It is certainly a confusing economic environment. The yield curve is inverted, suggesting a recession, yet the stock market is at a record high. The key question is whether the economy can achieve a so-called soft landing. I believe it is possible to achieve the soft landing should enough mitigating factors endure and the Federal Reserve awakes from its slumber.

The inverted yield curve, an indicator of economic growth and recessions, was unveiled in my dissertation many years ago. Since the 1960s, it has been eight out of eight in predicting recessions and has yet to experience a false signal. Over the last four cycles, the yield curve inversion has provided a warning of 13 months on average. We are only in the sixteenth month.

Further, over the last four cycles, the yield curve “uninverts” (short rates return to their normal pattern of being below long rates) before recessions begin. We are not in the uninversion yet.

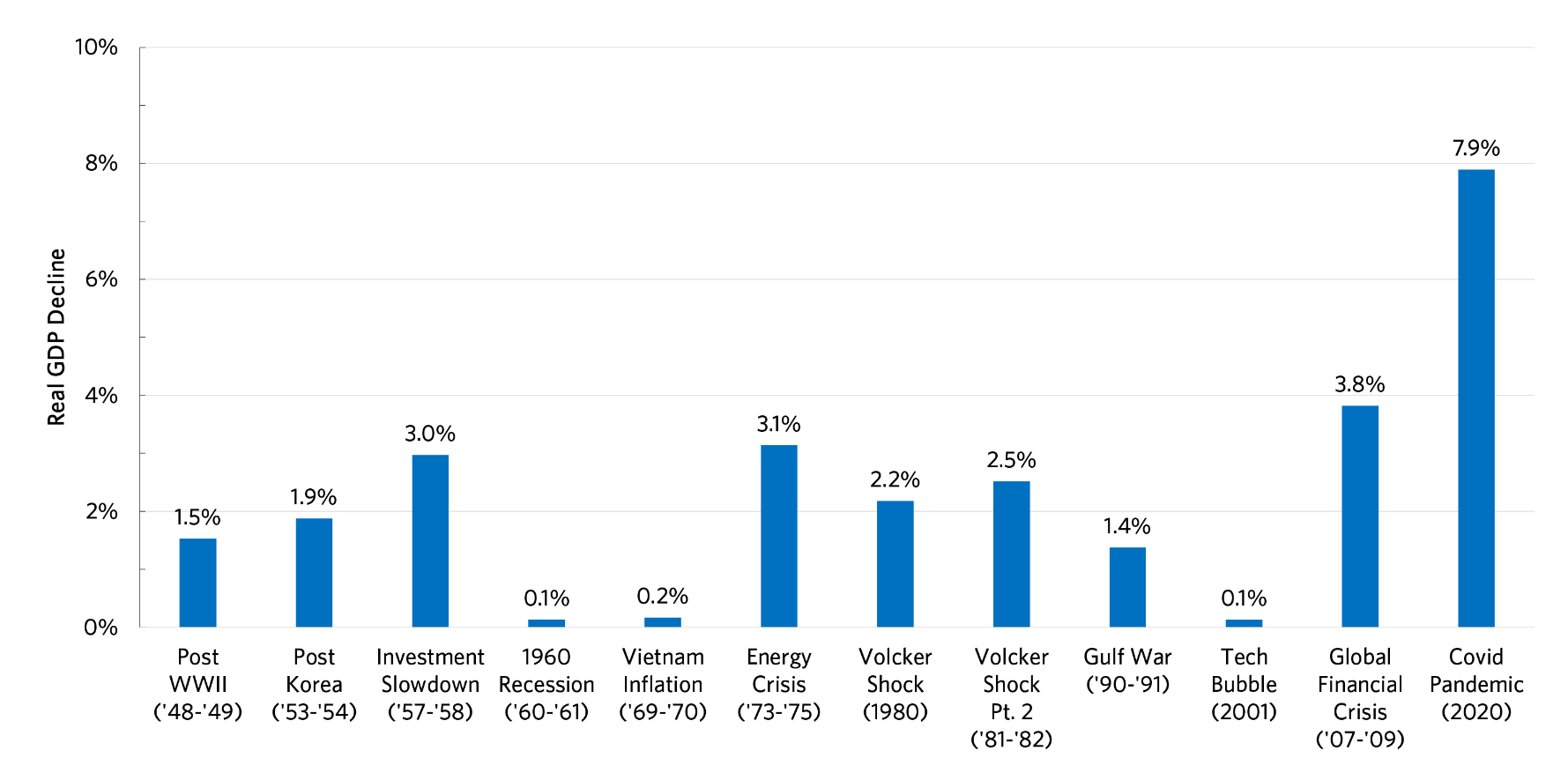

The yield curve indicator suggests growth will substantially slow in 2024. Even in the soft-landing scenario, there is a chance for a minor recession. We have seen minor recessions before, in 2001 and 1990-91 where the drawdown in GDP was around 1% (see Chart 1). It is crucial to avoid a deep recession like the one associated with the Global Financial Crisis (GFC).

Chart 1: Total GDP decline peak to trough in recession

Source: Research Affiliates using FRED

This slowing growth in the first half of 2024 will mainly be a function of slowing consumer spending and surging government debt service.

Personal consumption expenditures represent 68% of overall GDP growth. Real GDP growth in 2023 was driven by robust consumer spending of the $2.1trn in excess savings amassed during the pandemic as well as healthy government spending. It is important to look at the leading indicators of consumer savings because when the savings run out, spending will contract. Consumer loan delinquencies, for example, auto and credit cards, have been trending upward, suggesting savings have been substantially depleted.

