the ‘strong up’ strategy.

“Hence, using the Insider Sentiment Tracker more than tripled our reward-to-risk-ratio,” the authors concluded.