It is striking that the interest service on the net government debt is already over $700bn. What is less well-known is that the average interest rate is only 3.11%. Given short rates are at 5% and long rates over 4%, it is reasonable to expect that the average interest rate on government debt will sharply increase in 2024 as the government both rolls over existing debt and finances the current large deficit. The ballooning debt and debt service put upward pressure on long rates, thereby impeding business investment and economic growth.

Potential mitigating factors

Three key mitigating factors greatly reduce the chance that a deep recession occurs: excess labour demand, a healthy housing market and the yield curve.

The number of job openings is higher than those seeking work. In March 2022, the gap between job openings and job seekers was an astonishing six million. That gap has shrunk (which is consistent with slowing growth) but still stands at roughly 2.5 million. This means even with slowing growth there is a buffer before unemployment starts causing a problem. When people are laid off, their consumption spending is substantially curtailed. The fact that we have excess demand for labour reduces the risk of a disruptive surge in unemployment.

Before the GFC, consumers and banks were highly leveraged. The amount of equity in the average house was very close to the amount of mortgage debt. As housing prices decreased, a surge in foreclosures and fire sales fanned the flames of the recession, making the downturn the most severe since the Great Depression. The housing market is very different today. Consumers and banks are less leveraged. There is substantially more equity than debt. This means even if a slowdown in 2024 sparks a decrease in housing prices, it is unlikely to cause foreclosure-led havoc.

When businesses see the inverted yield curve, they take preventative action, investing less and engaging in small-scale layoffs. This leads to slower economic growth. Companies that become leaner have a much better chance of surviving an economic slowdown, dampening the volatility of the business cycle.

The source of risk is the Fed

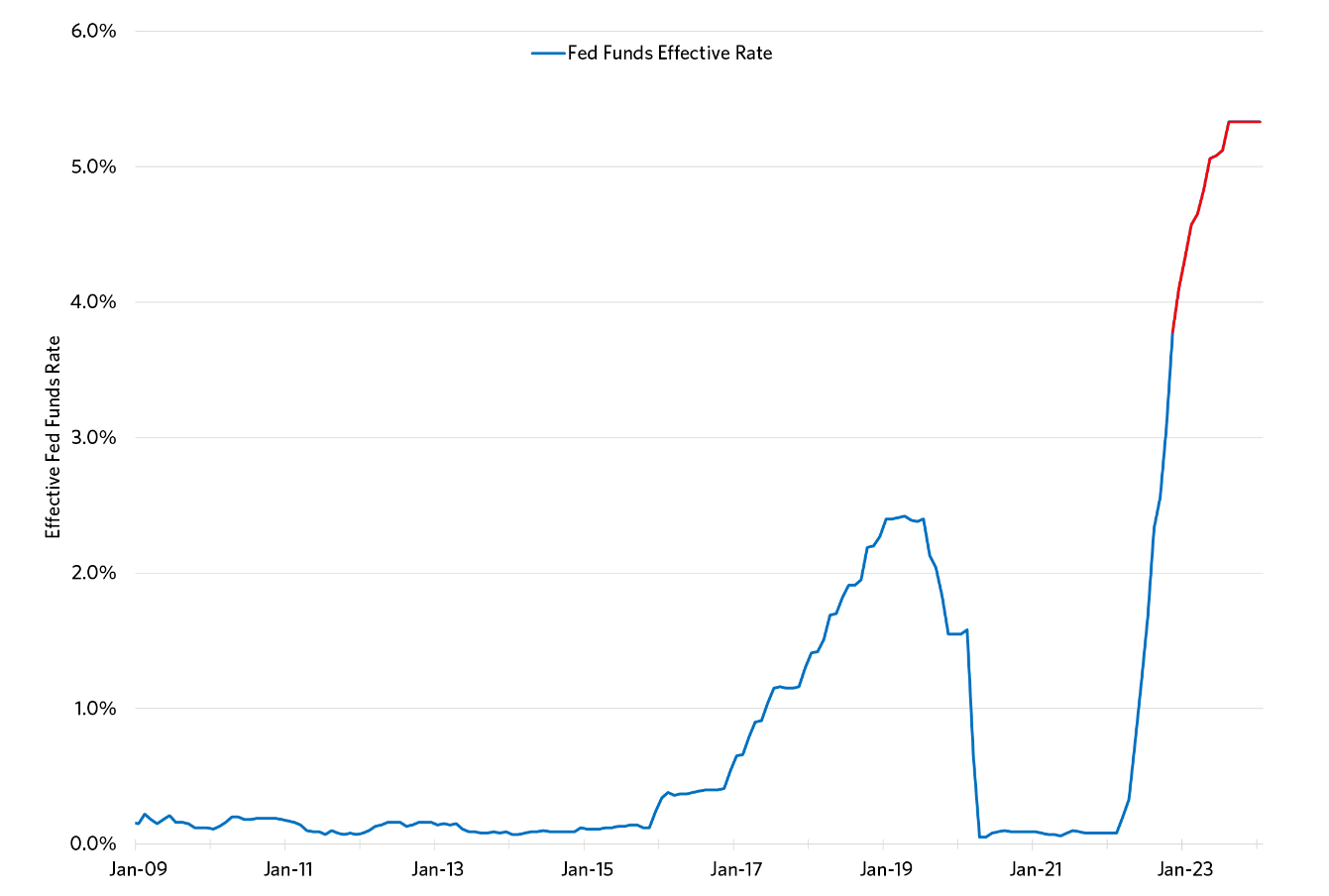

The Fed was far too late to start raising rates. Indeed, rates were kept near zero for an unprecedented period that includes much of the longest expansion on record that began after the GFC.

More recently, the Fed missed the inflation surge, mistakenly labelling inflation as “transitory.” The most important component of both the CPI and the Personal Consumption Expenditure deflator (the Fed’s favourite gauge) is shelter. Importantly, shelter inflation is measured using something called “owner’s equivalent rent” rather than relying on real-time housing prices and rental rates. This calculation operates with a lag. So, when rental inflation was in the double digits, it was obvious we were in for a surge in CPI.

Chart 2: Fed overshooting

Source: Research Affiliates using FRED

The Fed finally caught on and started a tightening cycle that was unprecedented in both speed and degree.

It is extraordinary to me that they made the same mistake in misreading the inflation data in 2023. On 4 January, I strongly advocated that the Fed stand down on rate hikes. I argued that inflation was under control if real-time data were used.

Consider the December 2023 CPI print of 3.4% YOY. This appears to be well above the Fed’s target rate. However, 3.4% is misleading because shelter inflation is reported at 6.2%. Shelter inflation reported in the CPI is totally disconnected from reality. Surveys report YOY rents at -2%. Making the conservative assumption that shelter inflation is running at +2%, recalculation of the CPI delivers 1.9% YOY inflation well below the Fed’s target. Indeed, through most of 2023, we were in the Fed’s comfort zone.

The Fed's actions, particularly in 2023, increased the risk of a deeper recession. It is imperative they attempt to undo the damage of their overshooting. The most effective solution is for the Fed to quickly reverse course and cut rates immediately. Ideally, the Fed funds rate is 3.5% by year-end (from 5.25% today). The sooner they open the easing door, the higher the probability of a soft landing.

Campbell Harvey is senior adviser and director of research at Research Affiliates